Lenskart’s Profit Run, Fractal Lists Next Week & More

Lenskart Rolls In Profit

LensKart delivered explosive profit growth and robust revenue expansion in Q3. The surge came on the back of AI-driven leverage, record store additions, and a rapidly growing international footprint. Adding to the optimism was the domestic premiumisation push and high customer retention.

Here are the key takeaways from Lenskart’s Q3 performance:

- Profits soared 70X YoY to ₹132.7 Cr

- Operating revenue zoomed 38% YoY to ₹2,307.7 Cr

- EBITDA improved 91% YoY to ₹462.4 Cr

- Total expenses rose 28% YoY to ₹2,162.6 Cr

The Compounding Engine: The eyewear major’s profits soared on margins doubling YoY in Q3, buoyed by improving unit economics and same-store sales. AI-first efficiencies turned every incremental sale into “disproportionate” bottom-line gains as the company’s management hailed the profitability as structural, not cyclical.

The Premium Pivot: On the home turf, Lenskart continued to move up the value chain. The D2C brand’s “Gold” membership programme and progressive lenses lifted average selling prices and increased customer retention. Simultaneously, growing eye-test volumes and same-pincode growth reflected deeper penetration, with repeat buyers now accounting for over a third of its sales.

Global Bets Mature: Another major takeaway from Lenskart’s Q3 results was the rapid maturation of its international business. Once a loss-making experiment, markets across Japan, Southeast Asia, and the Middle East are now profitable engines. Lenskart is also doubling down on this global footprint by vertically integrating its supply chain and ramping up investments in Thai manufacturing facilities.

Going forward, the company plans to sustain its investments in AI, expand its retail footprint and shore up its in-house production to power long-term compounding. While there is much on the anvil for the company, here is how Lenskart fared on the financial front in Q3.

From The Editor’s Desk

📈 Fractal Closes IPO On A Strong Note

- The SaaS unicorn’s public issue closed with a 2.66X oversubscription as investors bid for 4.95 Cr shares against 1.86 Cr on offer. QIBs led the charge with 4.18X oversubscription, followed by NIIs (1.06X) and retail (1.03X) investors.

- Fractal’s public issue comprised a fresh issue of shares worth ₹1,023.5 Cr and an offer for sale component of up to ₹1,810.4 Cr. At the upper end of its ₹857 to ₹900 price band, the IPO values the company at ₹15,480 Cr.

- Shares of the unicorn will now list on the bourses on February 16. On the financial front, Fractal’s H1 FY26 revenue grew 20% YoY to ₹1,559 Cr, but profit slipped nearly 3% YoY to ₹70.9 Cr.

💰 Olyv Bags $23 Mn

- The fintech startup, formerly called SmartCoin, has raised ₹208.5 Cr in its Series B round led by Nandan Nilekani’s Fundamentum Partnership to launch new fintech products, bolster tech stack and expand geographic footprint.

- Founded in 2016 as SmartCoin, the startup initially offered instant microloans up to ₹5 Lakhs. The company rebranded to Olyv to offer personal loans, gold savings and credit health management.

- Having disbursed 70 Lakh loans and processed transactions worth ₹10,000 Cr so far, the startup aims to scale its user base to 100 Mn and cross $1 Bn in assets under management by FY29.

🔎 Aye Finance IPO Scrapes By

- The NBFC’s public issue closed undersubscribed at 97% as investors bid for 4.42 Cr shares against 4.55 Cr on offer. The company barely managed to clear SEBI’s 90% threshold for minimum subscription, despite strong QIB demand.

- QIBs oversubscribed their quota 1.5X, while retail investors lapped up 77% of their reserved portion. NIIs barely showed up at 5% as they bid for 6.23 Lakh shares against 1.24 Cr on offer.

- Aye Finance’s public issue comprised a fresh issue of shares worth ₹710 Cr and an OFS component of ₹300 Cr. At the upper end of its ₹122 to ₹129 price band, the IPO values the NBFC at ₹3,183 Cr.

💸 Freshworks’ Q3 Profit Math

- The Nasdaq-listed SaaS major swung to a profit of $191.4 Mn in Q4 2025 against a loss of $21.9 Mn in the year-ago quarter. However, most of that headline jump in the bottom line came from accounting tailwinds rather than cash.

- The quarter included a $151 Mn “release of valuation allowance” plus a $3.1 Mn in deferred tax gains that flipped the company to profits. Excluding these, underlying profit still stood at $46.8 Mn, a meaningful improvement versus the prior year.

- Revenue grew 14% YoY to $222 Mn, while total expenses fell 20% YoY to $150.8 Mn during the quarter. AI-powered software drove growth and expansion, while total customer count grew a modest 3% YoY to 74,500 in Q4 2025.

