Zepto’s Year In Focus, GenWise Shuts Shop & More

Zepto’s Turbulent 2025

Zepto’s 2025 was anything but smooth. The quick commerce unicorn bled market share to rivals, saw leadership exits, mass layoffs, and mounting user complaints. So, what derailed Zepto’s growth rhythm in 2025?

The Cash Burn Crisis: Zepto’s year was defined by retreat, not conquest. The startup’s plan to file draft IPO papers by June collapsed as monthly burn skyrocketed, driven by the need to defend turf against better-funded competitors. Zepto was forced into unsustainable spending that eroded unit economics and made a public listing untenable. The IPO was pushed to June 2026, and private fundraising became the fallback.

Ambition Turns Sour: Simultaneously, Zepto Cafe crumbled by mid-2025. The quick food delivery vertical shut 45-50 outlets in July and then temporarily closed another 200 locations, citing supply constraints and weak demand.

While rivals scaled up, Zepto slowed down. To preserve cash, the company hiked brand commissions, slashed discounts and introduced hidden handling fees. The backlash was swift as Zepto’s monthly active user base shrank, followed by an internal restructuring which led to 500 job cuts.

A Strategic Reset: After slashing burn to INR 100 Cr and securing $450 Mn in its latest round, Zepto has gone back to basics in some ways – addressing the concerns around dark patterns, and chasing revenue diversification. But the new ‘no-hidden-fees’ Zepto still has to prove that its execution is paying dividends.

Now it’s preparing a confidential IPO filing for a $500 Mn listing by mid-2026. This gives the unicorn two quarters to rework unit economics, repair reputation, and reclaim market share. Yet analysts remain cautious over its marketplace model and resurgent competition.

While 2026 will be pivotal in deciding the fate of the quick commerce giant, let’s trace how Zepto fared in 2025.

From The Editor’s Desk

GenWise Shuts Shop

- The senior citizen-focussed fintech app has paused operations and laid off most of its 20-member team. GenWise is evaluating strategic options, with a buyout being one of the possibilities.

- Founded in 2023, GenWise used to offer digital passbooks, payment reminders and social networking opportunities to the elderly. With a $3.5 Mn funding backup, its product stack included an AI-powered companion for conversation and emotional support.

- Despite claims of reaching over 30 Lakh users, the startup shut shop due to weak monetisation, low ARPU, mounting losses, low digital comfort among senior citizens and the need for sustained hand-holding to drive engagement.

Swiggy’s INR 10,000 Cr QIP

- The foodtech major has kicked off a $1.2 Bn qualified institutional placement at a floor price of INR 390.51 per share, a nearly 2% discount to its last close. At least 10% of the issue is reserved for mutual funds, while the remaining will be available for QIBs.

- Mirroring rival Eternal’s INR 8,500 Cr QIP last month, Swiggy’s issue will largely go towards scaling up Instamart’s fulfilment network to 6.7 Mn sq ft by 2028-end. A portion of the fundraise will also be deployed for bolstering the tech stack and marketing.

- This comes as Swiggy looks to pivot its quick commerce business to the inventory-led model, protect market share in the cash-guzzling segment and fight the rising tide of competition from rivals like Blinkit and Zepto.

Job Cuts At Whatfix

- The B2B SaaS soonicorn has laid off around 60 employees, roughly 6% of its over 900-people-strong workforce. The retrenchments primarily impacted sales and marketing GTM teams amid AI-led automation.

- Founded in 2013, Whatfix offers an AI-powered digital adoption platform that is used by 700+ enterprises to onboard users, drive product adoption and squeeze more returns out of software investments.

- The layoffs mirror a broader 2025 pattern where legacy enterprise tech players like Salesforce and TCS have restructured teams to prioritise AI R&D, while new-age tech companies have cut jobs due to AI integrations.

Wakefit IPO Day 2

- The D2C mattress brand’s public issue was subscribed 39% by the end of Day 2, with investors bidding for 1.4 Cr shares against 3.6 Cr on offer, signalling a lukewarm response.

- Wakefit is looking to raise up to INR 377.2 Cr via a fresh issue and an OFS component of 4.68 Cr shares. The company is targeting a valuation of INR 6,373 Cr at the top end of the INR 185–195 price band.

- Founded in 2016, Wakefit has built a 3,000+ SKU portfolio across mattresses, pillows, bed frames and protectors. Backed by over $148 Mn in funding from Peak XV and Verlinvest, the startup minted a net profit of INR 35.6 Cr in H1 FY26.

Fibe Nets $35 Mn

- The digital lending startup has raised about INR 314 Cr from IFC as part of its Series F round. The fresh capital will be used to build a unified platform that bundles lending, saving, investing, and payments under one umbrella.

