How to get the money lying in the account of deceased parents? know the method

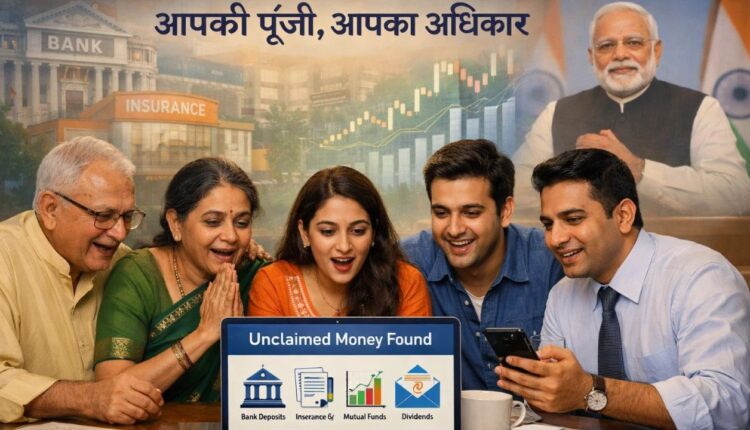

The government is trying to ensure that if someone or their family has money lying around that has not been claimed, then people should get it. For this, Prime Minister Narendra Modi has appealed to the people to check the unclaimed amount of money lying in dividends of banks, mutual funds, insurance policies or shares in the name of themselves or their family members. There is money worth more than Rs 1 lakh 4 thousand crore lying in the country, which is people’s own but either people do not know about it or they have forgotten it.

PM Modi has named it ‘Your Capital, Your Rights’ campaign and said that now the time has come for people to get back their rightful money. While sharing a post on LinkedIn, PM Modi wrote, ‘This is an opportunity to convert forgotten money into new hope. Participate in the ‘Your Capital, Your Rights’ campaign! He said that this money is the hard-earned savings of many families. ‘Rs 78 thousand crores are lying in banks, about Rs 14 thousand crores in insurance companies, Rs 3 thousand crores in mutual funds and Rs 9 thousand crores in share dividends are lying unclaimed.’

Also read:America again imposed ‘travel ban’, which countries will be affected? See full list

What is this campaign?

The ‘Your Capital, Your Rights’ campaign was launched in October 2025. Its objective is that the money lying without any claim related to bank accounts, insurance, dividends, shares, mutual funds and pension should reach its rightful owners. This campaign is running on 3A framework, Awareness, Accessibility and Action.

For this, camps have been set up in 477 districts of the country, which help the people. Digital helpdesk, demos, FAQs and information in local languages are being provided in these camps. So far, about Rs 2,000 crore has been returned to the people in the first two months of this campaign.

Senior Wealth Consultant Virendra Garg says, ‘There are government schemes about which people are not aware, they should take advantage of these schemes and claim their money as soon as possible.’

Where is the money lying?

- In banks: Money in accounts (savings, current, fixed deposits) with no transactions for 10 years. Total Rs 78 thousand crores.

- In insurance companies: If there is no claim even after the policy matures or after death. About Rs 14 thousand crores.

- Mutual Funds: Those mutual funds in which there has been no claim for 7-10 years. Unclaimed amount of up to Rs 3 thousand crores is lying in it.

- Share Dividend: About Rs 9 thousand crores are lying as share dividend.

How to check your money?

The government has created four easy portals to get this money-

To check money in bank accounts:

- First website: Go to.

- Register your name, mobile number and password.

- Now search by entering Bank, PAN, Voter ID, Driving License, Passport or Date of Birth.

- Here different sections will be available for family members.

- On the udgam.rbi.org.in website, when you check the status of unclaimed deposits,

- Here you will see all the information from bank account to balance.

- After this, you can apply to get your amount back by clicking on the “Submit Claim” option shown there.

- While filling the claim form, you have to provide some essential information like your name, address and bank details.

- After this, you may have to visit your bank for verification.

- Additionally, you can submit a written application to the bank or branch where you have your old account.

- The account can also be reactivated by providing old account details and KYC.

- Similarly, you can also claim the fixed deposit amount. After verification, the amount will be transferred to your old or new account.

To check insurance money

- But after checking the unclaimed amount, click on “Register Complaint” option.

- Here you will see a form in which insurer details, time of claim and policy details have to be filled. Also, documents like Aadhaar, PAN, bank details, death certificate (if the claim is for the deceased person’s insurance) and nominee proof will have to be attached.

- On submitting the form you will get a token number with which you can track the claim. IRDAI will send your claim amount in approximately 30 days.

- Additionally, if your name appears in the unclaimed amount, you can also claim directly from that insurance company.

To check the money of mutual funds

- Unclaimed mutual funds can be tracked and claimed on MFCentral or SEBI MITRA website.

- For this you will need PAN/KYC proof, bank details, folio statement and death certificate/nominee ID as per the situation.

- Once you get the matching folio, you may have to contact the concerned AMC (Asset Management Company) like SBI MF. Asset management companies manage mutual funds and other investments.

- After completion of the process, the money will be transferred to your bank account within 15-45 days.

To check share/dividend money

- If your share or dividend appears on the IEPF website, you will need to fill Form IEPF-5 on the MCA/IEPF portal to claim it.

After filling this form online, its printout has to be sent by speed post to the nodal officer of the company along with documents like KYC, bank proof, old share proof.

After verification by the company, the IEPF authority will approve your amount.

After this the dividend will be transferred to your bank account and shares to your demat account.

What happens if no one makes a claim?

If even after this campaign some people do not claim their outstanding amount, then that amount will be transferred to the security fund. Funds from bank accounts unused for more than 10 years are kept safe by transferring them to the Depositor Education and Awareness (DEA) Fund. From here the owner of the amount can claim his amount anytime by showing the documents. There is no time limit for this.

Also read:Will the Indian Constitution give justice to the Pakistani woman? Understand Article 226

If a shareholder does not take his dividend for 7 consecutive years, then that amount goes to the Investor Education and Protection Fund. From here also the owner can get his shares and amount back by giving the documents.

Unclaimed funds of insurance and mutual funds are also kept in the safe custody of different regulators. The owner can also claim these funds back at any time. Under no circumstances does the government or bank claim ownership of that amount.

Comments are closed.