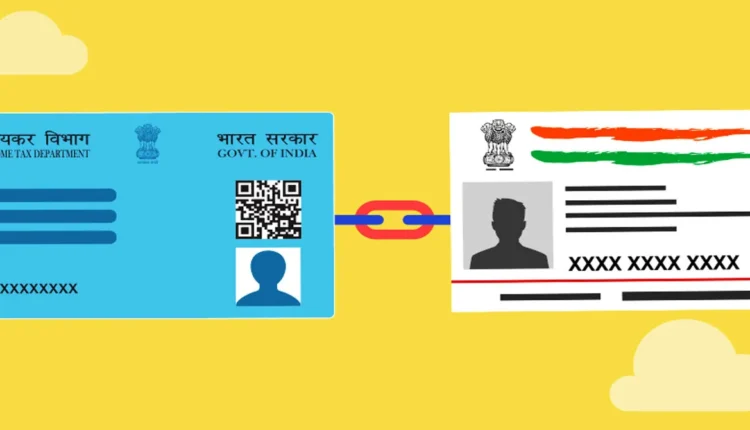

Will PAN card become garbage after 31st December? You will regret if you don’t link now!

Now only a few days are left for the year 2025 to end and the deadline for a very important work is also nearing. Yes, we are talking about linking PAN card with Aadhaar card. If you have not linked these two documents yet, then get alerted immediately. After the date of 31st December 2025, not only will you lose money, but your PAN card will become just a useless piece of paper.

The government and the Income Tax Department are repeatedly alerting people to complete this work. As per the rules, it has now become necessary to link PAN and Aadhaar. Those who miss this deadline may have to face great difficulties. Let us know what effect it will have on your pocket and financial life if this does not work.

PAN card will be deactivated

The Income Tax Department has made it clear that the last date for linking PAN and Aadhaar is 31 December 2025. Taxpayers who do not link their PAN with Aadhaar by this date will have to pay a fine of Rs 1,000. This penalty will be charged as late fee, because the original deadline for linking has already passed.

The biggest tension is not just the fine of Rs 1000, but the PAN card becoming inoperative. In the Income Tax Department’s notification dated April 3, 2025, it has been clearly stated that PAN cards which are not linked after the due date will become inactive in the system. This means that wherever use of PAN is necessary, you will be completely blocked. Also, those who have been allotted new PAN after October 1, 2024, are also required to complete the linking by December 31.

Banking and investment avenues will be closed

If your PAN becomes inactive then banking services will be hit the most. With an inactive PAN, you will not be able to open a new account in any bank. Not only this, if you invest in share market, mutual fund or equity, that too will come to a standstill. PAN is the biggest document for financial transactions and without it all your investment planning can go waste.

Apart from this, there will be many obstacles in bank transactions also. You will not be able to deposit more than Rs 50,000 in cash at a time in the bank. Also, there may be a problem in any transaction of more than Rs 10,000. It will also be difficult to get or renew a debit or credit card, because this will not be possible in an inactive PAN.

Double whammy on tax refund and TDS

Tax payers will face the biggest blow due to PAN becoming inoperative. You will not be able to file your Income Tax Return (ITR). If any of your old refunds are pending with the Income Tax Department, that will also get stuck. The problems do not end here. When PAN is not active, TDS and TCS will be deducted at a higher rate, many times more than the normal rate. This will have a direct impact on your savings.

Also, you will not be able to use Form 26AS and will not get the TDS certificate. If in future, PAN has to be reactivated or a new one has to be made, then that process can be very long and complicated. Therefore, it is smart to link PAN-Aadhaar by paying late fee of Rs 1000 today without waiting till 31st December and save yourself from future tensions.

Comments are closed.