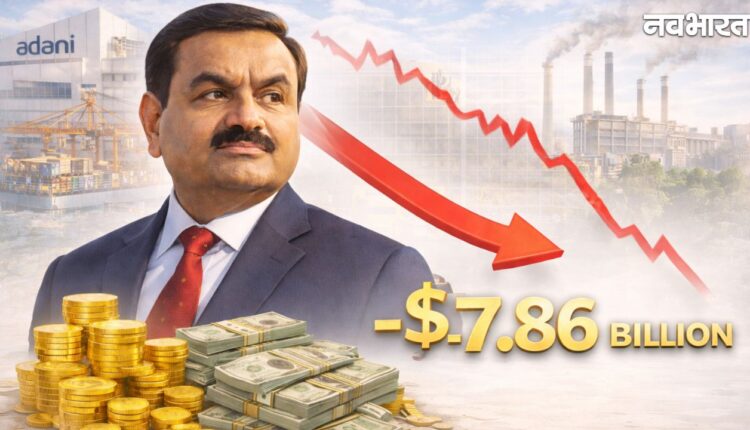

Gautam Adani got a big shock… Net worth declined by $7.86 billion, reached this place among the world’s richest people.

Gautam Adani SEC Bribery Case: Friday brought huge financial loss for Indian industrialist Gautam Adani as his net worth witnessed a huge decline in a single day. After the Gautam Adani SEC bribery case came to light, investors sold shares of Adani Group companies heavily. The news of the US Securities and Exchange Commission (SEC) issuing summons in an alleged fraud and bribery case created panic in the market. After this setback, Gautam Adani has also slipped down in the list of Asia’s richest people.

huge loss in one day

Due to the turmoil in the stock market on Friday, the net worth of Adani Group Chairman Gautam Adani decreased by $7.86 billion. This loss in Indian currency is estimated to be around Rs 7,20,02,70,90,000, which is the biggest fall in a day. According to Bloomberg Billionaires Index data, Adani’s total net worth has now come down to just $70 billion.

His net worth has decreased by approximately $14.5 billion since the beginning of this year. After this big decline in wealth, Gautam Adani has now reached 24th position in the list of the world’s richest people. Even in Asia, his ranking has now come to third place after Mukesh Ambani and China’s Zhong Shanshan.

Main reasons for decline

There was a huge fall of up to 13 percent in the shares of Adani Group on Friday, due to which the confidence of investors was completely shaken. The main reason for this decline is the demand by the US SEC to issue summons to Gautam and Sagar Adani. According to media reports, permission has been sought from the US court to issue summons in the alleged bribery and fraud case of $265 million.

This news has further increased the negative perception towards Adani Group in the global market. Adani Group has completely rejected all these allegations and called them completely baseless and against international law. The group clearly states that they comply with all necessary laws and the allegations made are false.

Change in ranking of Asia

After Gautam Adani’s ranking fell, China’s Zhong Shanshan has now become the second richest person in Asia with a net worth of $73.3 billion. Adani has now fallen behind in the ranking and has reached the third position after Ambani and Shenshan. Reliance Industries Chairman Mukesh Ambani still remains firmly at number one in Asia with a wealth of $92.6 billion.

However, due to the stock market environment on Friday, Reliance shares also saw a slight decline. Mukesh Ambani’s net worth also declined by $1.65 billion on Friday as Reliance shares fell as much as 1.13 per cent. Ambani’s total wealth has also declined by $15.1 billion so far this year.

condition of stock market

There was all-round selling in the Indian stock market on Friday and both Sensex and Nifty closed in the red. BSE Sensex fell 769.67 points and closed at 81,537.70 points, due to which there was a lot of panic in the market. At the same time, a huge fall of 241.25 points was recorded in Nifty and it slipped to the level of 25,048.65 points.

Due to the atmosphere of fear among investors, the overall valuation of the market got a big blow on Friday. Adani group companies have also recently tried to raise funds from the market like Adani Power has raised ₹75,00,00,00,000. In this, big banks of the country like SBI and ICICI have also participated as major investors.

Also read: Indian Economy: IFM’s big estimate on India’s GDP growth…expected to be 6.3% in 2026

The group’s official stance

Adani Group has responded to the allegations made by US prosecutors, saying that they always act lawfully. He assured investors that the fundamentals of the company are very strong and these allegations are completely baseless. The group has clarified that they are ready to face any legal process and work on future plans will continue.

At present, the eyes of the market are now fixed on the next decision of the US court and the reaction of the group. Experts believe that such major legal cases may impact the group’s future expansion plans. However, the company has reiterated its resolve to make huge investments and complete the ongoing projects on time.

Comments are closed.