2025 Indian Startup Trends, Zepto’s D-Street Dash & More

Inc42’s Startup Trends Report Is Her

Initial public offerings (IPOs) were a defining theme for the Indian startup ecosystem in 2025, with 18 startups making their public market debuts. Amid this run, private venture capital and angel investor funding in the Indian startup ecosystem remained more or less stable in 2025.

What The Data Shows: According to Inc42’s “Annual Indian Startup Trends Report, 2025”, Indian startups cumulatively raised $11 Bn across 936+ deals during the year.

While this figure represents an 8% decline from the $12 Bn raised across 993 deals in 2024, it needs to be viewed alongside the IPO spring. For context, Indian startup funding stood at $10 Bn in 2023 amid the funding winter.

Investors Turn Selective: The overall funding volumes appear muted compared to peak years, as investors have become much more selective and are preferring to wait out cycles before investing.

This shift is being supported by a maturing entrepreneurial ecosystem, rather than cyclical capital flows alone. Plus, the IPO wave has driven more investors to pre-IPO rounds rather than risk-heavy capital for companies without a proven profitability pathway.

Improved digital connectivity, wider distribution of technical talent beyond metros, better institutional education and the rise of structured incubators and research-linked centres across India have expanded the pipeline of investable founders and ideas.

The IPO Factor: With many mature startups now raising capital from the public markets, private funding at the late stage declined 14% YoY to $6 Bn across 122 deals in 2025, compared to $7 Bn across 150 deals last year.

While late stage focussed investors took a back seat this year, early and growth stage investors like Peak XV Partners, Accel, and Kalaari Capital remained active, backing sectors such as AI, deeptech, climate tech, space, defence, biotech and advanced manufacturing.

There’s a lot more in Inc42’s Annual Indian Startup Trends Report, 2025, including our predictions for funding in 2026, the key sectors and the ever-evolving world of AI and its impact on the Indian economy. Get the full report for free here!

From The Editor’s Desk

🔔 Zepto Makes A Dash For D-Street

- The quick commerce giant has filed its DRHP with SEBI via the confidential pre-filing route for its $1.3 Bn (11,600 Cr) IPO. The public issue will comprise both a fresh issue and an OFS component.

- The listing is expected to materialise by September 2026. The IPO proceeds will fuel Zepto’s battle against deep-pocketed rivals Swiggy Instamart and Blinkit, as well as new entrants like Amazon, Flipkart Minutes and BigBasket.

- Founded in 2020, Zepto initially offered 45-minute deliveries via local kiranas before pivoting to the 10-minute model. Buoyed by growing demand, the unicorn closed FY24 with an operating revenue of INR 4,454 Cr against a loss of INR 1,249 Cr.

💰 2025’s Mega Deal Paradox

- Only 18 mega rounds (deals above $100 Mn) materialised in 2025, down 25% from 24 last year. Zepto once again topped the charts with a $450 Mn round, while InMobi played second fiddle with its $350 Mn fundraise this year.

- These mega rounds still raked in $3.5 Bn. However, VCs stayed cautious on big-ticket bets, with mega deals slipping below 30% of the total funding for the second time since 2017.

- Largely to blame for the lower deal count was a selective backing of category leaders with defensible moats, proven unit economics, and profitability paths.

⚔️ IndiaMART vs OpenAI

- The B2B ecommerce giant has moved the Calcutta HC against the AI giant, alleging that its website and listings have been excluded from ChatGPT responses. The case has been listed for the next hearing on January 13.

- At the heart of the matter is USTR’s annual report that identifies online marketplaces that allegedly facilitate counterfeiting or piracy. IndiaMART has been featured on this list since at least 2021. The listed major claims that OpenAI relied on USTR reports to exclude IndiaMART.

- During the hearing, the HC observed that IndiaMART appears to have been selectively discriminated against as other platforms named in the same USTR report continue to appear on ChatGPT responses.

💵 Wow! Momo Bags INR 75 Cr

- The QSR chain has raised INR 75 Cr in its ongoing bridge round from Madhusudan Kela to boost innovation and enter 100+ cities in the next two years. Overall, the startup is looking to close the round at INR 130 Cr–150 Cr.

- Founded in 2008, Wow! Momo operates brands like Wow Chicken, Wow! China and China Belly, spanning 800 outlets across 80+ cities. The startup has raised over $150 Mn to date from names like Khazanah Nasional and 360 One.

- Going forward, the startup plans to double down on its omnichannel strategy and FMCG portfolio. It has also appointed Avendus as a banker for its potential IPO by 2027.

🎯 Startup M&A Trends In 2026

- The Indian startup ecosystem witnessed 72 M&A deals in 2025. Going forward, analysts expect to see even fewer, more strategic transactions in 2026. Profitability, tech stacks, and integration potential will likely matter more than scale.

