Retail Investors Bet RR Stock Will Have Most Upside In 2025 Among Robotics Players – Read

One of the greatest challenges retail investors face is figuring out which stock is undervalued and finding the right entry point to buy that stock.

However, history shows that these are the points where investors falter most often.

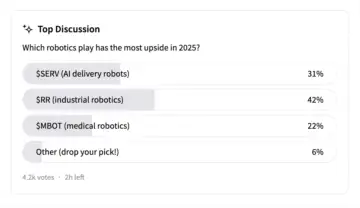

Stocktwits recently conducted a poll asking users on the platform which stock in the robotics sector has the most upside in 2025. Of the three names-Richtech Robotics Inc. (RR), Serve Robotics Inc. (SERV), and Microbot Medical Inc. (MBOT)-retail investors chose to side with RR, which has witnessed the most downside over the last year.

Richtech Robotics lost nearly 59% of its market capitalization during this period, compared to SERV’s almost 28% loss and MBOT’s 43% gain.

Even from a year-to-date perspective, RR stock has gained just about 14%, SERV has risen over 27%, and MBOT has increased over 80%. This leaves more room for RR to pare its losses after last year’s disappointing performance.

Interestingly, it appears retail investors are betting on the stock that seems to be undervalued due to its price movement. The question is whether a significant decline in stock price indicates an equally lucrative potential for a reversion to the mean or a persisting weakness in the fundamentals.

Another notable metric appears to be the short interest on these stocks. According to KoyFin, RR has the lowest short interest among the three names of about 3.1% while MBOT has a short interest of about 3.4% and SERV has a short interest of about 5.7%. Although the numbers do not seem significant, the needle still points toward RR as the best choice.

Investor perception, too, is a crucial deciding factor. While MBOT stock appears to be the least undervalued of the three stocks, SERV shares have drawn some negative reactions recently. The company announced $80 million worth of direct offering, drawing negative reactions from investors.

This development also favors RR as the stock with the most upside this year.

However, markets never cease to surprise, and with 2025 just two weeks old, investors will have plenty of time to assess how the evolving macro picture affected these companies’ fundamentals.

It will also be interesting to analyze whether the much-talked-about mean reversion worked for RR stock.

Comments are closed.