WinZO’s Many Fires, No More 10-Min Claims & More

The Unravelling Of WinZO

The ban on real-money gaming (RMG) in 2025 crushed the sector. winzoonce the sector’s golden child, saw its cofounders get arrestedINR 800 Cr worth of assets frozen, and 70% staff vanish amid the clampdown. So, how did it all go wrong for the battered gaming giant?

In ED’s Crosshairs: WinZO’s woes erupted right after the ban. In November 2025, the ED raided multiple offices of the company over allegations of money-laundering. Investigators alleged that WinZO illegally operated RMG platforms in Brazil, the US and Germany using the same India-based entity post-ban and diverting $55 Mn to a US-based shell company.

Then, there are also FIRs that allege cheating, PAN misuse, KYC fraud and pitting users against bots without disclosure.

The Crisis Deepens: With INR 700-880 Cr frozen and just INR 15 Cr in liquid cash, WinZO now runs with minimal office staff. The online gaming startup is also under fire for unpaid salaries, vendor dues and an insolvency plea. Zo TV, its post-ban short-video betis showing “zero progress” on content or operations.

The Fight For Survival: WinZO is running on fumes as it grapples with mounting legal bills and vendor lawsuits. Cofounder Saumya Rathore has moved courts to shift ED’s probe to Delhi and quash the agency’s ECIR. With little revenue in sight, overseas operations face permanent shutdown if shell entity charges stick. Cofounder Paavan Nanda remains jailed while skeletal teams chase ‘zero progress’.

Meanwhile, legal experts are scrambling to bulletproof overseas structures as investor confidence evaporates across India’s battered online gaming sector. Amid this backdrop, can WinZO’s legal manoeuvers help it resurrect before total collapse? Let’s find out…

From The Editor’s Desk

✂️ Blinkit Drops 10-Minute Branding

- The Eternal-owned quick commerce major has scrapped the “10-minute delivery” promise after the labour ministry’s intervention over rider safety concerns and breakneck timelines.

- This follows the nationwide gig workers’ strike on New Year’s Eve over pay cuts, safety voids and gruelling shifts in India’s $5 Bn+ quick commerce ecosystem.

- Dropping the “10-minute” promise is likely to be a win-win for both quick commerce majors and consumers. While the move is expected to soften consumer hype, it will also preserve scale. However, it could potentially hike costs due to buffer times.

📢 Amagi’s Ipo Day

- The SaaS major’s public issue limped to 6% subscription on the first day, receiving bids for 17.49 Lakh shares against 2.72 Cr on offer. The retail portion was subscribed 28%, while the NII quota saw a 4% subscription.

- Amagi’s fresh issue comprises a fresh issue of INR 816 Cr and an OFS of 2.69 Cr shares. At the upper end of its INR 343-361 price band, the INR 1,788.6 Cr IPO pegs the company at INR 7,966 Cr.

- Founded in 2008, Amagi’s SaaS tools enable broadcasters to manage and distribute TV channels across streaming platforms without physical infrastructure. The startup clocked a net profit of INR 6.5 Cr in H1 FY26 on an operating revenue of INR 704.8 Cr.

💰 BillionE Nets $25 Mn

- The electric mobility startup has raised around INR 207 Cr in a mix of equity and debt from SBI and others to deploy 500+ electric trucks by FY27, deepen partnerships and shore up its tech stack.

- Founded in 2021, BillionE delivers end-to-end commercial EV logistics, including e-trucks, e-buses, smart telematics and charging infrastructure. It claims to have already locked 250+ long-term MHCV contracts across sectors.

- With the latest fundraise, BillionE is looking to ride the logistics surge, which is anchored by government subsidies, decarbonisation wave and the booming trucking segment.

🔔 Shadowfax Locks IPO Launch Date

- The logistics unicorn has filed its RHP with SEBI for an INR 1,907 Cr IPO, which will open on January 20 and close on January 22. The public issue will comprise a fresh issue of INR 1,000 Cr and an OFS worth up to INR 907.27 Cr.

- Flipkart will sell shares worth up to INR 400 Cr, while Eight Roads Investments, IFC, Qualcomm, and others will also offload stakes as part of the OFS. The fresh proceeds will fuel expansion, lease payments, marketing and acquisitions.

- Founded in 2015, Shadowfax offers logistics services to ecommerce, quick commerce, food delivery and mobility companies. It has raised $400 Mn to date. In FY25, the startup flipped to the black with a profit of INR 6 Cr on an INR 2,485 Cr top line.

🤖 How GenAI Pivot Lifted SpeakX

- Founded in 2020, SpeakX.ai (formerly Yellow Class) pivoted from a hobby platform in 2023 to a conversational AI platform that today teaches English to over 140K paying subscribers.

