Chief Minister Youth Self-Employment Scheme: Loan of Rs 25 lakh, rebate of Rs 6 lakh, how to get it?

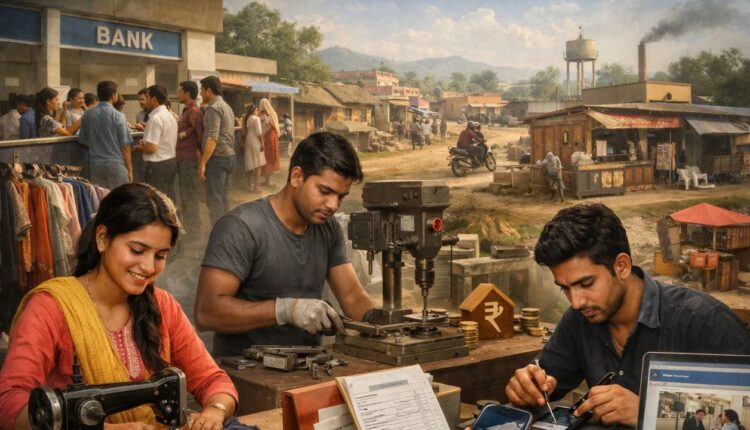

In a state like Uttar Pradesh with a large and young population, employment is not just an economic issue, but a question related to social stability and development. Every year millions of youth enter the labor market with education, training or traditional skills, but not all find permanent employment due to limited jobs in the government and private sector. In this background, the Uttar Pradesh government started the Chief Minister Yuva Swayam Rozgar Yojana (CM-Yuva Swayam Rozgar Yojana) with the aim of making the youth not job seekers but job providers.

The basic idea of this scheme is that if the youth are provided with cheap loans, subsidies, and institutional support, they can set up small-scale enterprises, service or manufacturing units. This will not only increase their income but will also create new employment opportunities at the local level. The government sees this as linked to the vision of ‘self-reliant youth, self-reliant Uttar Pradesh’.

Also read: Swiggy yes or PhonePe, There is a loss of thousands of crores, why are these companies not closed?

However, like any government scheme, this scheme also has two aspects. On one hand there are possibilities and opportunities, on the other there are challenges on the ground, banking processes, and implementation problems. In this article Khabargaon will discuss all the aspects of Chief Minister Youth Self-Employment Scheme.

What is the purpose?

The main objective of the Chief Minister Youth Self-Employment Scheme is to encourage the educated and semi-educated youth of the state for self-employment. Uttar Pradesh is the most populous state in the country. 17 percent of the total population of the country lives in UP, out of which 56 percent of the population is in the working age group. At present the total population of the state is about 24 crores, which means the number of young workers is more than 12 crores.

Traditionally a large number of youth have been dependent on agriculture, small trade, cottage industries and services. Now in the changing economic scenario, the government wants the youth to join modern businesses, start-ups, service sector and manufacturing sector at local level.

Through this scheme the government wants to achieve three big goals. First, to reduce the pressure of unemployment. Second, to strengthen the local economy so that migration from villages and towns to cities is reduced. Third, to connect youth with banking and formal financial systems, thereby reducing dependence on informal lending.

Eligibility conditions

The eligibility conditions of this scheme have been kept in such a way that more and more people can be included, so that more and more youth can take advantage of it.

The applicant must be a permanent resident of Uttar Pradesh.

The age limit is generally set between 18 to 40 years.

The minimum educational qualification is 0th pass, although it may change according to the type of business. Having 10th qualification means that the government wants that people who are less educated can also establish their own employment.

The applicant should not be a defaulter of any nationalized bank/financial institution/government institution etc. He should not be working in any government or private sector.

No member of the family has already availed the benefit of a similar government self-employment scheme.

Should not be a defaulter from any financial institution.

The applicant or any person from his family should not have availed the benefit of subsidy under the scheme of similar nature of the State/Central Government.