- Founded in 2015, Fibe offers loans to the salaried population, with ticket sizes ranging from INR 5,000 to INR 5 Lakh. The startup claims to have disbursed over 90 Lakh loans to date, and has a footprint across 940+ cities.

- Competing alongside PaySense, ZestMoney, Daily Salary and Refyne, FIbe operates in India’s booming lending tech market, which is projected to become a $1.3 Tn opportunity by 2030.

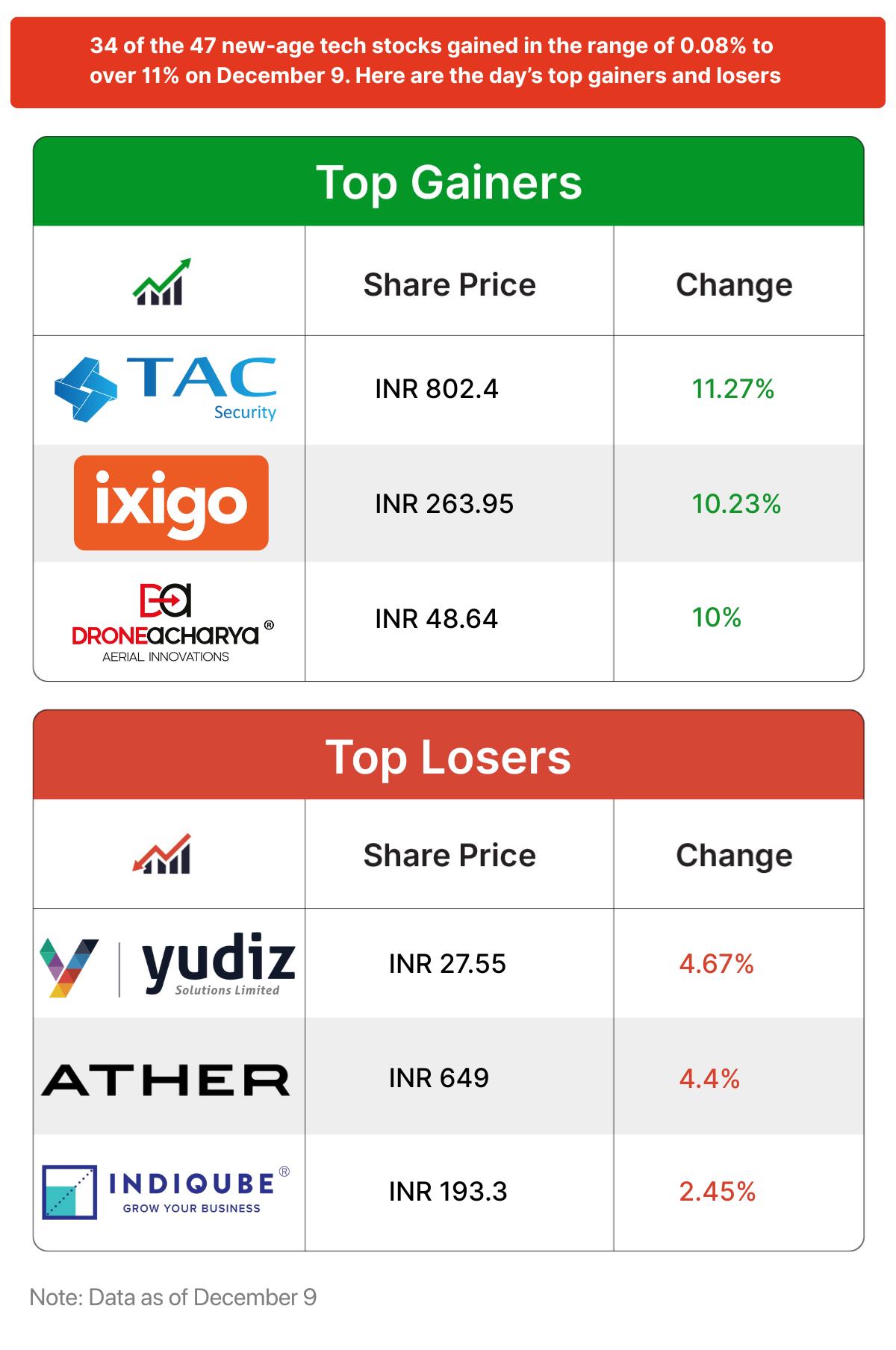

Inc42 Markets

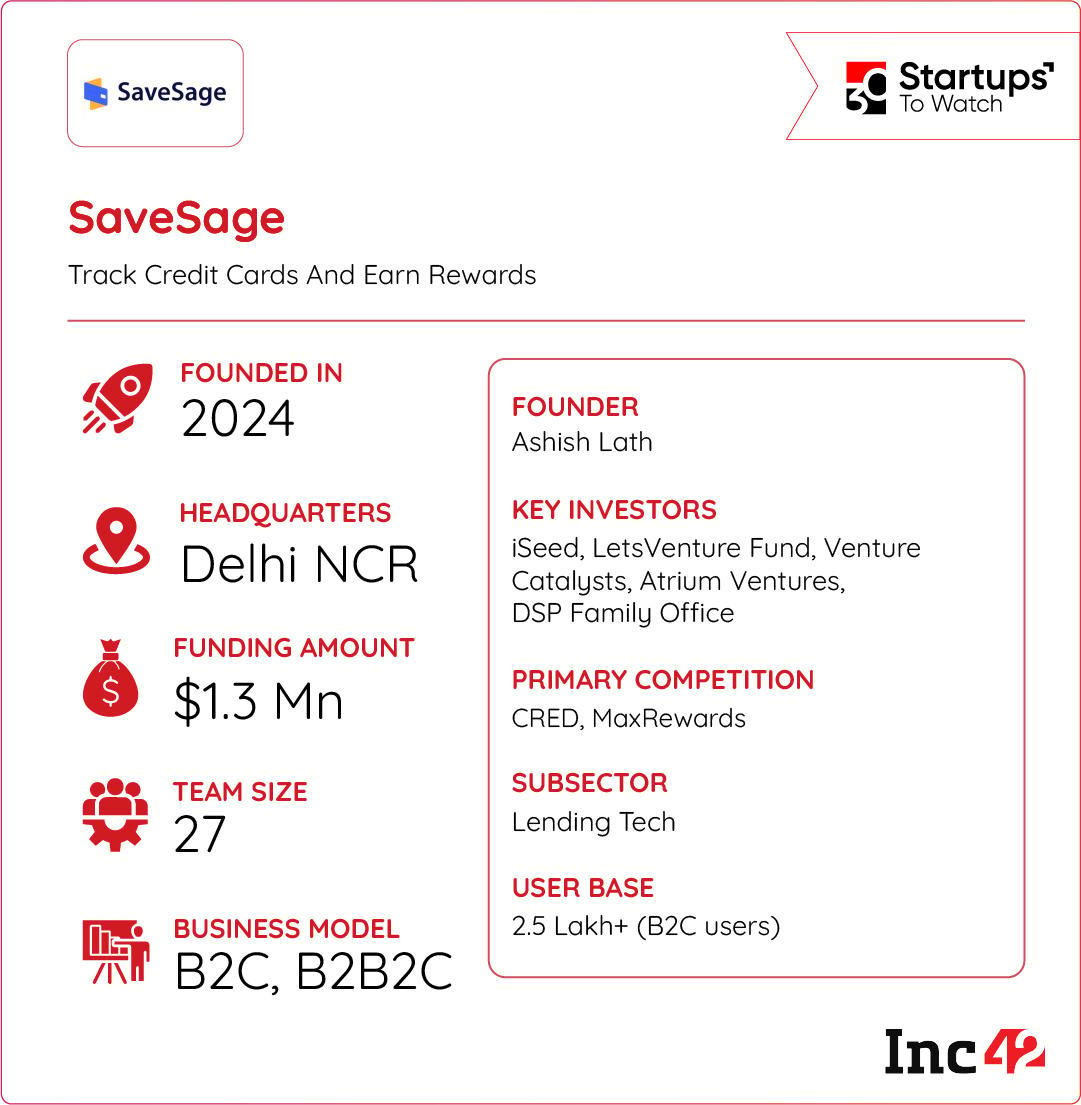

Inc42 Startup Spotlight

How SaveSage Is Solving India’s Credit Card Conundrum

India’s credit card adoption is surging, yet most users struggle to extract real value from their cards – reward points expire unused, hidden fees erode savings, and sub-optimal redemptions leave money on the table. SaveSage was born from a similar personal frustration of its founder.

AI-Led Credit Card Management: Founded in 2024, the Delhi NCR-based startup offers an AI-driven platform that manages the entire credit card lifecycle, from selection to redemption. SaveSage helps users choose the right cards, track spending, monitor rewards across 80+ loyalty programmes, flag expiring points, and recommend optimal redemption strategies. Users can also access expert consultations for personalised guidance on maximising card benefits.