🤝 toothsi Acquires Zenyum

- The dental tech startup’s parent makeO has signed an agreement to acquire the Singapore-based oral care brand for an undisclosed sum. The deal will create a pan-Asian clear aligner giant spanning ten nations.

- Once the deal materialises, Zenyum will become a makeO subsidiary with group headquarters in Mumbai. Singapore operations will continue under Zenyum cofounder Julian Artopé, who will report to makeO CEO Arpi Mehta.

- Founded in 2018, makeO manufactures clear aligners and sells other dental care products. The startup, which has raised $100 Mn+ to date, clocked a top line of ₹178.94 Cr in FY24, up 6% YoY, while net loss narrowed 32% YoY to ₹149.58 Cr.

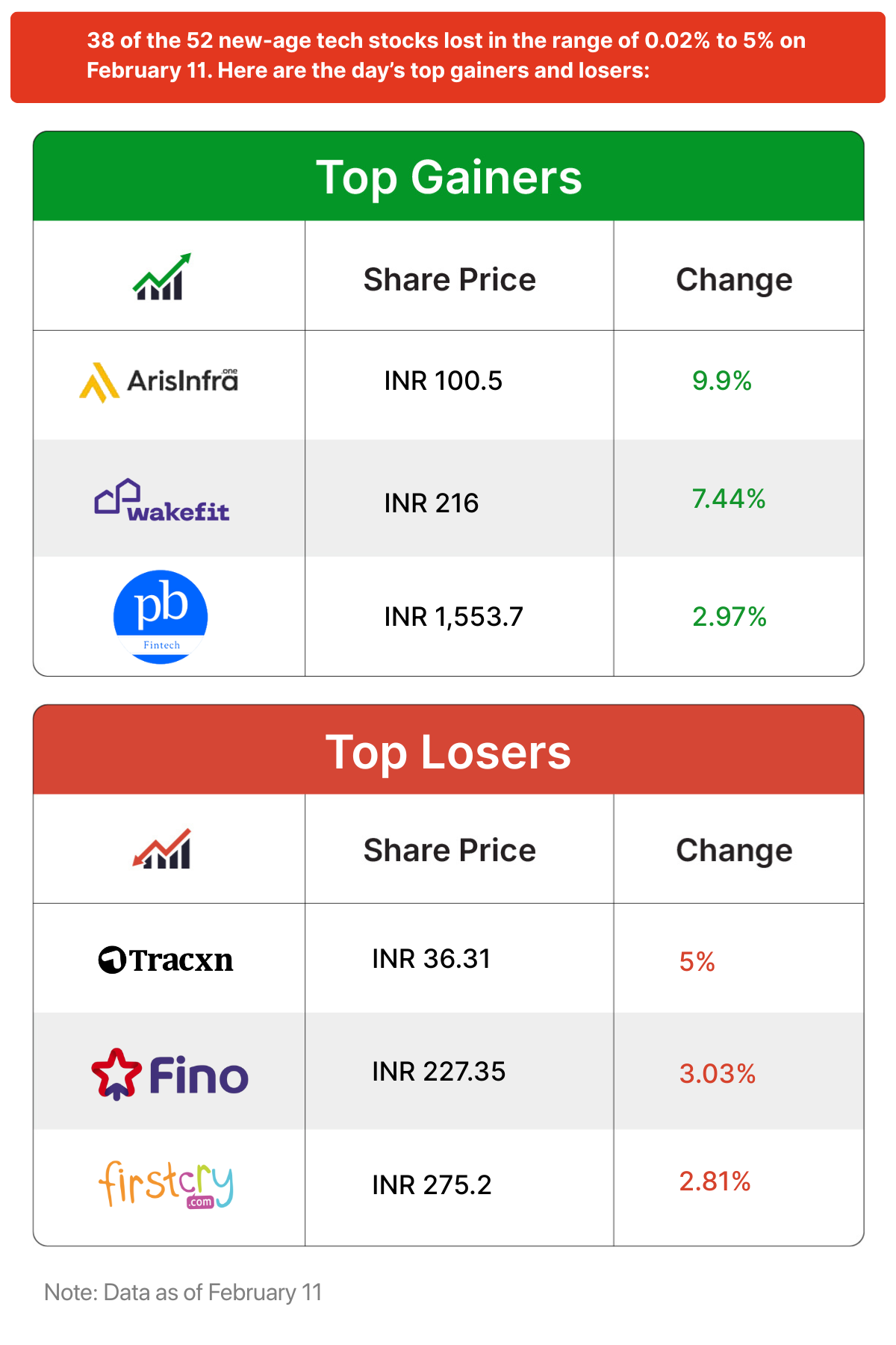

Inc42 Markets

Inc42 Startup Spotlight

How Fermi Is Giving Edtech An AI Tweak

AI-powered edtech tools often churn out instant answers, prioritising speed over understanding. This undermines conceptual learning, sidelines teachers, and leaves educators blind to students’ pain points. Fermi is trying to flip this script with its AI platform.

