Good News! This government bank has made loan cheaper, now EMI of house and car will be less. – ..

- Bank of Baroda Loan Rates: Bank has reduced the interest rates, know how much cheaper home, personal and auto loan will be available now.

- RBI reduced repo rate, Bank of Baroda gave direct benefit to customers, see new interest rates.

Bank of Baroda Loan Rates : If your loan is going on in Bank of Baroda or you are thinking of taking a loan, then there is a big good news for you. Bank of Baroda has given the first and fastest benefit to its customers due to the recent interest rate cut by the Reserve Bank of India (RBI).

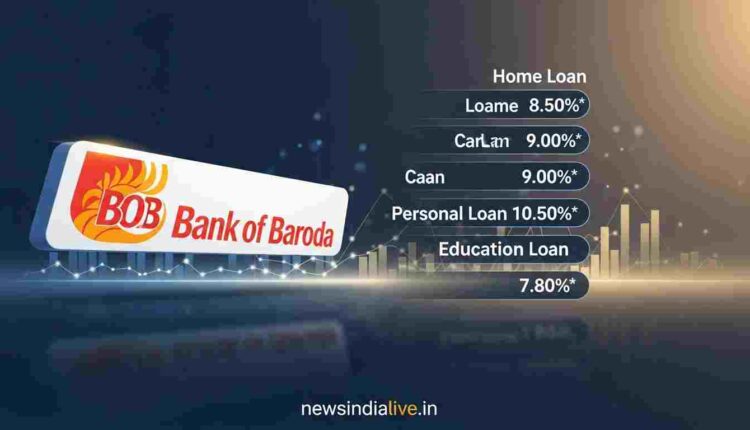

The bank has reduced the interest rates on all essential loans like home loan, car loan and personal loan. The new rates have also come into effect from December 6, 2025. In simple language, now your monthly installment (EMI) will be lighter than before.

Why and how much did the loan become cheaper?

Actually, RBI had cut the repo rate, after which it became cheaper for banks to take money from RBI. Bank of Baroda immediately passed this benefit on to its customers. The bank has reduced its lending rate (BRLLR) from 8.15% to 7.90%. This simply means that people whose budget was strained every month due to the burden of EMI, will now get some relief.

How much will you save on home loan?

According to the bank’s website, home loan interest rates now 7.20% to 8.95% Starting between. The rate at which you will get the loan will depend on your CIBIL score and loan amount. That is, the better your CIBIL score, the cheaper loan you will get.

Yes, one thing to keep in mind is that if you do not take credit insurance along with the loan, the bank may charge you an additional risk premium of 0.50%.

How much will the processing fee be?

A lump sum processing fee is also charged while taking the loan.

- If you are taking a home loan up to Rs 50 lakh, you may have to pay processing fees ranging from ₹ 8,500 to ₹ 15,000.

- For loans above Rs 50 lakh, this fee can range from ₹ 8,500 to ₹ 25,000.

Although this is an expense, it will be largely balanced by the savings in your EMIs due to the reduction in interest rates.

Comments are closed.