The purpose of these conditions is to ensure that the benefits of the scheme actually reach the new and needy youth.

How much loan will you get?

The most important feature of Mukhyamantri Yuva Swarozgar Yojana is the subsidy given under it. Under this, loans are provided to the youth through banks. Under this, a loan of up to Rs 25 lakh is given for the manufacturing sector and a maximum of Rs 10 lakh is given for the service sector.

In this, general category applicants will have to contribute at least 10 percent and Scheduled Caste/Scheduled Tribe/Backward Class, women and disabled people will have to contribute at least 5 percent, which is called margin money. After this, after loan disbursement, subsidy is provided to the borrower by the government, which is directly adjusted in the loan account.

This subsidy scheme attracts the youth as it reduces the debt burden on the youth and reduces the risk of starting a business.

how much is the subsidy

Under this scheme, two slabs have been kept regarding subsidy. Subsidy up to 15 percent of the total sanctioned loan will be given to the general category and up to 25 percent subsidy will be given to SC/ST/OBC/OBC, women, ex-servicemen, disabled and applicants from North-Eastern hilly and border areas.

In this way, the maximum amount of subsidy can be Rs 6.25 lakh for the manufacturing sector and Rs 2.5 lakh for the service sector.

application process

The application process under the scheme has been made available through both online and offline modes.

The applicant has to first register on the portal of the scheme.

Business proposal (project report) has to be uploaded.

The application is verified by the District Industries Center or the concerned department.

After this the application is sent to the bank, where the loan approval process takes place.

The government claims that the entire process is transparent and time bound, but in practice there are complaints of delays and sometimes it is also said that bribes are also demanded by the banks in the entire process.

Benefits of the scheme

This promotes local small businesses like shops, service centers and micro industries. The engagement of youth with the banking system increases, which strengthens their credit history and further financial facilities can be easily available in the future.

Economic activity accelerates in rural and semi-urban areas, as new businesses activate the local market and create new sources of income. Additionally, when a youth starts his own business, he also provides employment to others, such as by hiring employees or suppliers, creating a multiplier effect and increasing overall income and employment in the community. This scheme leads to industrial development, reduces unemployment and empowers women and backward classes, which encourages self-reliance and innovation in the society.

What are the challenges?

Although the objective of the scheme is quite good, there are many challenges in its implementation. The biggest problem is seen at the banking level. In many cases, banks make unnecessary delays in loan approval or demand additional guarantees, whereas under this scheme, as a rule, no collateral i.e. guarantee can be demanded. Moreover, often banks, if they do not want to approve the loan, point out shortcomings in the DPR and reject the loan on that basis. A common man does not know so much about banking technical things and he remains entangled in the process. Either the applicant has to bow down to the demands of the bank and either the loan is rejected by finding some loophole or the other.

The second practical problem is that the file from the Industry Department is sent to a branch of a bank. If the loan is canceled from there for some reason, then he has to go to the Industry Department again and complete the process and get the file transferred to another bank, whereas what should have happened is that once the process of the Industry Department is completed, the applicant can get his file processed at his own level in any bank he wants.

Banks sometimes ask for quotations in advance even for small works like construction of tin shed, boundary etc. In such a situation, the applicant has to contact a firm for quotation. Whereas if he gets this work done himself, he can give it to the bank later, but banks often insist that quotations for even small works should be given to them in advance. In such a situation, the genuine customer has to face unnecessary trouble.

Also read: India’s rice quenches the world’s hunger, but why is Trump angry with it?

There are some people who take advantage of the project in wrong way and get loan without even establishing the project by colluding with the bank officials and avail the benefit of subsidy. In this way the basic spirit of the project dies.

It has also been observed that the training arrangements are also not adequate. Merely providing credit is not enough, but continuous advice and market linkages are also necessary to make the business sustainable.

To improve this, it is necessary to fix the accountability of banks so that there are no unnecessary delays and also to strengthen the monitoring and feedback system through digital platforms.

Comments are closed.