OYO Sets New Horizons, Skippi’s Rough Patch & More

OYO Resets In 2025

OYO set the ball rolling for its D-Street debut in 2025. The hospitality giant rebranded as PRISM and secured board approval for a massive INR 6,650 Cr IPO. But is the Ritesh Agarwal-led company genuinely ready to take the next big leap?

Beyond The Budget Label: The rebrand to PRISM was more than cosmetic. It marked a strategic pivot from a budget hotel aggregator to a portfolio-led brand operating distinct verticals like Motel6, Townhouse and Sunday. Then, by moving toward boutique and curated inventory, PRISM is betting on higher average daily rates and stronger repeat cohorts in 2026. It is also distancing itself from the discount-heavy mass market.

The Global Shift: Perhaps the most striking development for PRISM in 2025 was its geographic rebalancing. India now contributes just 30% to the top line, matched equally by the US. Europe, too, is emerging as a profitability engine through vacation rentals.

PRISM has now entered the IPO fray with purportedly 12 straight profitable quarters and an FY25 profit of INR 244.8 Cr. Eyeing a valuation of $7-8 Bn, the company is betting that public investors will see it as a scalable, tech-first hospitality platform akin to Marriott or Airbnb, not a traditional travel aggregator.

The Overhang: Yet scrutiny over its IPO looms large. PRISM’s multi-brand architecture remains complex, and integration across thousands of properties will demand time and capital. Making matters worse, most of its global expansion has been debt-driven. The company’s balance sheet remains bogged down by a credit burden exceeding INR 7,000 Cr.

Amid the current state of affairs, does PRISM make a case for a blockbuster IPO? Let’s find out…

From The Editor’s Desk

Sahi Eyes $30 Mn At $200 Mn Valuation

- The trading platform is in advanced talks to raise $30-35 Mn in a Series B round from existing backers Accel and Elevation Capital. This will mark the startup’s third fundraise in less than two years.

- Founded in late 2023, Sahi is betting on a mobile-first trading experience aimed squarely at professional retail traders rather than passive investors. The platform claims to have so far clocked 1 Mn downloads on the Play Store.

- Sahi is trying to carve a niche in India’s increasingly crowded discount brokerage segment, which has seen a surge in retail participation in recent years on the back of tech-driven convenience, low-cost models and increased financial literacy.

Skippi Hits A Rough Patch

- The Shark Tank-fame ice lolly brand saw its operating revenue collapse 59% YoY to INR 8.2 Cr in FY25. Meanwhile, its employees are facing salary delays, PF has not been deposited for nearly two years, and distributors are stuck with unsold inventory.

- Insiders say that the demand surge after the appearance on the TV show was short-lived as sales teams in tier II and III cities underperformed, and the single-SKU business model failed to justify high distribution and sales costs.

- Despite the setback, the company claims that it has restructured its operations and is on track to clock INR 100–150 Cr in revenue for FY26.

