Urban Company In 2025, Outage At Rapido & More

Wishing you a happy Christmas from everyone at Inc42. Happy holidays!

Urban Company’s Momentous 2025

For Urban Company2025 was a year of bold expansion and tough trade-offs. The year saw the services unicorn foray into consumer durables, go public with a splash, face market scrutiny, and whatnot. Here’s everything that defined Urban Company’s year so far.

The IPO Moment: Urban Company’s public listing was a landmark event for the company. Its shares listed on the bourses at a 56% premium, reflecting strong investor enthusiasm. However, the optimism quickly fizzled out as the stock dropped 25% post-listing, with questions over profitability looming.

The Profitability Question: FY25 marked Urban Company’s first profitable year after nearly a decade of losses. But the gains proved narrow. While Q1 FY26 posted a net profit of INR 6.9 Cr, Q2 FY26 swung to a loss of INR 59.3 Cr, driven by upfront investments to scale new verticals.

The Hardware Bet: The year also saw Urban Company accelerate its push into consumer durables under the Native brand, moving beyond water purifiers and smart locks to explore air conditioners. While Native brought a hefty top line and improved margins, reliance on third-party OEMs and ongoing litigation risks posed challenges.

InstaHelp Future: The company’s instant home services arm also saw strong early traction. However, unit economics, service quality and partner retention remain a work in progress, with the management currently prioritising scale and efficiency over near-term losses.

Expansion & Restraint: Urban Company’s 2025 story was also defined by selective pullbacks and aggressive bets. The unicorn exited Saudi Arabia due to sustained losses, while gig worker shortages in the UAE and Singapore exposed the operational limits of its model. On the flip side, the company also created alternate revenue streams with the launch of micro-renovation vertical Revamp and instant services.

As the unicorn heads into 2026, here’s everything that shaped Urban Company in 2025.

From The Editor’s Desk

⚠️ Tech Outage Hits Rapido

- The ride-hailing platform witnessed a widespread service outage yesterday, with users in Delhi NCR, Bengaluru and Kolkata reporting login failures and ride disruptions. The issue was later resolved.

- Founded in 2015, Rapido initially offered bike-taxi services but later forayed into cab aggregation. Earlier this year, it launched a food delivery app Ownly, followed by rolling out flight, hotel, bus and train bookings on its app.

- This outage follows a broader pattern that has been plaguing consumer internet platforms over the past year. YouTube went down in the country earlier this month, while the Cloudflare outage in November impacted Zerodha, Groww and Angel One.

🛠️ Samsung Amps Up Make-In-India Play

- The smartphone maker has applied for the PLI scheme for mobile components to make phone screens in the country. Simultaneously, it has also sought an extension of its approval under the smartphone PLI scheme.

- The move is part of Samsung’s strategy to deepen local manufacturing and capitalise on the Centre’s push to make India a global electronics hub. Besides, the company is open to sourcing chips from India if they are competitively priced.

- Samsung operates one of its largest factories globally in Noida, which assembles smartphones, laptops and wearables. Meanwhile, rival Apple is also stepping up and is evaluating chip assembly and packaging in India via CG Semiconductor.

💰 Anicut’s Debt Fund Oversubscribed

- The alternate investment firm has closed the final close of its third private credit fund at INR 1,275 Cr, overshooting its initial INR 1,000 Cr target. The debt corpus will back startups across consumer internet, SaaS, manufacturing and shipbuilding.

- With the close of the latest fund, Anicut’s total assets under management now stand at about INR 4,500 Cr, spanning three debt and three equity funds.

- Founded in 2016, the investment firm’s portfolio includes names such as Milky Mist, Wow! Momo, Blue Tokai, XYXX, and ToneTag.

🚚 SBI Mutual Fund Dumps Delhivery Shares

- The mutual fund offloaded 18.18 lakh shares of the logistics giant on December 22 for INR 74.5 Cr, reducing its stake to 5.69% from 5.93% previously.

- SBI MF has been steadily trimming exposure in the startup over the past few months. The move reflects cautious positioning amid Delhivery’s subdued Q2 FY26 results and weak margins due to integration overhang from Ecom Express.

- To offset integration pains and build new revenue streams, Delhivery is diversifying. It recently floated a new arm to offer credit to truckers, followed by setting up new subsidiaries in the UK and the UAE to strengthen its international presence.

🦄 Tracking India’s Unicorns

- The Indian startup ecosystem has added six new unicorns in its kitty in 2025 so far — Netradyne, Porter, Drools, Fireflies.ai, Jumbotail and Dhan — keeping pace with the funding slowdown and tighter capital.