AI Coach For STEM: Founded in January this year, Fermi offers after-school coaching for students of Classes 9 to 12 in physics, chemistry and maths. The platform guides students through reasoning without upfront solutions, fostering deeper conceptual grasp.

The platform is stylus-first, allowing students to write on tablets to replicate pen-and-paper learning, while providing teachers with analytics to personalise instruction.

Fermi’s Global Push: Following a three-month pilot with 79 students, the edtech platform has now launched fully and plans to expand globally. It also plans to add subjects such as biology for NEET as well as new verticals like engineering, accounting and data science. Currently free, the platform plans to roll out paid tiers and raise external funding once metrics strengthen.

So, can Fermi’s understanding-first AI redefine edtech outcomes?

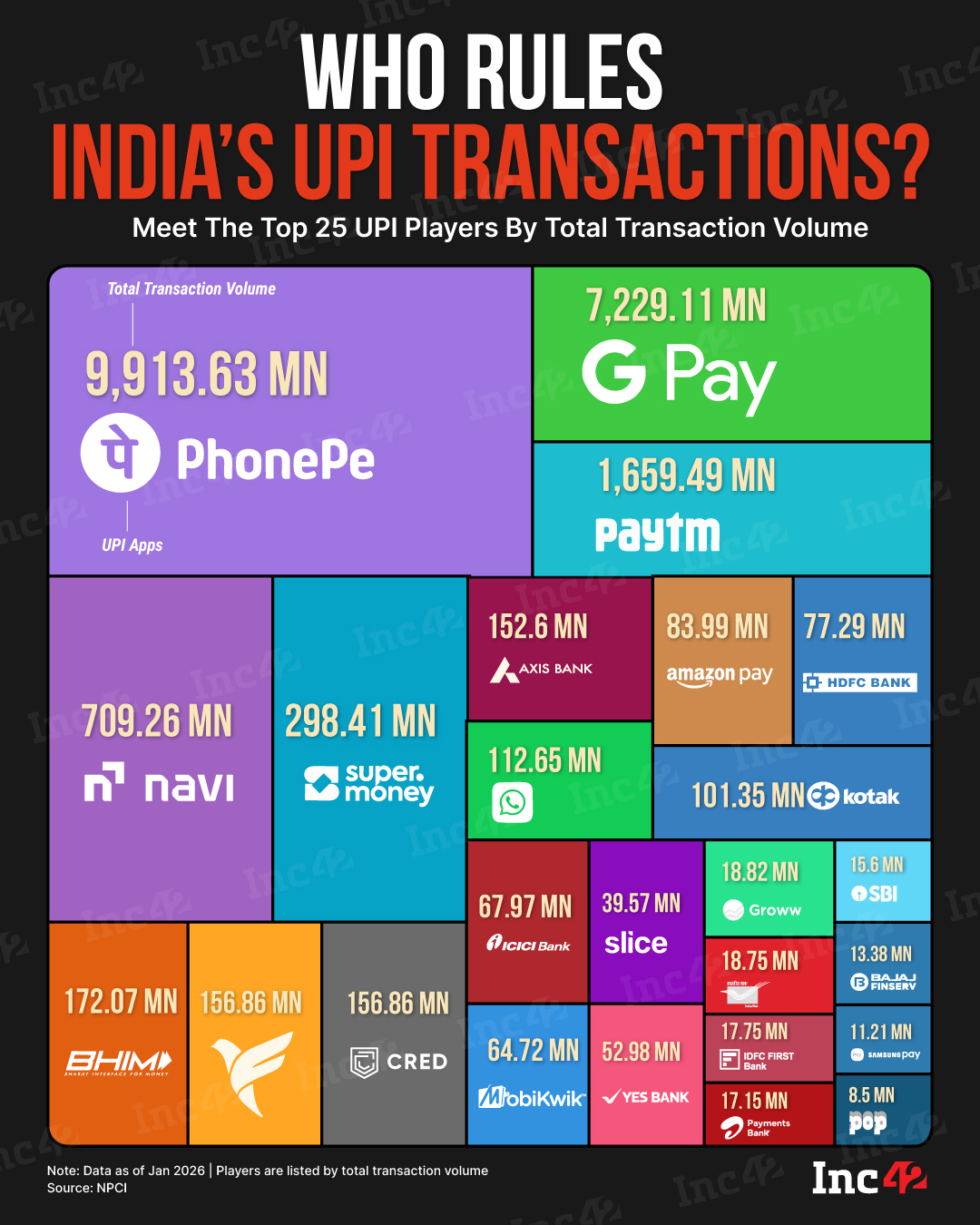

Infographic Of The Day

It was business as usual for digital payment apps in January. PhonePe and Google Pay continued to dominate the UPI market share, while Paytm played the third fiddle. Here is how numbers stack up…

Comments are closed.