‘Savvy’ Assistant: At the core of SaveSage’s offering is Savvy, an AI assistant that provides 24×7 personalised credit card advice. Complementing this are tools like MySpace for financial decision-making and Travel on Points, which helps users unlock higher-value travel redemptions by strategically using reward points. These features simplify what has traditionally been a complex, opaque process.

Growing At A Steady Pace: In just one year since launch, SaveSage claims to have crossed 2.5 Lakh users, signalling strong demand for better credit card intelligence. As Indians accumulate more cards, can SaveSage turn credit card confusion into a profitable, user-friendly experience?

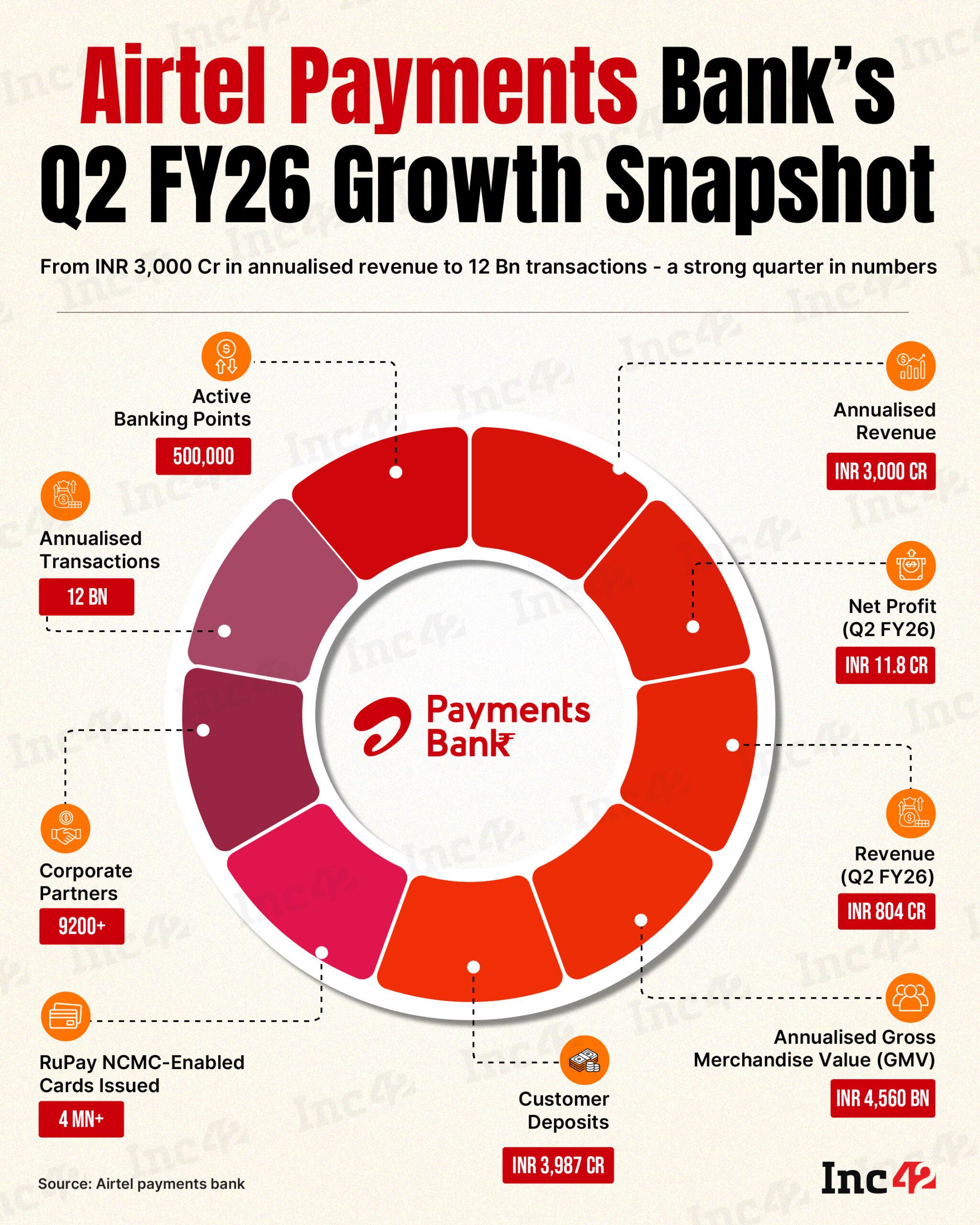

Infographic Of The Day

From INR 3,000 Cr in annualised revenue to 1,200 Cr transactions, Airtel Payments Bank continued to scale with strength and consistency in Q2 FY26. Here’s a sneak peek…

Comments are closed.