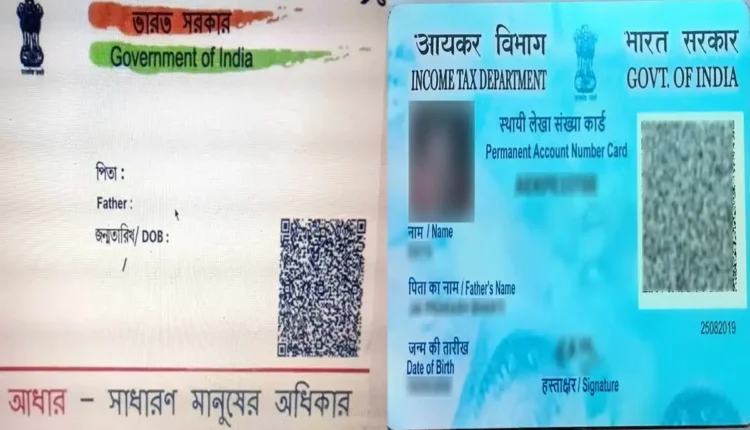

PAN and Aadhaar Card Linking: Essential Information and Exemptions

Need to link PAN and Aadhar card

Today is 31st December 2025, and if you have not yet linked your PAN card and Aadhar card, then get it done as soon as possible. It is very important to have a link between these two documents. If you do not get it done, you may have to pay a heavy fine, and many of your important work may also be affected. There may also be interruptions in banking services or tax related facilities. Do you want to know whether linking PAN and Aadhar card is mandatory for everyone? In this article we will tell you for whom this procedure is not necessary.

Who has got the exemption?

According to the rules of the Income Tax Department, persons aged 80 years and above are exempted from linking PAN and Aadhaar. The government has provided great relief to the citizens of this age group. Apart from this, super senior citizens have also got special exemption from this rule.

Along with this, it is not necessary for those who are NRIs to link PAN and Aadhaar card. As per the Income Tax Act, linking is not required if you are not resident in India. People living in Assam, Meghalaya and Jammu and Kashmir also do not come under the purview of this rule.

Children and joint account holders are also exempted, but if a child is below 8 years of age and has a PAN card, he will be brought under the tax net. Therefore, it is necessary to link PAN with Aadhar card. If the children’s bank account is linked to the parent’s account, it does not mean that they will get the exemption.

Consequences of not linking

If linking is not done, not only will the pending tax refund be stopped, but interest on the refund will also not be available. Therefore, it is important to ensure that your PAN and Aadhaar cards are linked.

Comments are closed.