- The next year will see M&A structures evolve from cash-heavy to hybrid and stock-based deals, driven by FEMA liberalisation and Indian corporates seeking flexible acquisition tools for cross-border expansion.

- Vertical SaaS, AI-first startups, D2C brands needing scale, fintech adjacencies and traditional healthcare are the five sectors where M&A momentum will dominate the chatter next year.

Inc42 Markets

Inc42 Startup Spotlight

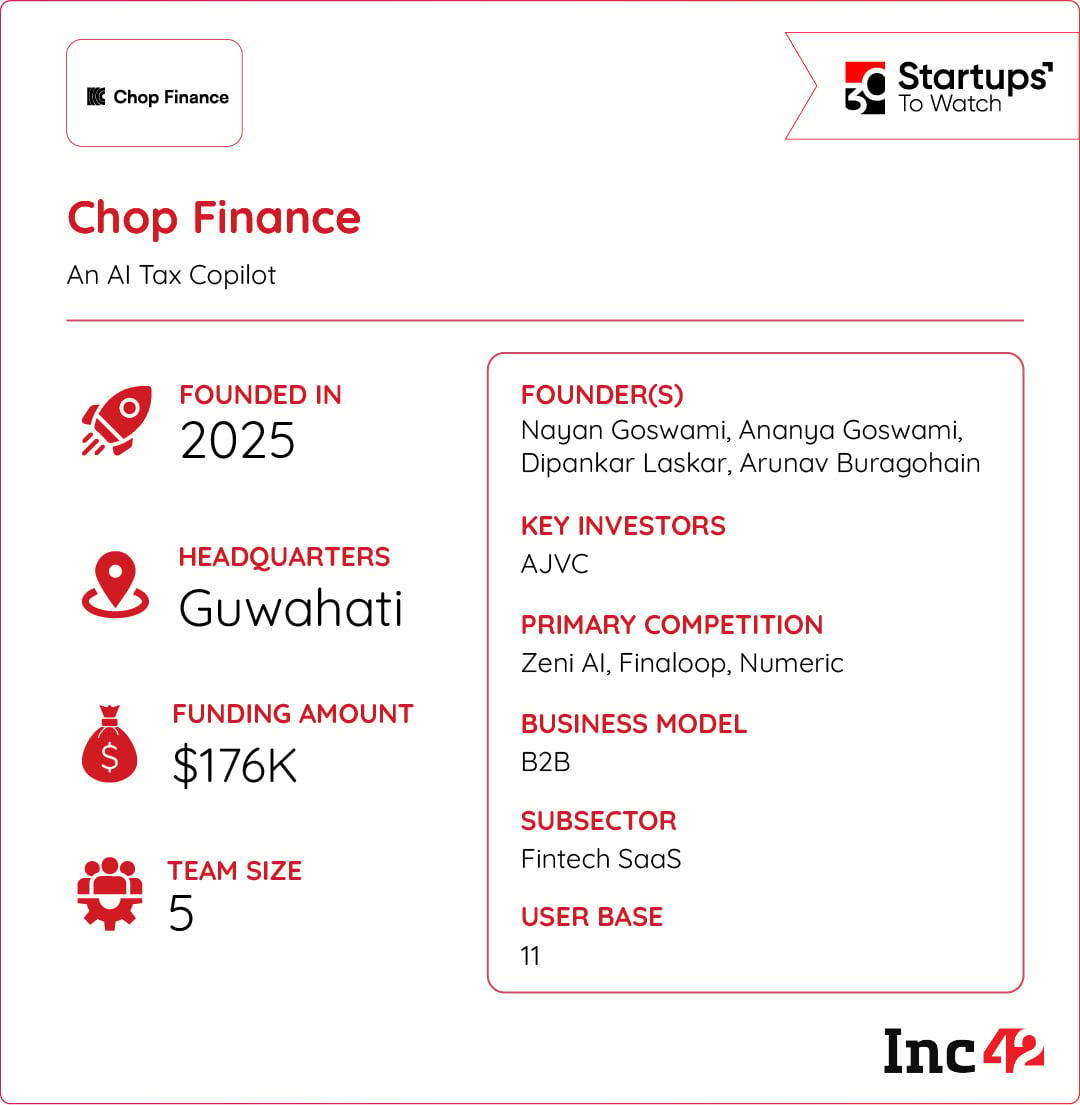

Can Chop Build A Super Intelligence For Accounting?

Finance teams have to juggle a lot of repetitive, rule-based tasks. Relying on outdated tools only compounds errors due to heavy manual effort and slow turnaround times. Enter Chop Finance, a startup that is building an AI-native automation layer for accounting and finance operations.

