Retail Turns Ecstatic – Read

Shares of financial services firm Robinhood Markets Inc (HOOD) surged over 10% on Wednesday to hit over three-year highs after analysts glorified the stock calling it one of their best ideas.

According to TheFly, Morgan Stanley added Robinhood to the firm’s “Financials’ Finest” list. The firm’s analyst sees a sustainable business model, as “opposed to a meme stock,” that’s expanding into different business lines with many vectors for growth.

Morgan Stanley believes that these factors are not yet reflected in the stock’s valuation and the shareholder base. The brokerage has an ‘Overweight’ rating with a $55 price target on the shares. The price target implies nearly 20% upside potential despite Wednesday’s rally.

Meanwhile, Bernstein named Robinhood the firm’s new “Best Idea in Global Digital Assets” coverage.

Although Robinhood has operated a constrained crypto business so far, the brokerage expects this to change as the regulatory environment for crypto becomes more favorable.

Although Robinhood’s shares gained nearly 200% in 2024, Bernstein sees more upside as it believes strong revenue growth will continue to drive profitability in 2025. The brokerage has an ‘Outperform’ rating on the shares with a price target of $51.

Other brokerages, too, have hiked their price target on the stock. Earlier this week, JMP Securities raised the firm’s price target on Robinhood to $60 from $53 while keeping an ‘Outperform’ rating on the shares.

Meanwhile, Barclays raised the firm’s price target on the stock to $54 from $49 while keeping an ‘Overweight’ rating.

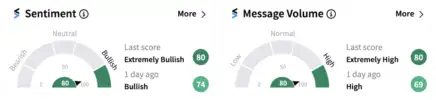

Following the developments, retail sentiment on Stocktwits jumped into the ‘extremely bullish’ territory (80/100) from ‘bullish’ a day ago. Retail chatter, too, rose to ‘extremely high’ levels. HOOD’s Sentiment Meter and Message Volume as of 1:05 p.m. ET on Jan. 15, 2025 | Source: Stocktwits

Earlier this week, the Securities and Exchange Commission announced that broker-dealers Robinhood Securities LLC and Robinhood Financial LLC agreed to pay $45 million in combined civil penalties to settle a range of SEC charges arising from their brokerage operations.

Comments are closed.