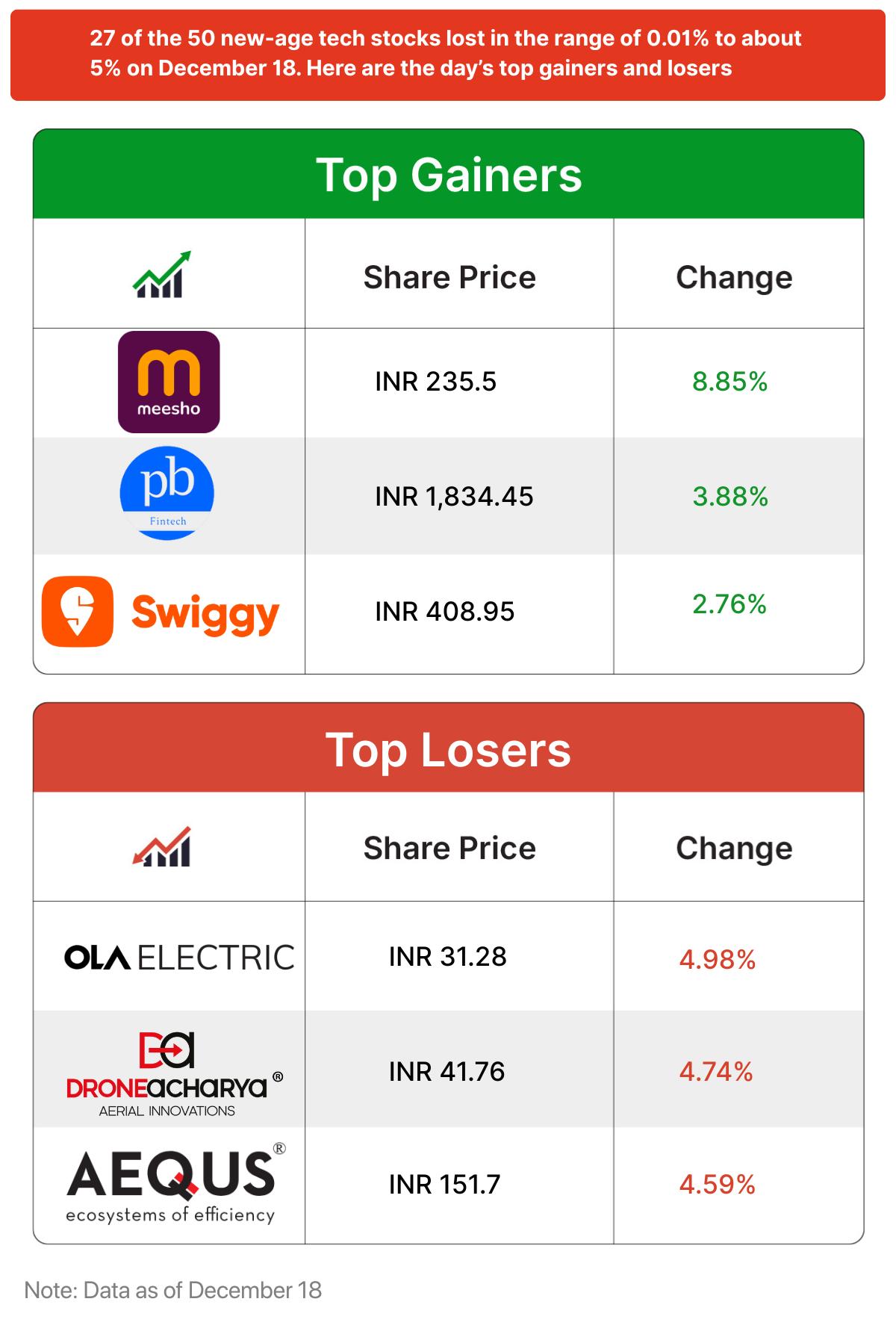

Bhavish Aggarwal On Stock Selling Spree

- The EV maker’s founder offloaded another 2.83 Cr shares worth INR 90.3 Cr yesterday. With this, Aggarwal has dumped stock worth INR 324.6 Cr over three days.

- Aggarwal sold shares worth INR 92 Cr on December 16, followed by another INR 142.3 Cr bulk deal on December 17. Previously, Ola Electric attributed the move to repay a loan of INR 260 Cr and release all 3.93% pledged shares.

- The EV maker’s stock hit a fresh all-time low of INR 30.79 during intraday trading yesterday. This adds to the growing list of troubles plaguing the company, including customer complaints, rising competition and heavy losses.

FabHotels’ Parent Files For IPO

- The budget hotel chain’s parent Travelstack has filed its DRHP with SEBI for an IPO, which will comprise a fresh issue of shares worth INR 250 Cr and an OFS of up to 2.69 Cr shares.

- Travelstack operates TravelPlus, which offers a SaaS platform to enable 100+ enterprises to book travel, manage approvals and process expenses. It also operates the budget hotel chain FabHotels.

- Ahead of filing its DRHP, Travelstack turned profitable on paper. It reported a net profit of INR 32.2 Cr in H1 FY26 on an operating revenue of INR 400.4 Cr. However, the profit hinged almost entirely on an INR 37.4 Cr deferred tax gain.

PW Ups Stake In Xylem

- The listed unicorn has increased its stake in the Kerala-based edtech platform to 77.27%, with a fresh investment of INR 122.9 Cr. This transaction is part of a multi-stage deal signed by PW in 2023 to acquire 100% of Xylem.

- PW initially acquired a 50% stake in Xylem for INR 500 Cr and expanded its holding to 64.98% before this latest infusion. The subsidiary acts as a backbone for PW’s offline expansion in southern states.

- The Xylem stake increase is one component of PW’s aggressive investment spree. In Q2, the edtech major pumped around INR 500 Cr into PenPencil, Finz Fintech and Knowledge Planet to support working capital and expansion plans.