AI For Accounting: Founded in 2024, Chop Finance’s platform executes complex, multi-step workflows through natural language instructions, automating tasks that previously required sustained human effort. The startup helps tax professionals, CA firms and enterprise finance teams process structured and unstructured data, flag discrepancies and produce ready-to-file outputs.

Automating Workflows: Unlike traditional accounting software that requires structured inputs, the Guwahati-based startup uses agentic AI to understand context, interpret documents and execute end-to-end workflows autonomously. This allows finance teams to delegate entire processes, from invoice reconciliation to compliance to AI agents that learn, reason and adapt over time.

With the global AI-driven finance and expense automation segment projected to grow to $4.9 Bn by 2030, can Chop Finance become the operating system for modern finance teams?

Infographic Of The Day

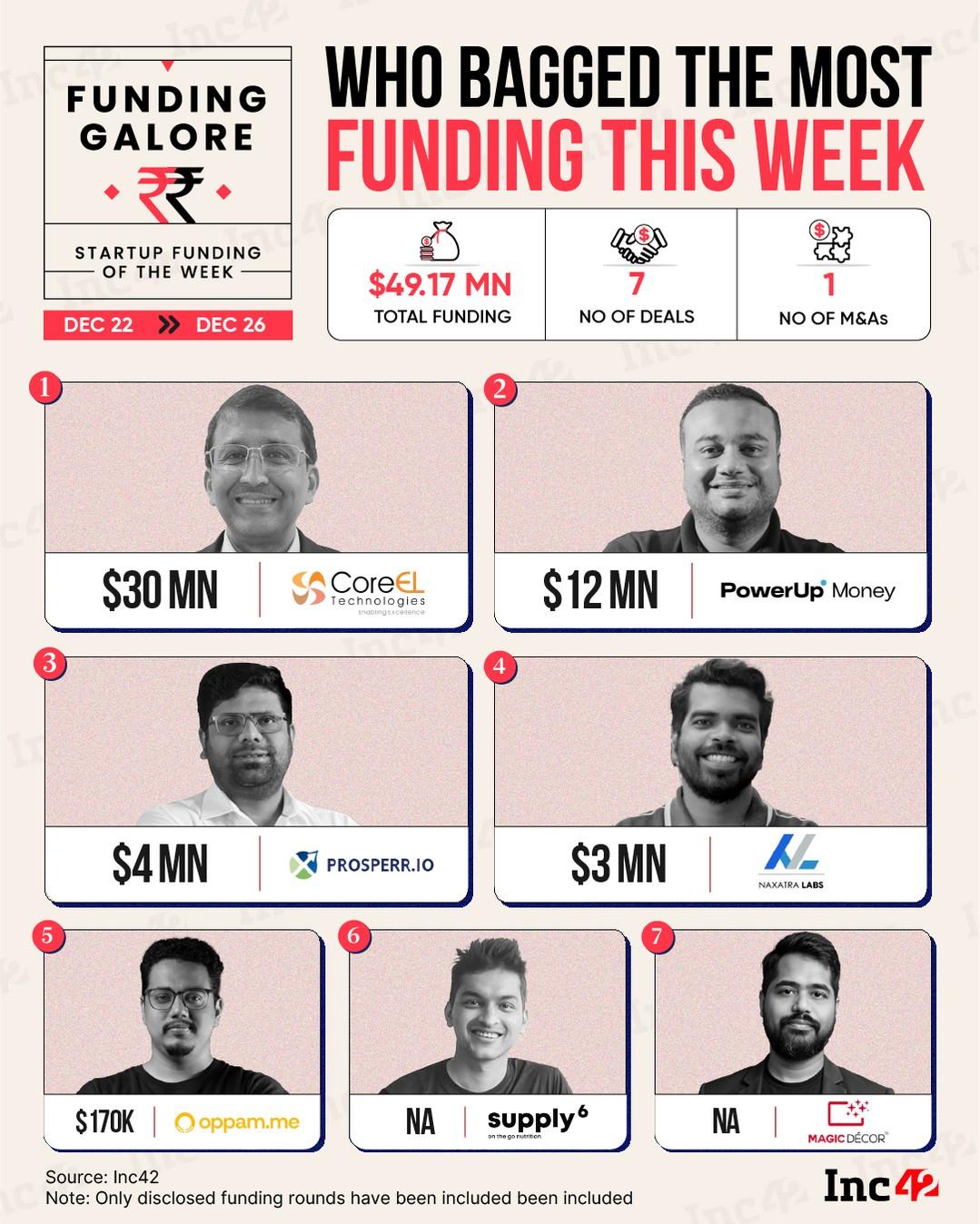

Funding activity saw a massive decline as Indian startups raised a mere $49.2 Mn last week, down 86% from the $347.7 Mn in the preceding week. Here’s how the numbers stack up…

Comments are closed.