Father-son feud at billionaire Kwek family’s CDL named among Singapore’s pivotal corporate events this year

The feud was included in a list recently compiled by The Straits Timeswhich also revisited several major reforms and high-profile court cases.

Here is a look back at the family drama, which started with a lawsuit filed in late February by Leng Beng, CDL’s executive chairman, against Sherman, the firm’s group CEO.

The lawsuit, which also named several other board members, accused them of bypassing the firm’s nomination committee to alter the board’s makeup and make sweeping governance changes in an “attempted coup” to consolidate control of the company. Sherman had earlier appointed two new independent directors to CDL’s board despite Leng Beng’s objections.

The suit sought to reverse those changes and remove Sherman from his role as chief executive.

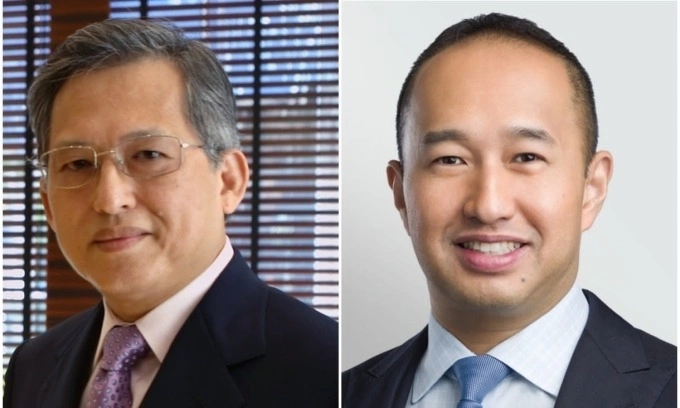

Kwek Leng Beng (L), executive chairman of City Developments Limited, and Sherman Kwek, group CEO of the company. Photo courtesy of Reuters, City Developments Limited |

The dispute quickly turned into a public spat, with Sherman pinning the blame on Catherine Wu, a long-time adviser to his father and CDL’s hotel arm. He accused her of meddling in matters “well beyond her scope” and said her influence should be limited. Leng Beng, meanwhile, pointed out what he called a “long series of missteps” by his son that he said had hurt the company’s stock.

Tensions escalated with the two ceasing contact before the standoff ended abruptly in mid-March when Leng Beng withdrew the lawsuit, saying all board members had agreed to put the incident behind them. Wu had resigned from her advisory role days earlier, according to The Business Times.

However, a rift between board members was evident at an investor meeting in April, where several directors argued over the process used to appoint two new members, as reported by Bloomberg.

Sherman acknowledged at the same meeting that the dispute had dented investor confidence and made reducing the company’s growing debt a key focus.

As a result, CDL has been divesting from assets to shore up its finances and optimize its portfolio. The developer said earlier this month that it has raised S$1.9 billion from divestments so far this year.

Most recently, it announced last week that it had reached a deal to sell Quayside Isle, the only commercial site in Singapore’s exclusive Sentosa Cove enclave, for S$97.3 million (US$75.4 million).

Sherman said at a result briefing in August that succession plans for the chairman role are “fluid,” adding that any decision would also depend on discussions with shareholders and the board.

At the same event, Leng Beng said: “As far as (the) succession plan is concerned, the past (is) over.

“We look forward to the future with strength, tenacity … I am always looking forward, and this should be the case,” he said, as quoted by Channel News Asia.

Despite the boardroom tussle, Leng Beng and his family still ranked second on Forbes’ list of Singapore’s 50 richest in early September, boasting an estimated net worth of US$14.3 billion.

Other notable events

Among the more recent major events on the list was Singapore’s crackdown on the alleged Cambodian scam network linked to Prince Group and its founder, Chinese-born Cambodian tycoon Chen Zhi.

In a raid carried out in late October, police seized assets worth more than S$150 million (US$116 million) connected to the group. Several people believed to be associated with the alleged scam operation or Chen were also arrested, including a former captain of a superyacht owned by the tycoon and the owner of a car leasing company in Singapore.

Another high-profile case involved Singapore-based Malaysian tycoon Ong Beng Seng, who was sentenced in August after pleading guilty to abetting the obstruction of justice in a case tied to a former transport minister.

Ong is best known as the figure behind the Singapore Grand Prix, which brought Formula 1 racing to the country. He was charged last October for aiding then transport minister S. Iswaran in concealing evidence during an investigation by the city-state’s anti-corruption agency.

He was shown judicial mercy and received the maximum fine of S$3,000 instead of a possible three-month prison sentence.

Comments are closed.