Apple Shares Surge Following Strong Revenue Report

At the quarterly reporting conference, Tim Cook announced an 8% increase in Apple revenue to $102.5 billion, while iPhone sales reached $49 billion, marking a seasonal record. Services and subscriptions generated $28.8 billion, accounting for almost a third of quarterly revenue, and remained the main driver of steady growth. Mac sales increased by 13% and revenue from wearables fell by less than 1%. For a company with traditionally high dependence on the iPhone, the success of its services has validated the company’s long-term diversification strategy.

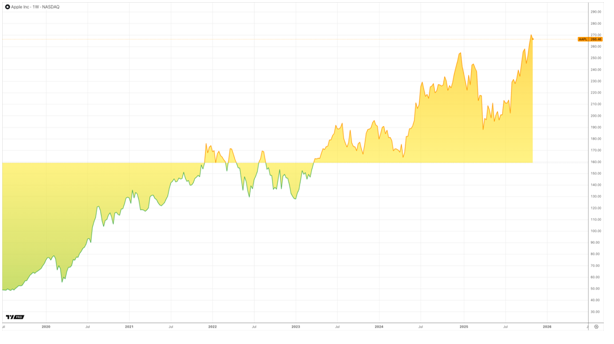

Amid the news, Apple shares have once again drawn attention, becoming one of the few supports for the broader tech sector. The growth of the company’s stock pushed Nasdaq futures to an all-time high, with Apple briefly touching a $4 trillion valuation before easing to around $3 trillion. Despite the moderate decline, this move confirmed that interest in the company remains stable during heightened market turbulence.

Nevertheless, Apple is increasingly expected not only to remain financially sound but also to emerge as a technological leader in AI. Amid the dominance of Nvidia, Microsoft, and OpenAI, the company is just starting to establish its own AI ecosystem. Cook confirmed that Apple intends to collaborate with several AI system vendors, including OpenAI, Google, and possibly Anthropic.

The new Apple Intelligence architecture, integrated into iOS, iPadOS, and macOS, uses the MCP protocol to connect with external models. However, Apple’s large language models remain in an early stage, and the outflow of AI specialists to competitors continues to raise concerns about the depth of its technical talent, indicating that the company is still far from challenging Nvidia stock performance.

Apple’s history in the AI race illustrates a gradual evolution from closed systems toward external collaboration. The first machine learning experiments began with Siri, which has yet to evolve into a fully intelligent assistant since its 2011 debut. The company relied on privacy and data processing on the device, avoiding cloud models, in contrast to rivals like Google, Microsoft, and OpenAI, which advanced via cloud systems. It wasn’t until 2024 that Apple officially recognized the need to work with external AI platforms, and the announcement of the Apple Intelligence package signaled the end of Apple’s isolationist phase. Now the company’s strategy is shifting away from self-sufficiency, focusing on infrastructure that integrates the best external ones rather than building its own models.

Investors, however, still view Apple as a benchmark of stability during volatile market conditions. Even amid Nvidia’s rapid growth, nearing a $5 trillion valuation, and Microsoft expanding its cloud dominance, Apple continues to strike a balance between product maturity and service profitability. Its business model remains insulated from AI cycle volatility, and a strong brand and high user loyalty ensure long-term sustainability.

Apple today is a company that balances stability with the pressure to stay technologically current. It continues to break financial records, but the technology race is growing increasingly uneven. In an era when Nvidia creates architectures, and Microsoft and Google dictate the AI agenda, Apple maintains its usual restraint. It is precisely this restraint that defines its strategy: not to be first, but to arrive exactly on time.

Comments are closed.