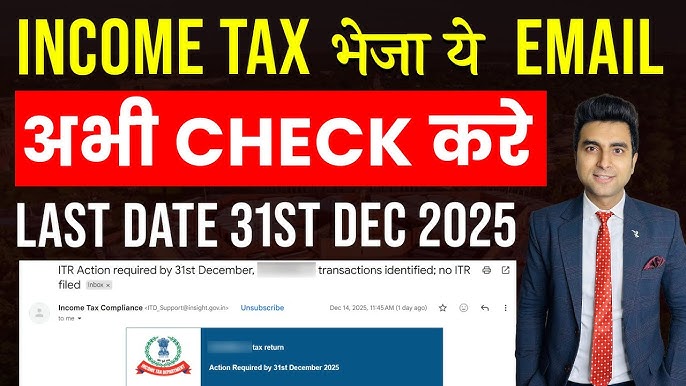

Have you also received SMS or email from Income Tax Department?

ITR: If recently you have received a message from the Income Tax Department on your mobile or email and you are nervous, then there is no need to panic at all. Many taxpayers are currently confused as to why this message came and what further action will be taken. The Income Tax Department itself has given clarification on this.

This is not a notice or action message

The Income Tax Department has clearly stated that the SMS and emails being sent are not notices related to any kind of penalty, investigation or legal action. it’s just a Information and help message Is. Its purpose is to alert taxpayers so that they can file their income tax returns on time and in the correct manner.

What is being said in the message

Through these messages, taxpayers are being asked to check their Annual Information Statement i.e. AIS carefully. AIS contains your salary, bank transactions, investments, interest and other financial information. If you find any mistake in it, correct it in time. For this, the facility to give online feedback has also been provided.

a chance to correct one’s own mistakes

The Income Tax Department has given the facility to the taxpayers to correct their mistakes themselves. If you have filed ITR but there is an error in it, you can file a revised return. At the same time, those who have not yet filed ITR can still file it. This can avoid any kind of trouble or investigation in future.

Last date to file ITR

According to the Income Tax Department, taxpayers who have not yet filed their income tax returns have time till December 31, 2025. You can avoid penalties and notices by filing returns before this date. It will be beneficial for you to check AIS in time and give correct information.

Read Also:Swivel Seat for the first time in Maruti WagonR, a game changer feature for the elderly.

No need to panic, need to show understanding

Overall, this message from the Income Tax Department is not to scare you, but to show you the right path. If you have done everything right, there is nothing to worry about. And if there is a small mistake somewhere, now you have every chance to correct it. It is wise not to ignore the message and update your tax information in time.

Comments are closed.