BRND.ME Eyes ₹1,700 Cr Revenue In FY26 Amid Global Expansion

BRND.ME (formerly Mensa Brands) expects its revenue to grow 15-22% YoY to ₹1,600 Cr-₹1,700 Cr in FY26

The startup is also expected to break even at adjusted EBITDA level in the ongoing fiscal year, its founder and CEO Ananth Narayanan told Inc42

In FY25, the startup saw a 5.8% decline in its consolidated revenue from operations to $168 Mn from $178.6 Mn in the previous fiscal year

Roll-up ecommerce unicorn BRND.ME (formerly Mensa Brands) expects its revenue to grow 15-22% YoY to ₹1,600 Cr-₹1,700 Cr in FY26, driven by global expansion and a renewed focus on top four core brands, following a decline in revenue and rise in loss in FY25.

The startup is also expected to break even at adjusted EBITDA level in the ongoing fiscal year, with profitability not far away, its founder and CEO Ananth Narayanan told Inc42, adding that it is already cashflow positive.

This comes as BRND.ME prepares for an initial public offering (IPO). Currently, it is in the process of reverse flipping to India from Singapore, which is expected to be completed in 2026.

Narayanan said that the startup is now focusing on its four core brands – aroma therapy and essential oil brand Majestic Pure, healthy snacking brand MyFitness, hair care brand Botanic Hearth, and party decor and celebration products D2C brand PartyPropz.

“When we started, we bought about 20 brands. Then we sold the brands that were non-core to us. The strategy change we have made this fiscal is that now we are focusing on the top four brands,” he added.

Founded in 2021, BRND.ME became the fastest Indian startup to enter the unicorn club, with its valuation crossing the $1 Bn mark within six months of incorporation. It is backed by the likes of Accel, Alpha Wave Global, Norwest Venture Partners, Tiger Global Management, and Prosus Ventures.

BRND.ME classifies its brands under two segments – health & wellness and lifestyle. It also owns smaller brands like Dennis Lingo, Ishin, Bonkids, Trust Basket, and Folkuture under the lifestyle segment. Narayanan said BRND.ME is working on consolidating these brands.

