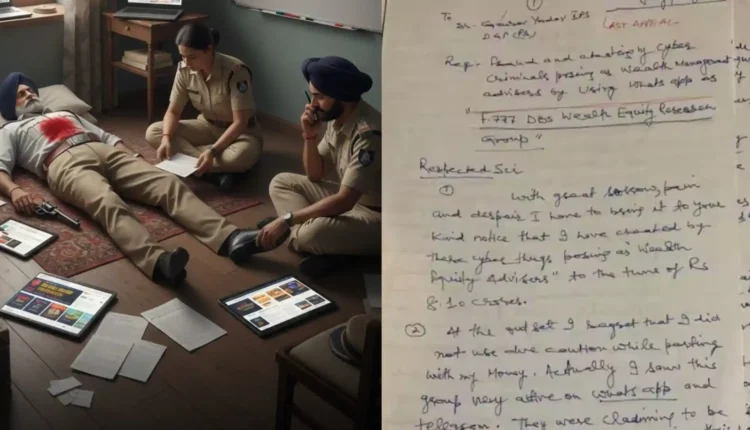

How did former Punjab IG Amar Singh Chahal fall into the trap of thugs? Big disclosure made in 12 page suicide note

On Monday, former IPS officer and retired IG Amar Singh Chahal tried to commit suicide by shooting himself in Patiala, Punjab. After the incident, he was admitted to the hospital in critical condition, where doctors immediately performed surgery. The bullet hit near the chest, causing damage to the liver. At present his condition remains critical and the police is busy investigating the entire matter.

12 page suicide note, last appeal written to DGP

Police have found a 12-page suicide note from the incident site, which was written directly to the DGP of Punjab. In this note, Amar Singh Chahal has described himself as a victim of online cyber fraud. He wrote that some swindlers, posing as wealth equity advisors, defrauded him of Rs 8.10 crore, due to which he became mentally broken.

This is how more than Rs 8 crore money was looted in the name of investment

According to the suicide note, the thugs lured Amar Singh with huge profits in IPO, OTC trading and share market. A man claiming to be the CEO of DBS Bank took him into confidence. An online dashboard was shown, showing fake profits. When Amar Singh tried to withdraw the money, crores of rupees more were extorted from him in the name of tax and service charge.

Family and friends had no news

Neither Amar Singh’s family nor his close friends were aware of this entire fraud. It is written in the note that when he wants to withdraw Rs 5 crore, he will pay 1.5% service fee and 3% tax. Rs 2.25 crore Were taken. Even after this the money was not returned and a new demand of Rs 2 crore and 20 lakh was made.

Read Also:What will happen if PAN-Aadhaar is not linked by 31st December? Know the complete loss

How the thugs wove their web, the entire plan was revealed in the note

Amar Singh told that he was added to a WhatsApp group, where stock market tips were given daily. Questions were answered immediately in the group, which further increased trust. By showing different schemes, people were lured with the promise of higher returns. From Axis, HDFC and ICICI Bank accounts more than 8 crore rupees Transfers were made, out of which about Rs 7 crore were borrowed.

Comments are closed.