Widening housing price-income gap strains affordability even for top earners

In 2014 the price of a 70-square-meter apartment in the affordable segment was roughly equivalent to six years of salaries for a bank employee, who is on average among the top income earners in the country.

But by 2023 the same employee would have had to shell out nine years of income to buy the same apartment.

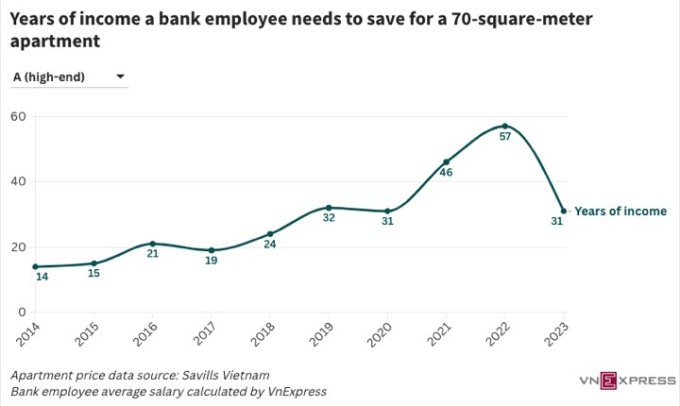

To buy an apartment in the high-end segment, the figure jumped from 14 years to 31 years.

An average worker’s income rose by 7% annually between 2014 and 2022, or half the rise in apartment prices.

In the affordable segment, prices rose by 11% annually, according to property consultancy Savills Vietnam.

The increases were 10% and 16% in the mid- and high-priced segments.

For the average worker, whose income has risen to VND7.6 million per month, a 55-square-meter apartment (among the smallest on the market) now costs 21-23 years of salary.

The house price to income ratio in Vietnam is among Southeast Asia’s highest at 22.8, according to living cost database Numbeo.

It is double that of Malaysia and exceeds that of some developed countries such as Japan, Singapore and South Korea.

The ratio has increased by 27% since 2014, meaning owning a home has become that much more challenging.

“The rapid increase in property prices, outpacing wage growth, will quickly widen inequality,” Le Kien Cuong and his co-researchers from the Ho Chi Minh City University of Banking said in a 2021 study.

As people spend money on rents, their savings reduce as does, gradually, their ability to become homeowners, they added.

Dang Hung Vo, the former Deputy Minister of Natural Resources and Environment, warned that the rapid rise in housing prices would create pressure on social welfare.

Besides, speculators typically wait for prices to rise to but rather than invest in production, he said.

“Failure to curb speculation and the imbalance between the various housing segments has inevitably driven the property market to a dead end.”

The property market has macroeconomic impacts, he added.

Giang Huynh, head of research at Savills Vietnam, said housing supply lags demand in HCMC and Hanoi due to legal bottlenecks slowing the launch of new projects, and rising land prices and construction costs are also driving up housing prices.

In HCMC, for instance, the construction price index rose from 100 to 123 between 2015 and 2023, and so developers have been raising prices.

Economist Dinh The Hien said the launch of new housing projects mostly in the mid- and high-priced segments means the gap between income and housing prices keeps expanding.

Vo said taxing people who have more than one property could help reduce speculation, but a transparent and efficient database is required for that.

Comments are closed.