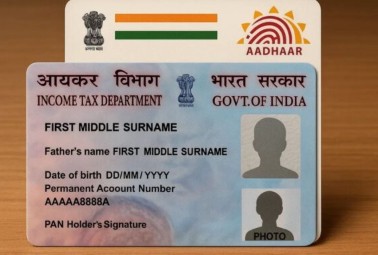

If not linked till 31st December, PAN will become inactive.

7

The Income Tax Department has already made it clear that unlinked PAN will be deactivated after the deadline.

What will happen if PAN-Aadhaar is not linked by 31st December?

If you do not link PAN to Aadhaar in time, then:

- PAN card will become inactive

- Will not be able to file Income Tax Return (ITR)

- There will be problem in opening bank account or updating KYC.

- Mutual funds, stock market and other investments will be affected

- Additional hassles may occur on high value transactions

- In simple words, your financial activities may come to a halt if PAN becomes inactive.

How to check whether PAN-Aadhaar is linked or not?

You can find out in a few seconds sitting at home whether your PAN is linked to Aadhaar or not –

- Visit the official website of Income Tax Department

- Click on ‘Link Aadhaar Status’ option

- Enter PAN and Aadhaar number

- Status will appear on the screen

How to link PAN-Aadhaar?

If PAN is not yet linked to Aadhaar, you can complete the process online through the Income Tax Portal.

Why is PAN-Aadhaar linking necessary?

- According to the government, through PAN-Aadhaar linking

- Fake PAN is banned

- Tax system becomes more transparent

- Financial fraud is reduced

The deadline of 31st December is near. If you have not linked PAN-Aadhaar yet, do not wait for the last moment. A small work can save you from big problems in future.

Comments are closed.