Foodtech In 2026, UC’s Tax Troubles & More

Inside 2026 Foodtech Factory

The year 2025 brought soft consumer spending, stagnant user growth and fresh tax burdens for India’s food delivery giants. As a result, growth slowed, profitability remained stressed, and yet the sector kept experimenting. Amid this backdrop, what does 2026 look like for the sector?

The Urban Ladder: Order volumes are expected to grow only in the ‘high’ single digits in 2026, led almost entirely by metro users. Outside the top cities, tier III and IV markets are projected to remain sluggish, forcing platforms to prioritise defending urban share over chasing new geographies.

Efficiency Over Hype: Industry insiders see Zomato and Swiggy focus more on delivering efficiently and transparently, rather than quickly. Multi-order batching may become a flashpoint as users may not take well to the long ETAs. Simultaneously, companies may try to balance cost optimisation with sturdier packaging to improve perceived value.

The New Normal: Healthier eating will emerge as a big theme, but will remain additive rather than a replacement. Platforms will likely keep expanding “healthy” food options, while comfort staples like pizza and biryani will continue to anchor volumes.

No Need For Speed? The quick food delivery mania that generated buzz in 2025 is projected to retreat due to limited SKUs and dicey unit economics. To offset this, foodtech giants may push hybrid models (bundling hot-snack SKUs with grocery), which travel well, carry better margins and don’t depend on ultra-precise ETAs.

Rival Landscape: ONDC’s food ambitions are projected to lose commercial steam in 2026, constrained by fragmented networks, weak tracking and lower-commission incentives. The real disruptor could likely be Rapido’s Ownly, which will lean into lower delivery fees, narrower restaurant commissions and aggressive discounting to upend the food delivery segment.

Taken together, 2026 could turn out to be a year where growth is modest and consumers are more value-conscious. So, what will the food delivery battleground look like next year? Let’s find out…

From The Editor’s Desk

⚖️ Urban Company’s Tax Troubles

- The consumer services unicorn has received a fresh tax demand and penalty notice totalling INR 56.4 Cr from Maharashtra GST authorities over alleged non-payment of taxes between April 2021 and March 2025.

- GST officials argue that services like appliance repair and painting also fall under Section 9(5) of the CGST Act, making Urban Company liable to pay GST on all such payouts during the period.

- This is the latest in a string of tax disputes involving Urban Company. The startup is already contesting at least three other GST demands, totalling INR 51 Cr in Haryana, Maharashtra and Tamil Nadu.

🧑🏫 Another Storm Brews At Unacademy

- In the middle of active M&A talks, CEO Gaurav Munjal has clarified that the decision to reduce the ESOP exercise window to just 30 days from 10 years previously was taken to ensure employees get shares in Unacademy or the merged entity.

- Munjal argued that investors with liquidation preference could legally wipe out all ESOP value in a low-valuation M&A deal. He added that an early window was meant to convert vested options into common shares before such rights kick in.

- The controversy arose as the CEO recently publicly confirmed that Unacademy, once valued at $3.5 Bn, is on sale. Reports suggest that the troubled company could be sold for as little as $300 Mn.

🚁Reprieve For DroneAcharya

- Securities Appellate Tribunal (SAT) has temporarily stayed the recovery of penalties against the startup by SEBI, giving the SME-listed drone company its first sigh of relief in a high-stakes market conduct case.

- However, the tribunal directed DroneAcharya to deposit 50% of the total penalty within four weeks, while giving SEBI four weeks to file its reply. The next hearing in the matter is scheduled for February 12.

- SEBI’s original order had barred key executives from the securities markets and imposed a penalty of INR 75 Lakh on DroneAcharya and its founders over allegations of inflated revenues, misuse of IPO proceeds and misleading disclosures.

📊 Mixed Week For New-Age Tech Stocks

- It was a subdued week for India’s startup stocks. While 26 stocks under Inc42’s coverage declined in the range 0.3% to 20%, the remaining 22 names gained between 0.04% to a sharp 35%.

- While recently-listed Meesho, Lenskart and Groww topped the gainers’ chart after upbeat brokerage commentary, DroneAcharya shares continued their downward trend amid SEBI’s fraud allegations.

- Largely to blame for the mixed show of the startup stocks last week were choppy conditions in the broader market, weak global cues, foreign institutional selling and a weaker rupee.

✈️ OTAs Hit Turbulence In 2025

- For the sector, 2025 was defined by regulatory disruptions, airline instability and safety shocks that forced online travel aggregators (OTAs) to reconfigure their tech stacks and cash-flow models.

- Geopolitical tensions also hit the peak travel season. Even post the conflict, recovery remained slow as advisories, airspace uncertainty and traveller caution persisted. Pressure especially intensified on OTAs as they directly interfaced with customers.

