Retail Investors vs Foreign Selling: Did Domestic Investors Save the Market? Here’s the whole story

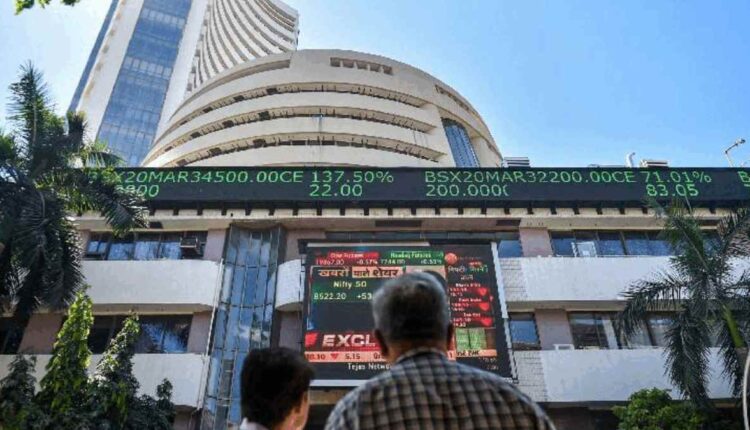

Retail investors vs FPI Selling: India’s stock market is once again reaching new heights. Both Sensex and Nifty are at their highest level in almost 14 months. The interesting thing is that this rise is happening despite continuous selling by foreign investors.

In the beginning of this month alone, foreign investors withdrew approximately Rs 10,000 crore from the stock market. It’s not just a matter of a week or two; They have been selling continuously for several months.

Still, the market has not crashed. The direct reason for this is that domestic investors and common investors like us are continuously investing. While on one hand Domestic Institutional Investors (DIIs) are buying heavily, on the other hand the common people have also maintained their morale, supported the market and contributed significantly to its rise.

Also Read This: IPO rain this week: 12 new issues will open, 16 companies will do explosive listing, read all the details in one click.

Common investors remained strong, their trust was not broken

Over the past few months, there has been a lot of volatility in markets around the world. From increasing taxes in America to pressure on companies, everything has affected India as well. Despite this, one thing is clear: Indian investors have not lost faith in the market.

People are continuously investing and are standing firm in the face of foreign selling. It would not be wrong to say that the current market boom is largely due to these domestic investors.

Also Read This: Advance Tax Deadline: Don’t miss it, otherwise you may get a big shock while filing returns, know the details.

Who bore the impact of foreign selling?

Sanjay Shah of Prudent Corporate says that active participation of retail investors has reduced the impact of foreign selling to a great extent. According to him, the money coming in every month through SIPs (Systematic Investment Plan) is currently at its highest level, due to which the market remains completely balanced.

He also believes that the limited investment options and benefits of SIPs have increased investor confidence. According to his company’s data, while SIPs were around Rs 980 crore at the beginning of the year, it has now increased to around Rs 1100 crore. This clearly shows that the interest of retail investors has increased instead of decreasing.

Also Read This: Share Market: Huge profit in this largecap stock, 1445% jump in two and a half years, still a chance for entry?

Tremendous interest in IPO market also

The market of new shares, i.e. IPOs, is also in full swing these days. Common people are continuously investing money here too and are bidding strongly in many IPOs.

It is often seen that due to IPOs, investors’ money remains in the stock market, instead of going somewhere else. Sanjay Shah believes that when companies raise money by selling their shares, that money circulates back into the market, and economic activity increases.

Also Read This: Tremendous surge in the market due to RBI policy: Nifty again close to all-time high, what double top pattern is being formed?

Comments are closed.