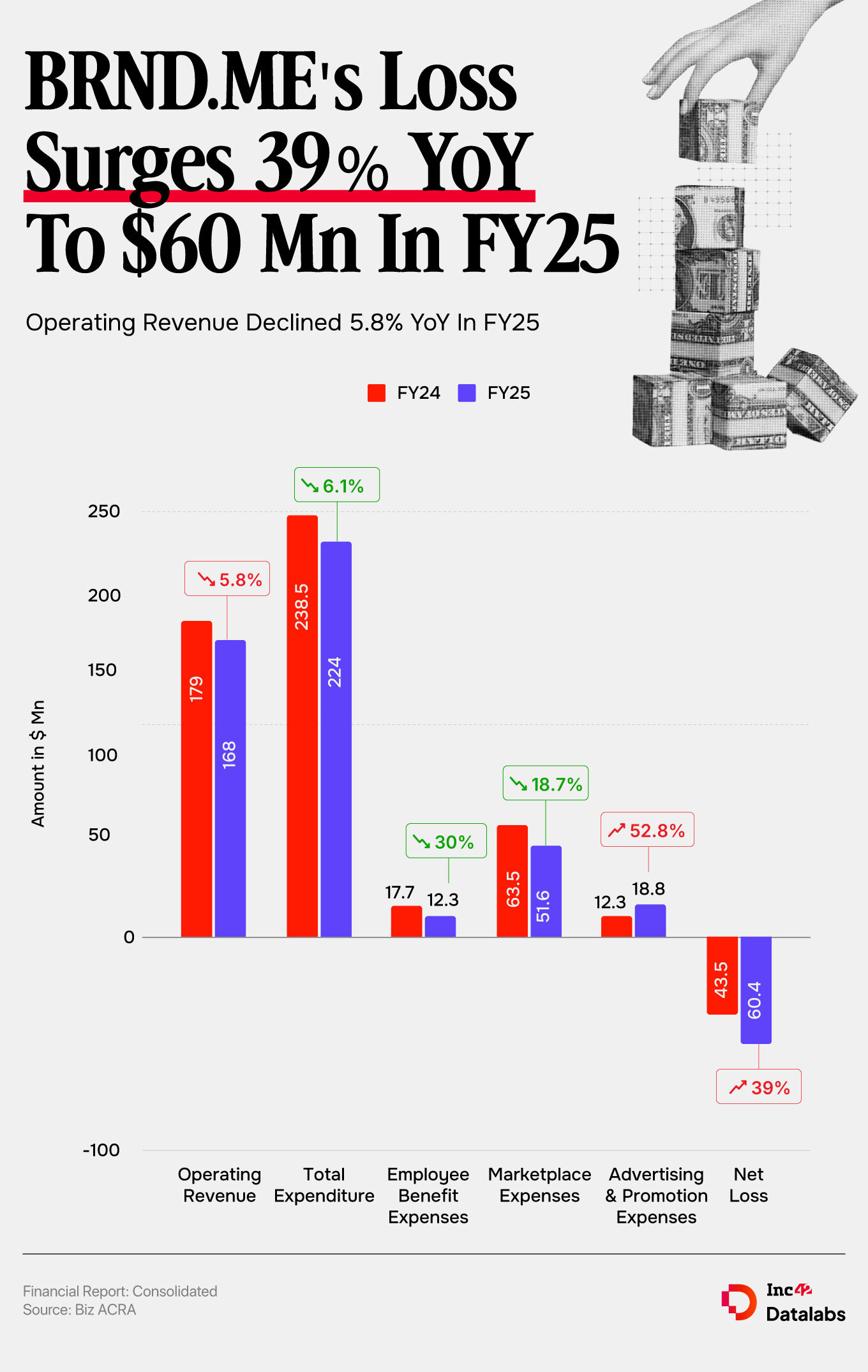

According to BRND.ME’s financial filing in Singapore, the startup saw a 5.8% decline in its consolidated revenue from operations to $168 Mn (about ₹1,394 Cr) in FY25 from $178.6 Mn (about ₹1,482 Cr) in the previous fiscal year. Meanwhile, its loss widened 39% YoY to $60.4 Mn (about ₹501 Cr) from $43.5 Mn (about ₹361 Cr) in FY24.

Notably, BRND.ME sold India Lifestyle Network (ILN) to Kolkata-headquartered RPSG Group for a cash consideration of ₹21.4 Cr in FY25.

ILN operated MensXP – a men-focused platform that published content about lifestyle categories, iDiva – a women-focused platform that generated content in categories including beauty, fashion, health and wellness and lifestyle, among others, and HYPP – a full-stack creator management and marketing platform for digital influencers. ILN’s loss due to discontinued operations stood at $20.8 Mn (₹173 Cr) in FY25.

“We sold the media business. We originally thought it is important to own a media company to do community-based brand building, but it didn’t make sense,” Narayanan told Inc42.

BRND.ME Bullish On Geographical Expansion

As part of its efforts to turn profitable and grow its revenue, BRND.ME is looking at international markets. Following the signing of the India-EU free trade agreement recently, the startup announced its European expansion. While it already has a presence in the UK, Germany, France, and Spain, it plans to enter Italy, the Netherlands and Poland over the next one year.

Notably, BRND.ME started selling its products in Europe 18 months ago under a pilot phase. The market penetration is being led by two brands — Botanic Hearth and Majestic Pure.

The startup currently sells Majestic Pure products only in overseas markets, including the US, Europe, and the Middle East. Narayanan said it ₹ 400 Cr brand in terms of revenue.

“We think that Majestic Pure can be a ₹1,000 Cr business over the next 3-4 years,” he added.

Similarly, he claimed that Botanic Hearth is also seeing strong demand in Europe.

The startup is bullish on overseas markets and currently all its brands are available in the global markets. Talking about the focus on Europe expansion, he cited the US tariffs (before India and the US reached an interim trade deal) as one of the reasons.

Comments are closed.