- While EaseMyTrip, which derives 50-60% of revenue from air ticketing, became 2025’s cautionary tale, MakeMyTrip continued to grow by balancing higher-margin hotel bookings to subsidise low-margin flight operations.

Inc42 Markets

Inc42 Startup Spotlight

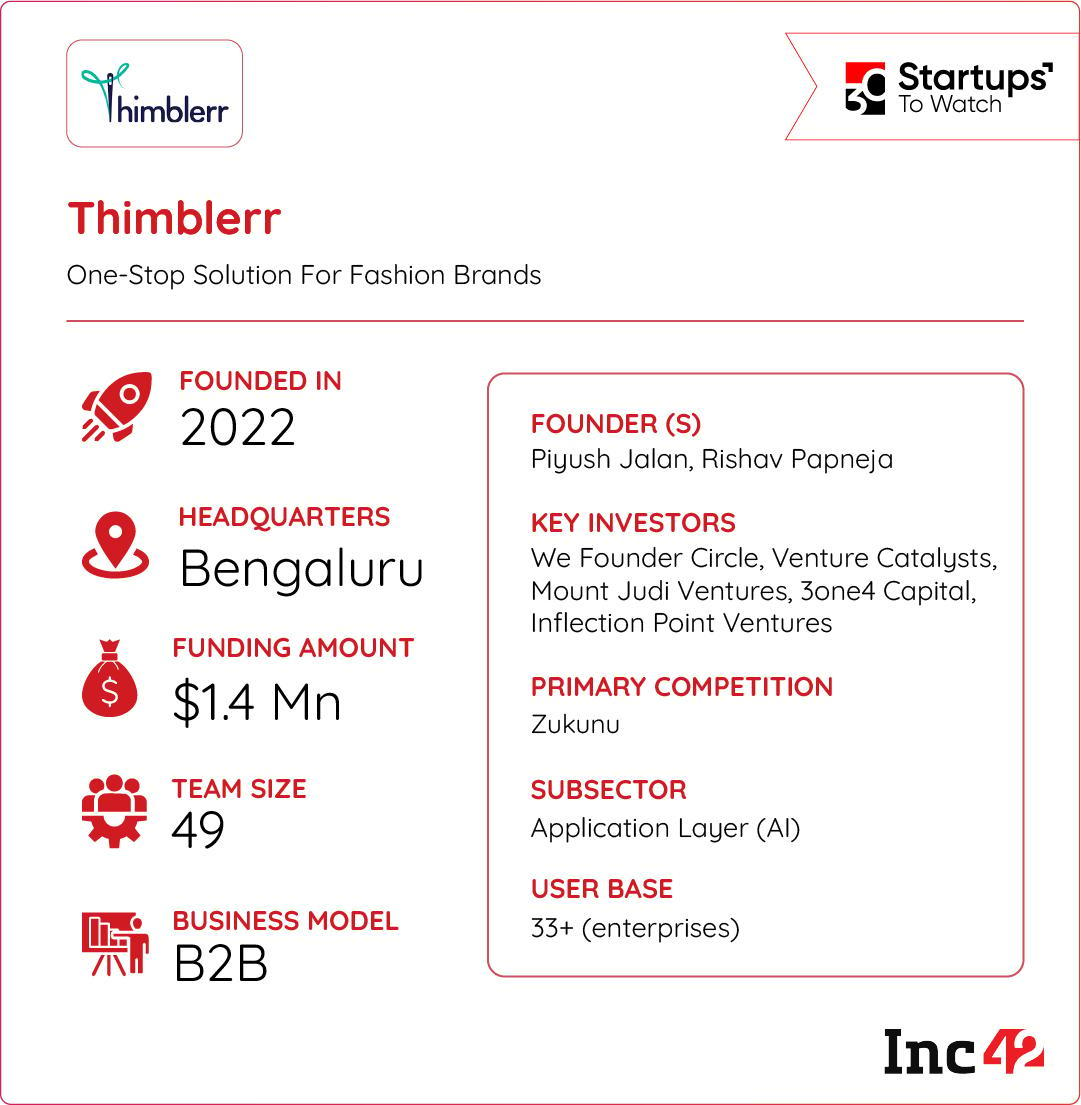

How Thimblerr Is Digitising Fashion Manufacturing

Slow and fragmented manufacturing continues to be a major pain point for fashion brands. Long design-to-delivery cycles, multiple vendors, unpredictable timelines and high minimum order quantities prevent them from launching trendy styles at quicker speeds.

Speeding Up Manufacturing: Founded in 2022, Thimblerr offers a full-stack, tech-driven manufacturing platform that helps brands launch new styles up to 5X faster. The startup replaces the traditional 180-day cycle with a 30 to 60-day workflow using AI-assisted design, instant raw material selection, rapid product development and real-time production tracking.

