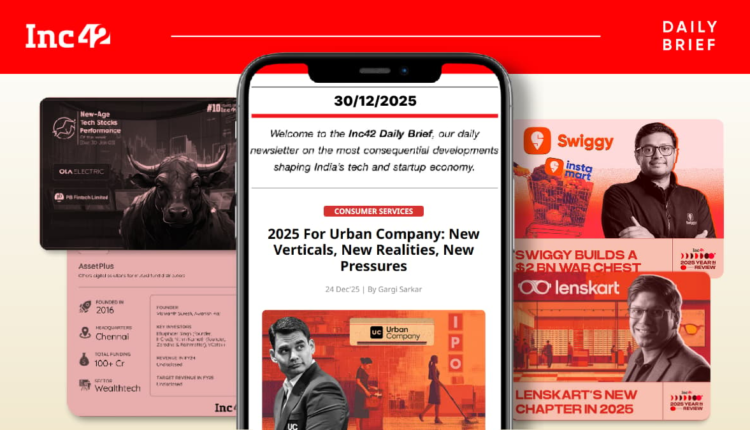

2025 In Review, Lenskart’s Big Wins & More

Decoding 2025 For Consumer Tech Giants

India’s consumer-facing giants went through a year of reckoning in 2025. Hypergrowth gave way to profitability pressures, while public market scrutiny became the new normal. All in all, 2025 was about proving sustainable unit economics.

It also became a record-breaking year for startup IPOs, signalling that India’s tech ecosystem is moving in the right direction. With that said, here’s how the biggest new-age tech companies fared in 2025.

Urban Company’s Milestone Year

- For the hyperlocal services giant, 2025 was a year of bold expansion and tough trade-offs. The year saw the services unicorn foray into consumer durables, go public with a splash, face market scrutiny, and whatnot.

- While its shares debuted at a 56% premium on the bourses, the post-listing euphoria faded quickly as concerns over profitability and expansion costs weighed heavily on the sentiment.

- On the geographic front, the unicorn exited Saudi Arabia due to sustained losses and faced gig worker shortages in the UAE and Singapore. Meanwhile, it forayed into micro-renovation and instant help segments to offset market pressures.

Swiggy’s Expanding Multiverse

- The foodtech major’s 2025 was defined by aggressive quick commerce expansion and a slew of new apps and offerings. Losses also widened, testing its balance between growth and profitability.

- Another major takeaway of the year was the company raising INR 10,000 Cr via a QIP, pushing its cash reserves to INR 17,000 Cr. This positions Swiggy close to Eternal-owned Blinkit’s INR 18,000 Cr war chest as the quick commerce race continues to intensify.

- The year also saw Swiggy introduce megapods, large-format dark stores, to gain operational efficiency and expand assortment. The listed major also pushed the pedal on widening its lead in high-AOV cohorts, rather than relying on discount-led growth.

Lenskart’s Year Of Big Wins

- Much happened at the omnichannel eyewear giant in 2025. It listed on the bourses, forayed into the AI smartglasses space and ramped up local manufacturing with an INR 1,500 Cr Telangana facility.

- However, operational struggles, growing expenses and questions over its profitability played a spoilsport for the company. The hefty INR 70K Cr valuation at a 235X P/E multiple also raised eyebrows, while store-level unit economics remained dicey.

- 2026 will be a critical moment for the company, as the coming three to four quarters will be closely watched for signs of sustainable growth, improved margins, and stronger operational discipline.

Eternal’s Triple-Engine Year

- For the listed foodtech juggernaut, 2025 was all about Blinkit. The quick commerce arm remained the breakout revenue engine, driven by an inventory-led model, rapid expansion of dark stores, and narrowing adjusted EBITDA losses.

- Food delivery arm Zomato continued to deliver stable profitability, but revenue growth slowed amid sectoral headwinds. Eternal also shut down Quick and Everyday, laid off 500-600 staffers and faced intensifying competition from the entry of Rapido’s Ownly.

- Despite a favourable macro landscape and aggressive expansion, the going-out vertical, District, saw deepening losses and volatile revenues, while monetisation stayed wobbly.

PhonePe Diversification Push

- The digital payments major continued its stranglehold over UPI, commanding 46% of the market share in 2025. However, the zero-MDR landscape meant that this scale did not translate to profitability.

- To create alternate sources of revenue, the company in 2025 accelerated its lending tech play. It focussed on building partnerships with banks and NBFCs, activating on-field agents and leveraging AI to prevent frauds.

- Going into 2026, the fintech major aims to push further into insurance tech and wealthtech segments and position itself as a tech-first platform ahead of its $1.5 Bn IPO next year.

Zepto’s Stress Tests

- The quick commerce giant’s 2025 was marked by a $450 Mn private round, a fight over market share, recalibration of its Zepto Cafe business and fierce competition from listed rivals.

- Cofounder and CEO Aadit Palicha waded into numerous debates surrounding cash burn in quick commerce and Zepto Cafe’s growth, and Zepto spent much of the year addressing questions about dark patterns and unfair fees.

- Having brushed those concerns aside, the quick commerce giant is now eyeing an IPO in 2026, and is looking to raise more than $1.2 Bn from the public markets

As the year draws to a close, let’s revisit the key events, trends and controversies that shaped the Indian startup ecosystem in 2025.

Comments are closed.