Inc42 Markets

Inc42 Startup Spotlight

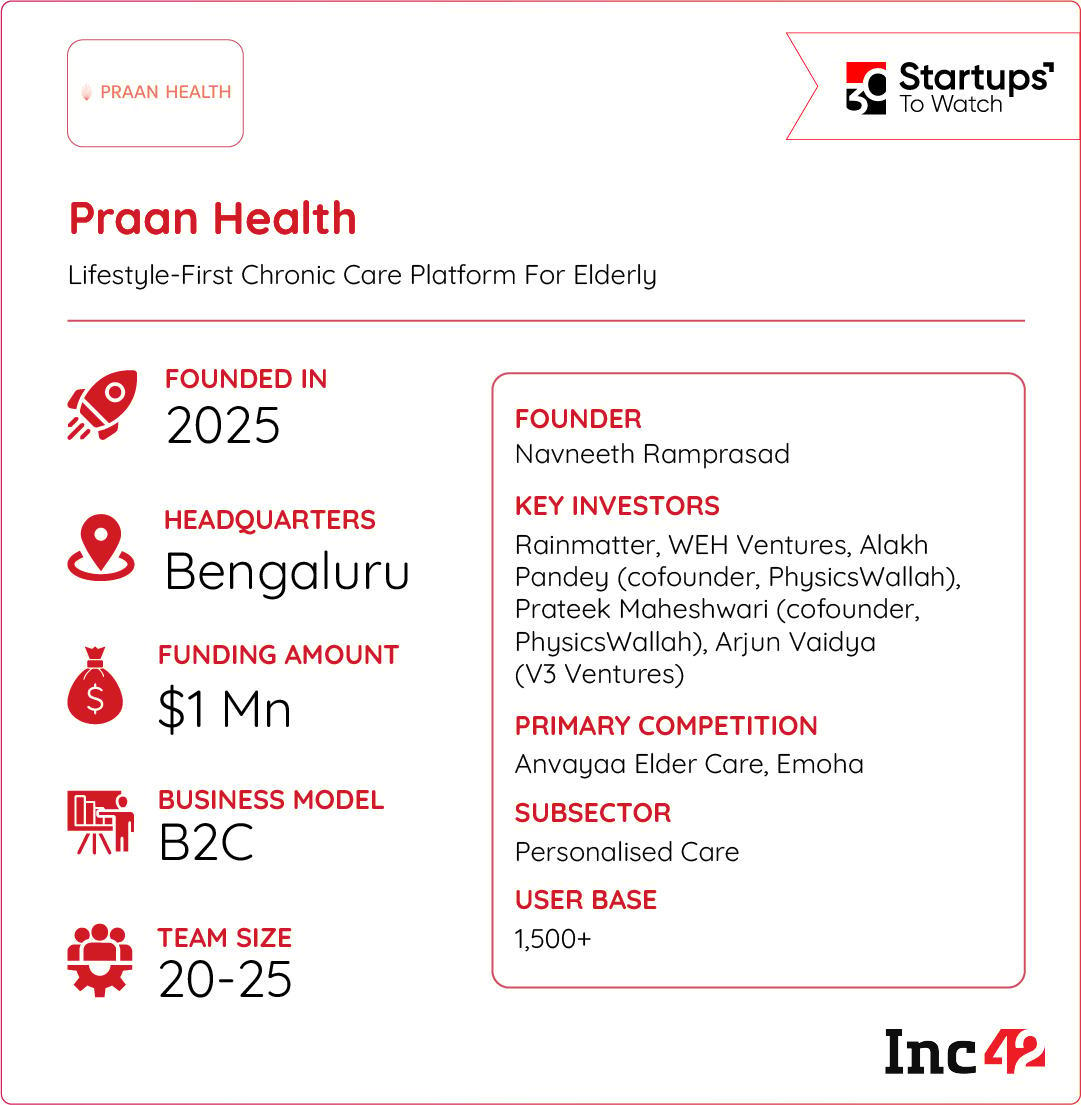

How Praan Is Rewriting Chronic Care For The Elderly

India’s ageing population is staring at a health emergency. Chronic lifestyle diseases often surge post the age of 50, but care remains fragmented and reactive rather than preventive. Solving this problem for this niche cohort is Praan.

A Lifestyle-First Bet: Founded in 2024, Praan Health is building a lifestyle-first chronic care platform tailored specifically for people aged 50 and above. Its model is built around four core pillars – strength training to rebuild muscle and mobility, clinical nutrition to correct long-term dietary patterns, medical supervision to manage complex conditions safely, and continuous behavioural accountability to sustain change.