- In total, 126 Indian startups have entered the unicorn club to date, collectively raising over $117 Bn in funding and are now valued at more than $389 Bn.

- While BRND.ME (formerly Mensa Brands) hit the $1 Bn valuation in just six months, GlobalBees managed to clinch the title in seven months. New‑age players like 5ire, Ola Krutrim and Glance also grabbed the coveted status in less than a year.

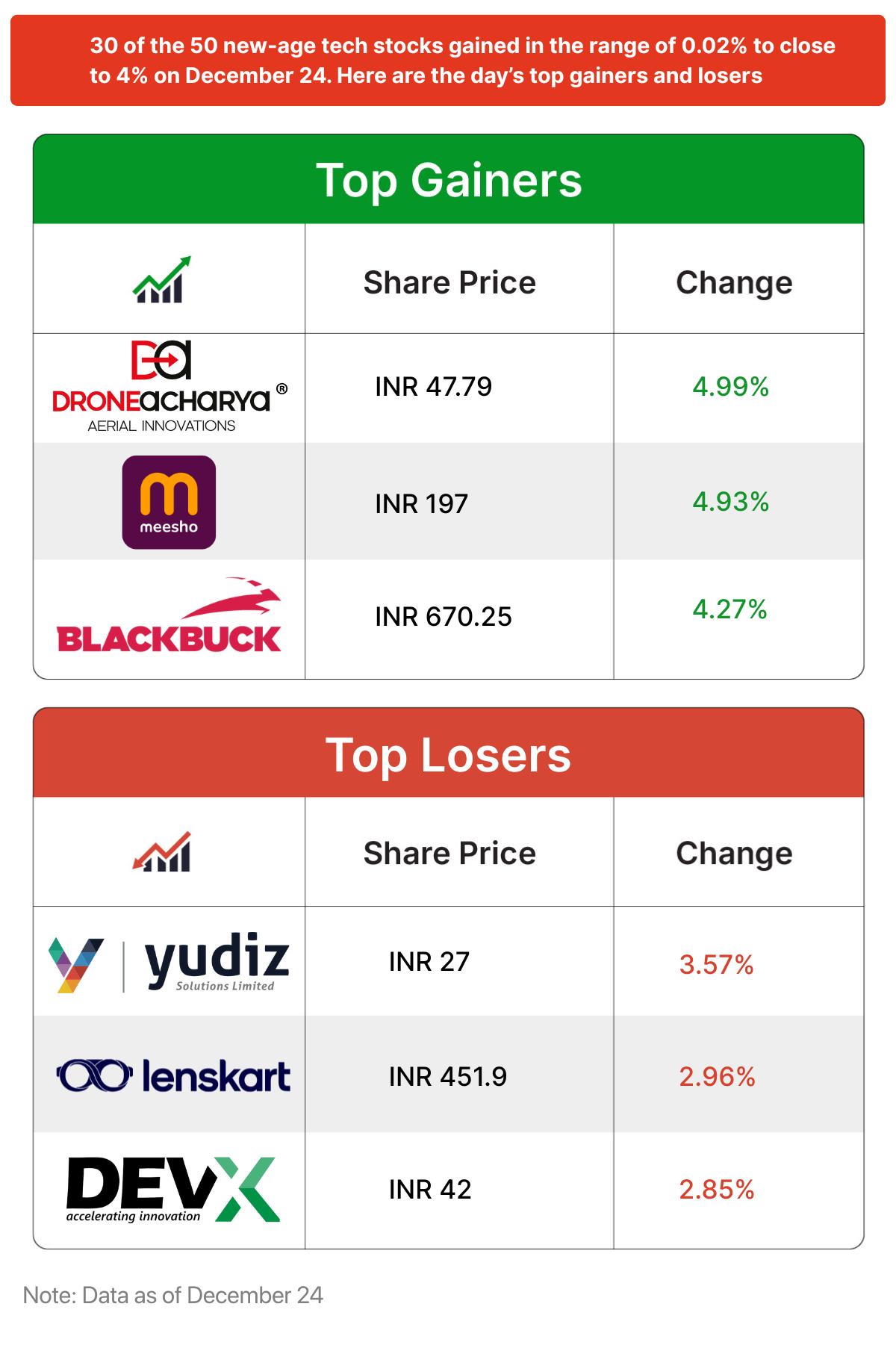

Inc42 Markets

Inc42 Startup Spotlight

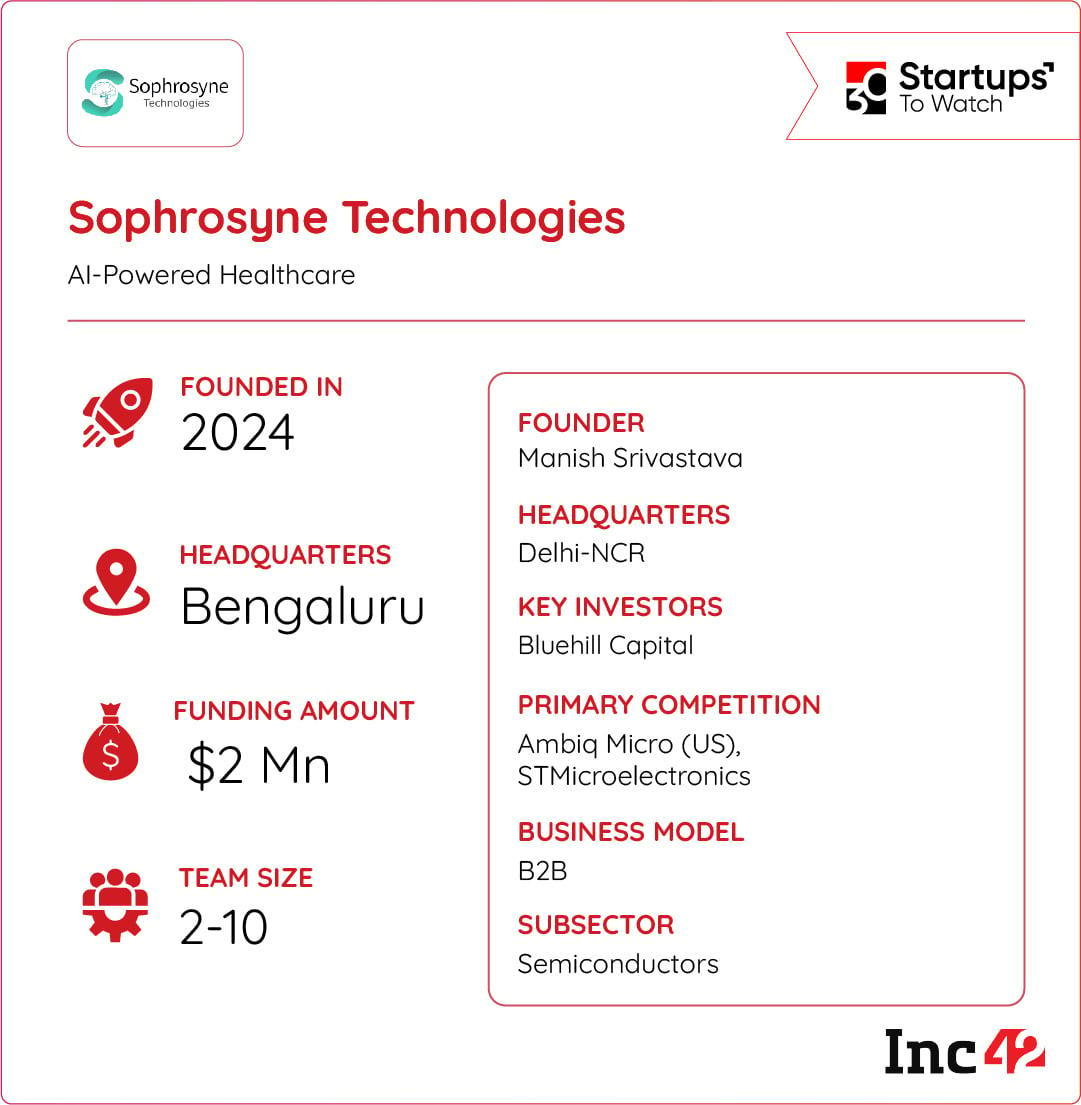

Can Sophrosyne Build India’s First Multi-Vital Chip?

India’s healthtech startups are racing to localise critical technologies, yet most wearables and medical-grade devices still rely on fragmented sensor modules that are costly to integrate, prone to accuracy issues, limit scalability and drain battery life quickly.

Next-Gen Biosensing: Founded in 2022, Sophrosyne Technologies is developing multi-vital biosensing system-on-chip platforms that integrate ECG, PPG, respiration and temperature monitoring into a single, low-power chip. Its upcoming flagship SoC is designed to deliver medical-grade precision and continuous multi-vital tracking in a compact, energy-efficient package tailored for global wearable and digital health OEMs.

