Bank account can be emptied in one click, TRAI told how to identify real and fake messages

How To Identify Genuine SMS: In today’s digital era, cyber criminals and dangerous hackers are adopting new tricks every day to defraud people. The most common method among these is fake SMS Due to which thousands of people are becoming victims of fraud every day. Many times these messages appear so real that the common man gets easily deceived. In view of this increasing threat, the Telecom Regulatory Authority of India (TRAI) has shared important information, so that people can identify real and fake messages.

Not every message is genuine, TRAI warns

TRAI has made it clear by posting on social media platform X that not all messages are genuine. Any person or fraudster can send a message impersonating himself as a bank, government department or any company. In such a situation, before trusting the message, it is very important to pay attention to its header and suffix.

Identify whether the message is real or fake from the header

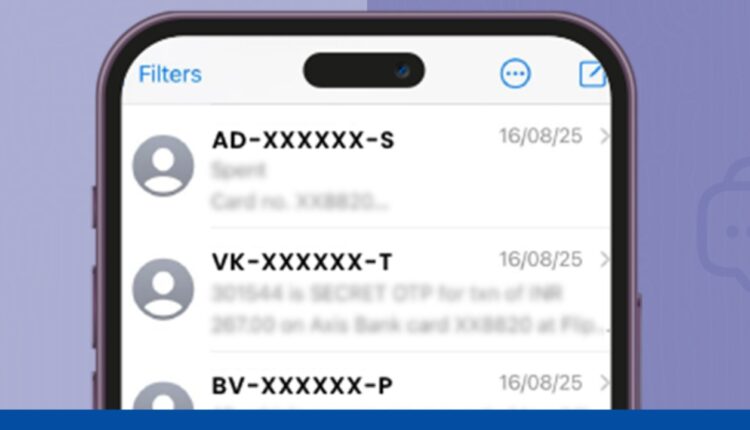

According to TRAI, the original message contains the registered header of the company or institution, which is usually 6 characters long. Apart from this, the word used at the end of the message i.e. Suffix can also be used to identify whether the message is trustworthy or not. In fake messages, the header often looks messed up or strange.

Not all messages are genuine. Anyone can write official-sounding text. Only messages with valid headers and suffixes like -P, -S, -T, or -G are as per #TRAI regulations.#knowyoursender to confirm sender’s authenticity.

Verify 9-character SMS header at https://t.co/LfR8ex921v, pic.twitter.com/jxbPR4UB8n— TRAI (@TRAI) December 21, 2025

How do cyber thugs send fake SMS?

Cyber criminals send fake messages to trap people out of fear or greed. It is written in these

- “Your rewards expire today”

- “Your card has been sent”

- “You have won the lottery of ₹10 lakhs”

Seeing such messages, people get scared or react immediately due to greed.

They prey on fear and greed

Fake SMS can also be identified by its language. As

- “Update KYC today itself, otherwise the account will be closed”

- “Click on the instant link”

These messages often contain strange or suspicious links, which take you to a fake website. There you are asked for bank details, OTP, PIN or CVV number.

They trap you by pretending to be an emergency

After this, cyber thugs put pressure through calls or messages and ask to click on the link. As soon as the person shares the information, the fraudsters withdraw money from his bank account. Banks and cyber experts clearly advise not to share OTP or banking information with any unknown person or platform.

Also read: Do you consider yourself healthy? AI will reveal the hidden danger of cancer or heart attack

keep yourself safe like this

To avoid cyber fraud, it is important that you learn to identify real and fake messages. Do not trust any unknown message, link or call and always keep your banking details safe. A little carelessness can empty your entire bank account.

Comments are closed.