- Pre-GenAI, the edtech startup struggled with hardcoded dialogue, which limited personalisation. To solve this, SpeakX leveraged Google Gemini for context-aware conversations without human intervention costs.

- The startup claims to have achieved profitability, with a 20-member lean team. It claims to be on track to clock $1.4 Mn FY26 profits, with no human tutors needed as AI handles onboarding, engagement and feedback for sustained learning outcomes.

Inc42 Markets

Inc42 Startup Spotlight

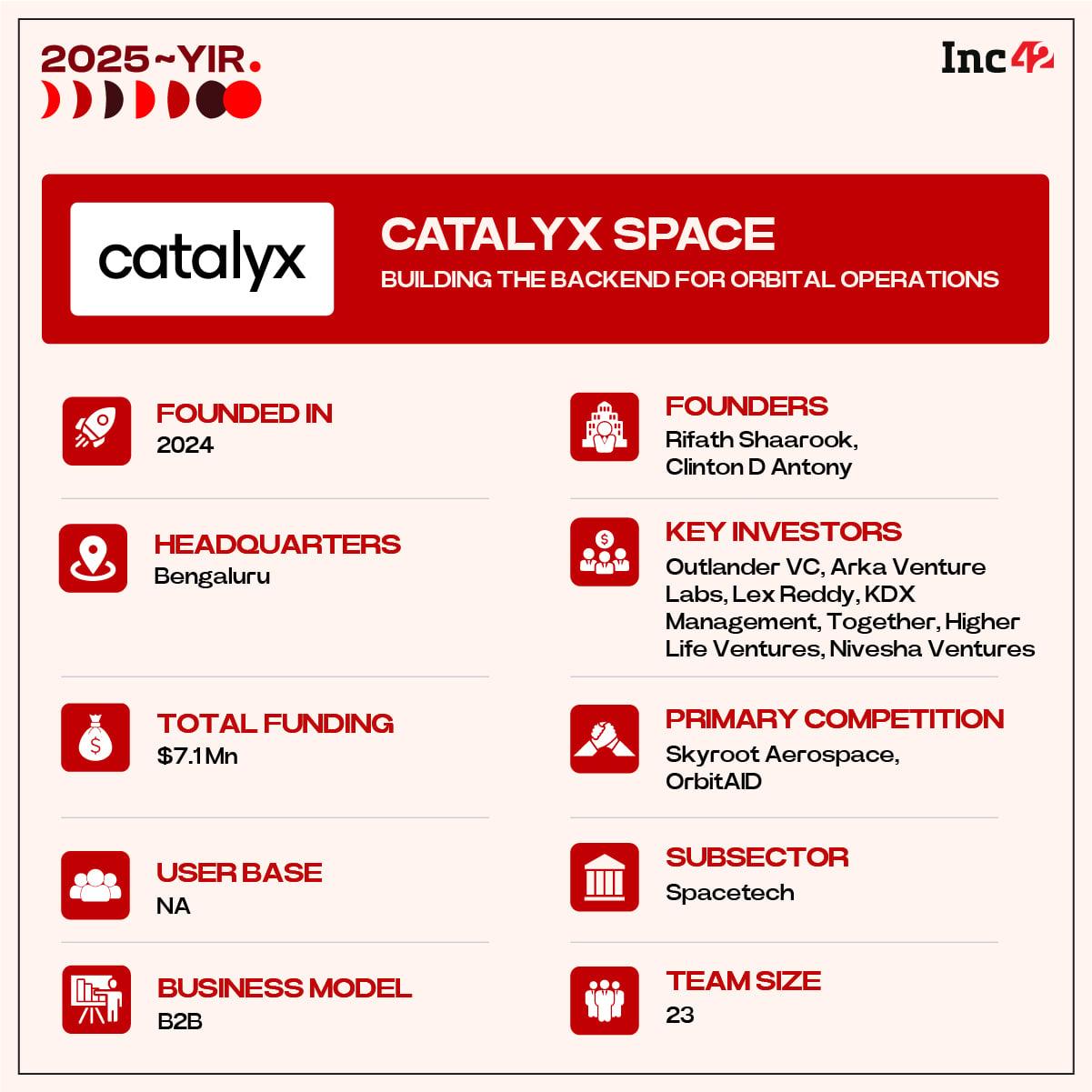

How Catalyx Is Building The Highway To Earth’s Orbit

Space missions are fragmented nightmares. Researchers juggle multiple vendors for payloads, integration, launch coordination, ground stations, and data retrieval. This burns time and money. Enter Catalyx Space, a startup trying to fix this chaos.

One-Stop Orbital Shop: Founded in 2024, Catalyx Space provides unmanned space laboratories, re-entry capsules and a vertically integrated spacecraft platform. Its flagship Cosmotron satellite bus lets customers integrate payloads and access mission data directly via a web portal supported by a ground-station network.

