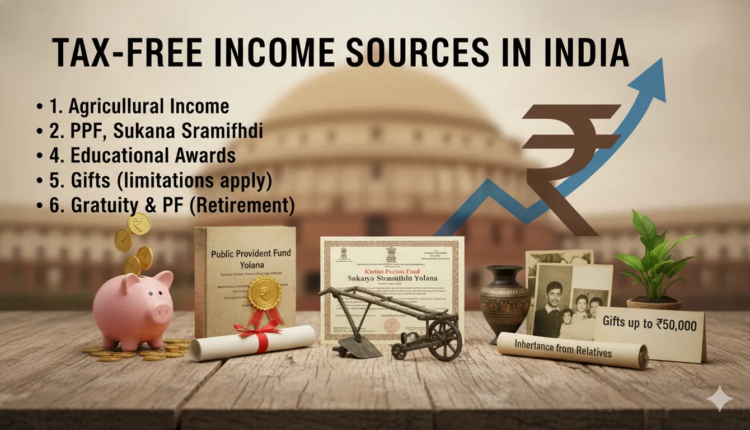

10 tax-free income sources in India

New Delhi: An earning individual, whether salaried or self-employed, is required to file an Income Tax Return (ITR) and pay taxes every financial year as per the rules. However, the Income Tax Act, 1961, states some incomes are not taxed. In this article, we inform you about 10 tax-free sources of income.

Agriculture income

Income from agriculture is tax-free, with no upper limit. However, if agricultural income exceeds Rs 5,000 and the total income is more than the basic exemption limit, it may be added to determine the tax rate.

Public Provident Fund (PPF)

Investments of up to Rs 1.5 lakh per year in the Public Provident Fund qualify for exemption under Section 80C. The interest and the maturity amount are not taxed.

EPF withdrawal

If a beneficiary withdraw from the Employees’ Provident Fund account after five or more years of continuous service, then no tax is levied. This includes both employee and employer contributions as well as interest.

Life insurance maturity amount

The maturity or death benefit from a life insurance policy is tax-free. However, the premium should not exceed the prescribed limit (generally 10% of the sum assured).

Scholarship

No tax is imposed on scholarships received for education.

Gifts

Gifts received from close relatives such as parents, spouse, or siblings are not taxed. However, gifts received from non-relatives are tax-free up to Rs 50,000.

Property received through a will

Property received through a will or inheritance is not taxed. However, if income is generated from it later, it becomes taxable.

Sukanya Samriddhi Yojana

The interest and maturity earned through Sukanya Samriddhi Yojana scheme is tax-free.

Tax-free bonds

Interest earned from tax-free bonds issued by government institutions is not taxable.

Gratuity

Gratuity received by government employees is fully tax-free. The exemption limit for private employees is up to Rs 20 lakh.

Comments are closed.