AI For Insights: Beyond hardware, Sophrosyne is also developing proprietary AI models for signal processing, deep learning and edge inference to convert raw physiological signals into actionable health insights. This edge-first approach allows real-time processing on the device itself, reducing latency, improving privacy, and enabling more responsive health monitoring.

Riding The Semicon Wave: The startup’s trajectory aligns with the Centre’s broader push to make India a semiconductor hub. As the country targets a $150 Bn semiconductor opportunity by 2030, can Sophrosyne become the quiet chip that powers the “Made in India” revolution?

Infographic Of The Day

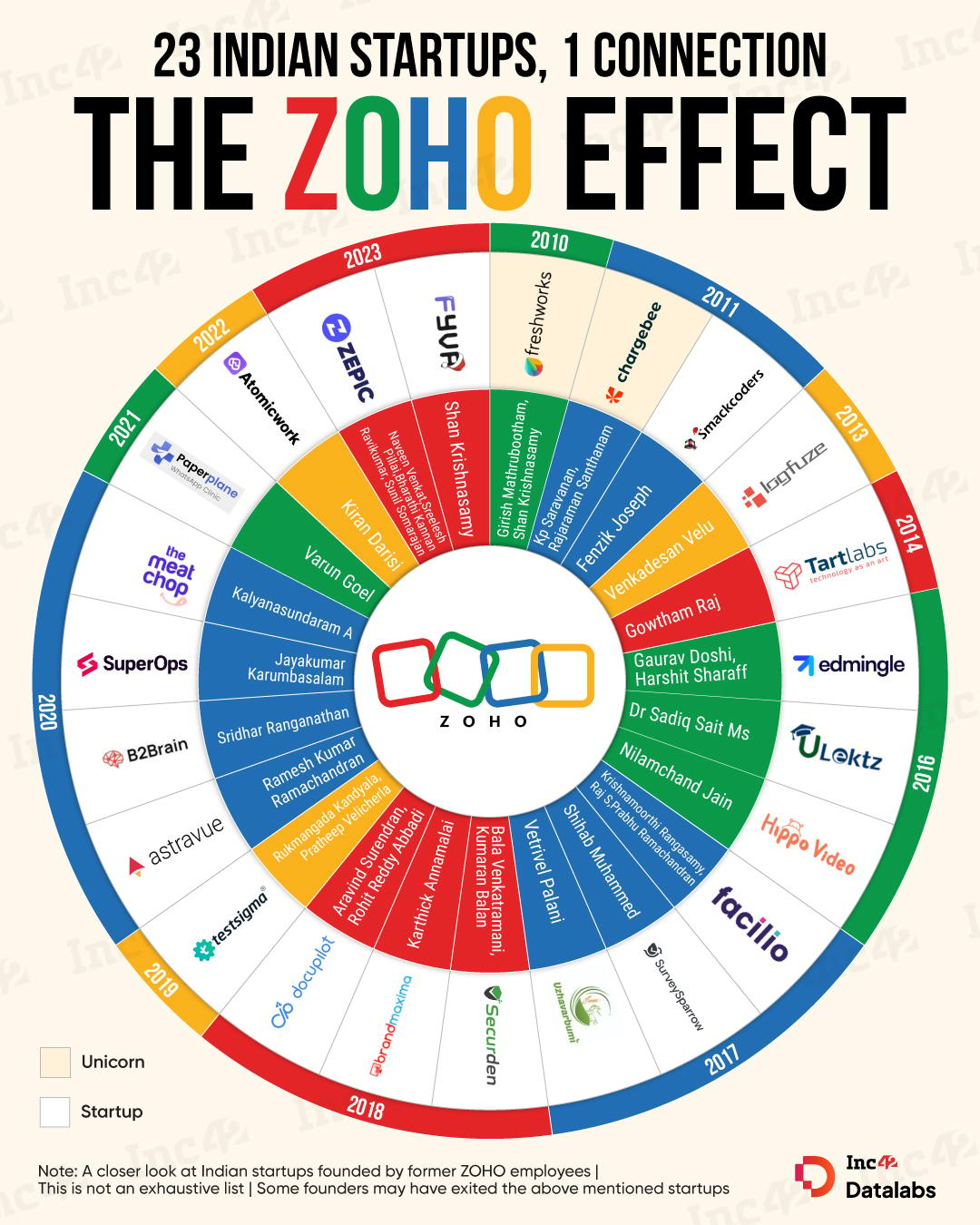

From Freshworks to Chargebee, 23 Indian startups trace their roots back to one unlikely common thread — Zoho. Here is how…

Comments are closed.