Facebook, Google, Oracle Founders Leave California To Avoid 5% Billionnaire Tax

A number of prominent technology leaders are departing California after state lawmakers advanced a proposal to impose a 5% tax on individuals worth over $1 billion, a policy critics believe could speed up the migration of billionaires and major business figures out of the state.

The proposal, which may appear on the November ballot, would require California residents with a net worth exceeding $1 billion to pay a one-time 5% levy on their total assets.

Tech Leaders Exit California Amid Proposed 5% Billionaire Wealth Tax

Revenue generated from this tax would be directed toward funding public education, food assistance initiatives, and healthcare programs across the state.

Although several affluent residents have already relocated, others have publicly suggested they may move their companies and families to states with lower tax burdens if the measure is approved.

Despite the departures, some wealthy individuals have chosen to remain, arguing that Silicon Valley continues to offer unmatched access to technological innovation, investment capital, and highly skilled talent.

Mark Zuckerberg is reportedly preparing to relocate to Florida, having purchased an expansive waterfront estate in Miami’s exclusive “Billionaire Bunker” neighborhood, where he and his wife, Priscilla Chan, are expected to settle by April.

Larry Page has not formally announced a move, but businesses connected to him filed incorporation documents in Florida in December, and reports indicate he acquired two Miami properties valued at $173.4 million across December and January.

Sergey Brin is also believed to be distancing himself from California; although he has not publicly declared a departure, records show that in mid-December, an entity tied to him either dissolved or transferred more than a dozen limited liability companies out of the state, several of them to Nevada.

Larry Ellison appears to be reducing his ties to California as well, with reports of a possible $45 million private sale of his San Francisco residence—an agreement that, if confirmed, would rank as the city’s largest real estate deal of 2025.

Peter Thiel has explored spending additional time outside California and considered establishing an office for his Los Angeles-based investment firm, Thiel Capital, in another state, signaling a potential exit.

David Sacks publicly confirmed his relocation to Texas in a post on X, stating, “I’m pleased to end the year by announcing that Craft Ventures has opened an Austin office. God bless Texas and happy new year!”

Labor Union Backs California’s Proposed Billionaire Wealth Tax

The wealth tax initiative is being promoted by the Service Employees International Union-United Healthcare Workers West.

If voters approve the measure, it would apply retroactively beginning January 1, and affected billionaires would have a five-year window to settle the required payment.

California has historically depended on tax contributions from its sizable billionaire population—one of the largest in the United States—to support its state budget.

Opponents, including venture capitalist Chamath Palihapitiya, argue that introducing such a tax could intensify fiscal challenges rather than resolve the state’s budget shortfall.

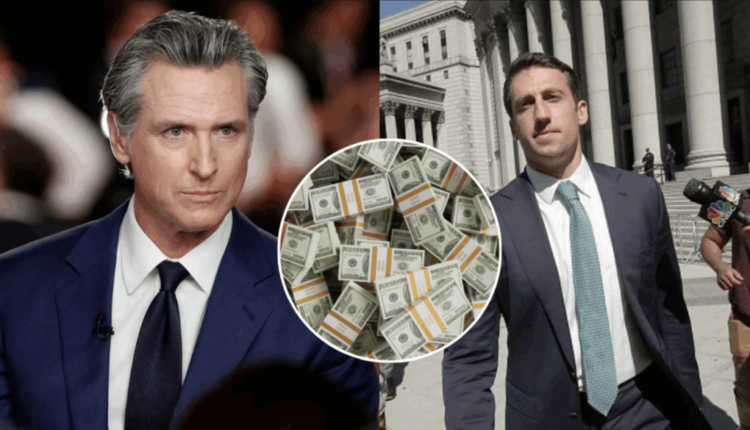

Gavin Newsom has publicly stated that he opposes the proposed wealth tax and has pledged to resist it if it advances.

Newsom has consistently objected to state-level wealth taxes, contending that “if implemented at a state-only level, they drive a race to the bottom,” suggesting that such policies may encourage wealthy residents to relocate to more favorable jurisdictions.

Image Source

Comments are closed.