RBI Cuts Repo Rate by 25 bps to 5.25% Amid Rupee Slump and Strong GDP

The Reserve Bank of India (RBI) has reduced the repo rate by 25 basis points to 5.25%, balancing record-low inflation with a sharply weakening rupee and stronger-than-expected economic growth. The cut follows two consecutive policy meetings in which the central bank kept rates unchanged.

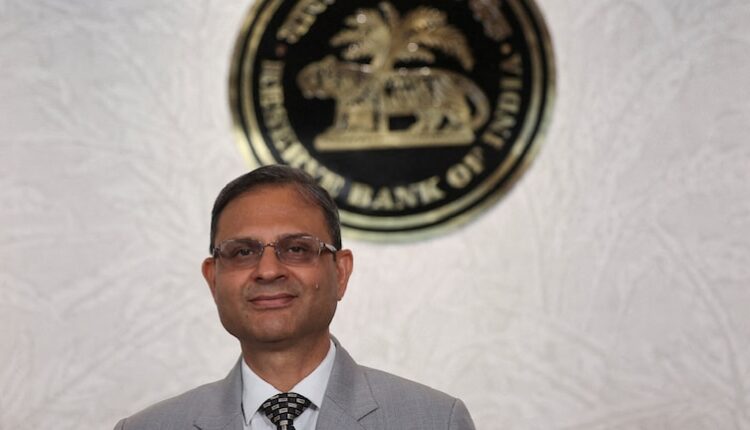

RBI Governor Sanjay Malhotra had signalled possible rate reductions last month, noting that there was “definitely scope” for easing. Since then, India’s economy has remained resilient despite steep 50% US tariffs, while the rupee has dropped to a record low below ₹90 per dollar, complicating the central bank’s policy choices.

A Bloomberg survey of 44 economists showed that most expected a 25-basis-point rate cut, as inflation remains well below the RBI’s 4% target. However, major institutions—including Citigroup, Standard Chartered, and the State Bank of India—believed the rupee’s volatility could push the RBI to maintain a pause.

Key Decisions from the December 3–5 MPC Meeting

Repo rate cut: Reduced by 25 bps to 5.25%

Policy stance: Neutral

GDP growth forecast: Raised to 7.3% (from 6.8%)

Inflation forecast for FY26: Lowered to 2% (from 2.6%)

Economists note that while inflation remains comfortably low, the RBI faces a difficult balancing act. The sharp decline of the rupee since the previous MPC meeting has increased uncertainty around India–US trade negotiations and complicated the policy outlook.

Soumya Kanti Ghosh, Chief Economic Adviser at SBI and member of the Prime Minister’s Economic Advisory Council, said expectations of a rate cut had “faded” in recent weeks due to currency pressures. He believes the RBI may now enter an extended phase of cautious policy management.

Despite the external headwinds, official data shows India continues to outperform major economies, supported by strong domestic demand and resilient growth fundamentals.

Comments are closed.