How will gold, stock markets perform after US elections?

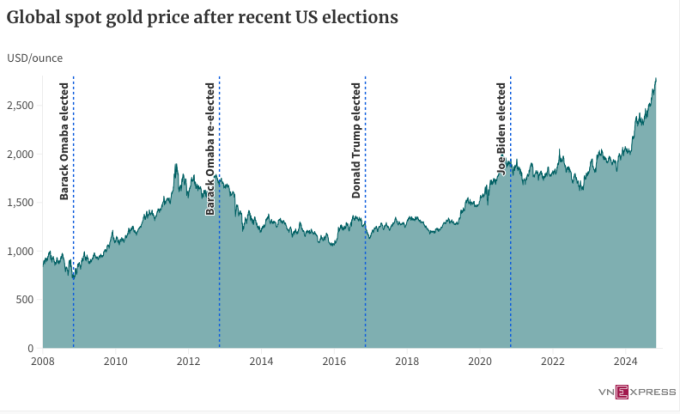

Though gold has historically not been immediately impacted by U.S. elections, ongoing geopolitical tensions are expected to drive up prices of the safe-haven asset, according to a recent note by the World Gold Council.

Thus, its prices will rise irrespective of who wins, it said.

“We remain of the opinion that the fiscal plans proposed under both administrations will continue to attract investors to gold.”

Figures from financial data site Visual Capitalist show no clear pattern in gold value under each U.S. Presidency.

Under Republican President George H. W. Bush, gold fell by 19%, while it surged 215% during his son George W. Bush’s term.

Similarly, gold dropped 20% under Democratic President Bill Clinton but gained 44% during Barack Obama’s presidency.

Investment fund Elara Capital has predicted gold prices will remain high regardless of the election outcome, forecasting a 10% increase over the next 12 months. They attribute this to concerns over the U.S. budget deficit and movements in U.S. Treasury yields.

From a technical perspective, experts from financial portal FXEmpire said, gold is at a critical long-term resistance point.

While there is an upward trend, significant corrections could occur before reaching new highs.

The major resistance range is projected at US$2,800-3,000 per ounce, they said.

Spot gold was hovering at around $2,728 at the time of publishing.

In Vietnam, prices of gold rings, as opposed to bullion, often follow global price trends, which means they will likely be influenced by U.S. presidential policies, the strength of the dollar, interest rates, and investor sentiment.

On the other hand, bar prices have shown few trajectory similarities with global rates.

At times bar prices have been VND20 million higher than global rates for a tael of 37.5 grams or 1.2 ounces since domestic production is strictly controlled by the government and new supply has not been added for years.

A study by stock brokerage Mirae Asset Vietnam found that stock market trends in the U.S. differ depending on which party wins, and a victory for the Democrats often resulted in larger gains for stocks.

When a Democratic president won, the stock market went up 3.8% on average after three months and 17% a year later, it said, citing data from the last 20 elections between 1944 and 2020.

When a Republican president won, the market went up 2.17% after three months and 0.83% after a year.

Mirae said though U.S. elections typically have little direct impact on the Vietnamese stock markets, they often track U.S. market trends.

In the third quarter the movements of the S&P 500 in the U.S. and the VN-Index were 76% similar.

But Tran Hoang Son, director of market analysis at VPBank Securities, said the VN-Index has been stuck below 1,300 points for a long time and needs a major investment boost to break this key level.

In the short term the index is likely to hover in the range of 1,180-1,205 points, he added.

It was at 1,245 points at noon Tuesday.

Comments are closed.