Thimblerr claims to deliver production-ready samples in under seven days, enabling brands to test and iterate without committing to large batches upfront.

Cloud-Factory Model: Thimblerr’s USP lies in its cloud-factory network, AI-led system and a library of over 6,000 fabrics and trims. This offers fashion brands a single transparent, low-risk path from concept to delivery. By digitising sourcing, design collaboration and production monitoring, the platform removes the friction prevalent in the fast-fashion space that needs agility and efficiency over scale.

Eye On The Prize: Thimblerr is targeting the tech-driven global apparel manufacturing services market, which is expected to grow to $6 Bn by 2030. So, can Thimblerr’s AI approach power the next generation of fashion brands?

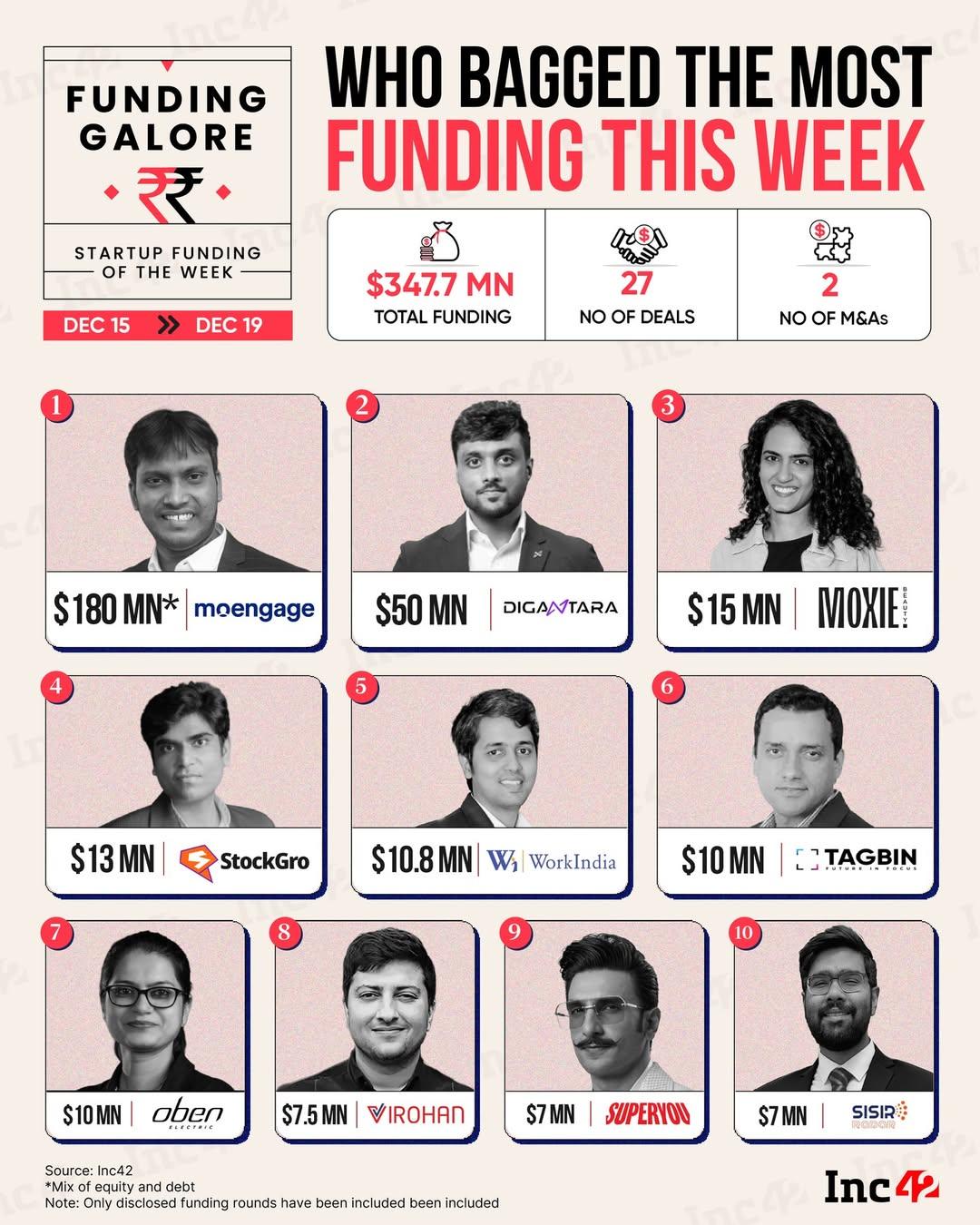

Infographic Of The Day

Weekly startup funding bounced back strongly last week. Homegrown new-age tech companies raised $347.7 Mn, while deal count improved to 27. Here’s how the numbers stack up.

Comments are closed.