Catalyx Lifts Off: In 2025, Catalyx partnered with over 26 space missions, launched one orbital satellite, and completed a successful drop test of its REX re-entry capsule from 14,000 ft. The startup plans to demonstrate a 50-kg-class Cosmotron platform in early 2026.

Backed by $7.1 Mn funding from marquee names, the Ahmedabad-based startup is eyeing a piece of the global space logistics segment, which is on track to hit nearly $18 Bn by 2030. Can Catalyx become the logistics backbone for the new orbital economy?

Infographic Of The Day

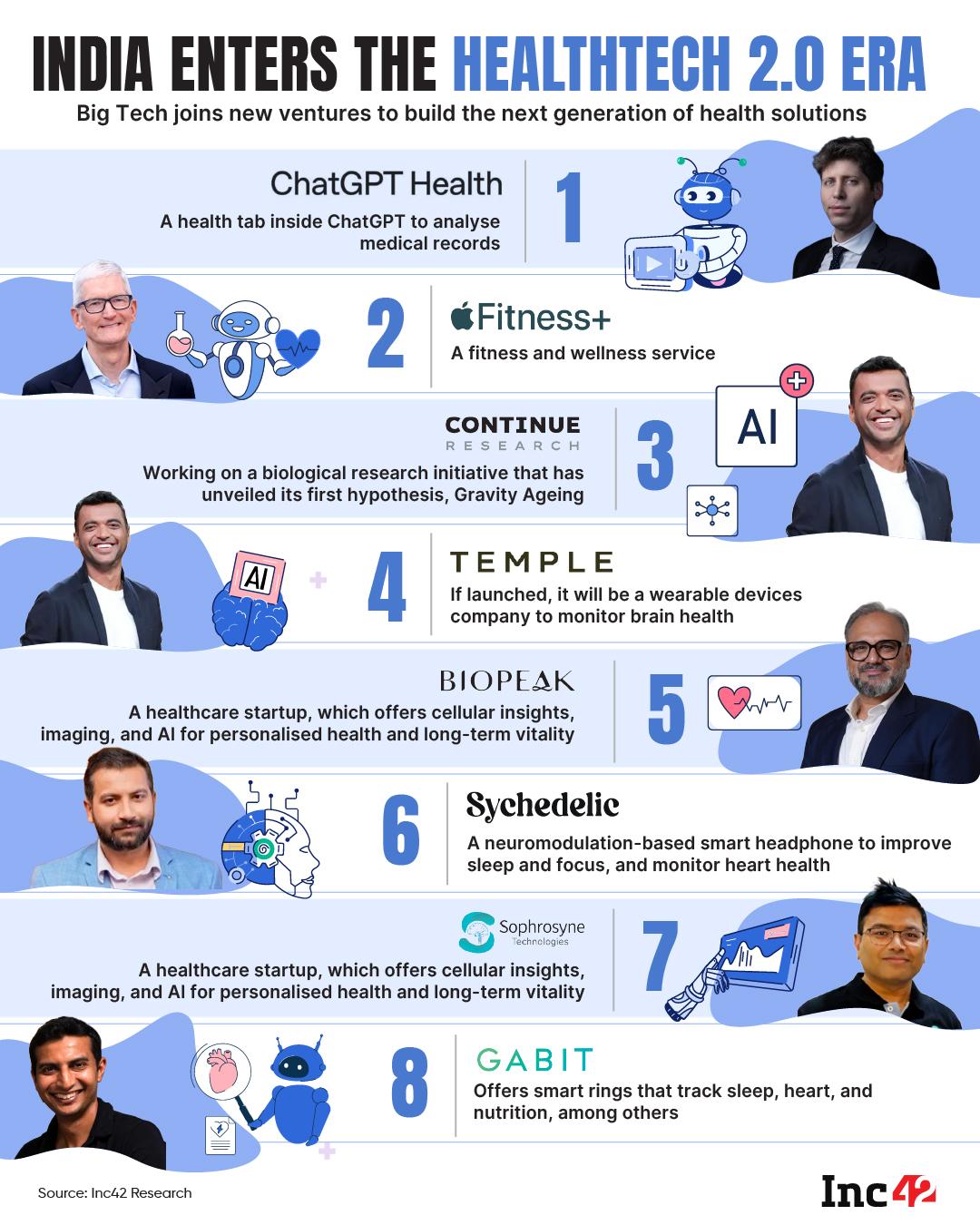

India’s healthtech landscape is entering a new chapter. This time, the shift is being led not just by startups, but by big tech giants building the next generation of preventive, personalised and data-driven health solutions.

Comments are closed.