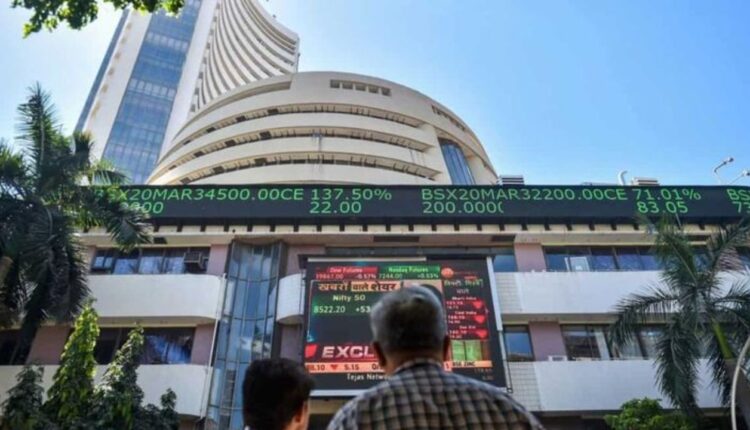

Exit mode of foreign investors in the stock market, when will the selling of FIIs be stopped? Expert predicted

FIIs In Share Market: Selling by foreign institutional investors (FIIs) may continue until major positive signals are received in the Indian stock market. This information was given by the analyst. Foreign investors are continuously selling in the Indian stock market. Between January 1 and 16, FIIs have sold equities worth Rs 22,529 crore.

This month, selling by foreign institutional investors (FIIs) continued in all the days except one session, said Dr VK Vijayakumar, Chief Investment Strategist, Geojit Investments Ltd. India’s underperformance compared to other major markets continues into early 2026. Nifty has given a return of -1.73 percent since the beginning of this year.

10% return despite sluggish performance

Dr. VK Vijayakumar further said that a special feature of the 2025 market was that despite the sluggish performance, Nifty had given a return of 10 percent. The reason for this was the strong investment of Rs 7.44 lakh crore by DII. However, during this period, FIIs had sold equities worth Rs 1.66 lakh crore. According to analysts, FII selling One reason for the high valuation is the uncertainty of the trade deal between America and India.

According to Vijayakumar, the AI trade that will dominate stock market trends in 2025 is likely to continue into early 2026 as well. However, this trend may reverse any time in 2026.

How was the domestic stock market last week?

The market remained largely stable last week amid mixed signals and closed almost flat. During this period, Sensex was at 83,570.35 with a slight weakness of 5.89 points or 0.01 percent and Nifty was at 25,694.35 with a gain of 11.05 points or 0.04 percent.

Also read: Share Market Outlook: Earning opportunity or time to be careful? How will the market be on Monday; Know the expert’s opinion

Will foreign investors remain sell-side?

Ajit Mishra, senior vice-president, research, Religare Broking Ltd, said the expectations generated by better Q3 results of select large-cap IT companies were dashed by tariff uncertainties, geopolitical tensions and continued withdrawal of foreign investments. He further said that foreign investors may continue selling in the coming times.

Comments are closed.