A Guided Journey: Praan runs various programmes that cover more than 25 chronic conditions, from diabetes and hypertension to obesity and arthritis. Users receive doctor-led care, personalised nutrition plans, guided strength coaching and real-time progress tracking through digital tools.

Building Continuous Care: Backed by Rainmatter Investments and WEH Ventures, Praan is currently scaling its clinical teams and deepening its tech stack as India’s ageing population moves from episodic hospital visits to home-based care. So, can Praan Health make lifestyle-first chronic care mainstream?

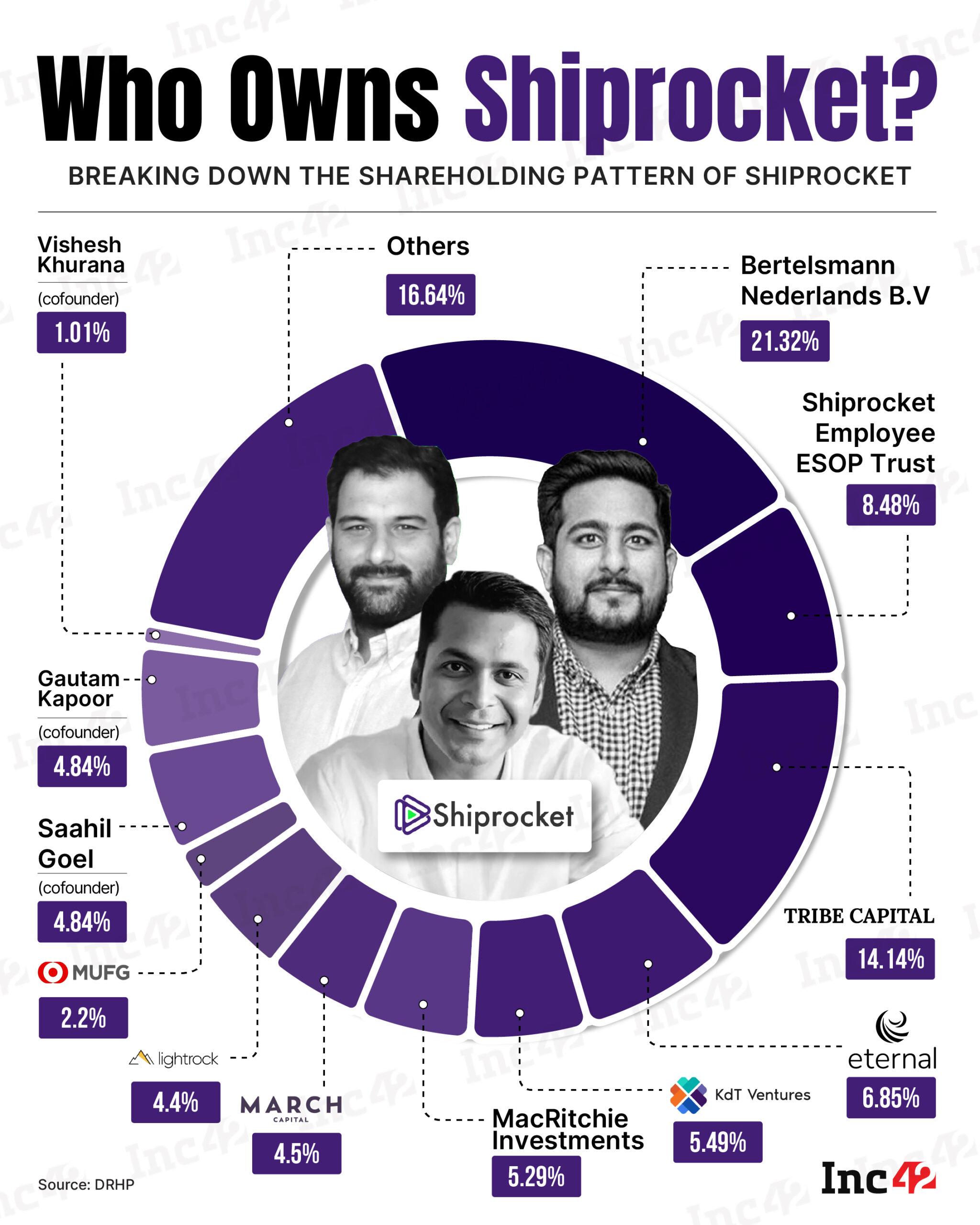

Infographic Of The Day

Shiprocket is gearing up for its INR 2,342 Cr IPO, with cofounders and other institutional backers looking to offload their stakes via OFS. But who dominates the logistics unicorn’s cap table?

Comments are closed.