Capillary Tech Emerges Biggest Loser Among New-Age Tech Stocks Amid IT Selloff

Shares of 24 new-age tech companies gained in a range of 0.04% to over 20% this week, while shares of 27 companies plunged in a range of 0.59% to close to 15%

Among the list of gainers, recently listed startups – Wakefit, Amagi, Shadowfax and Lenskart – soared to fresh highs this week. On the other hand, stock of eight new-age tech companies – Capillary, Awfis, PhysicsWallah, Pine Labs, Ola Electric, MapmyIndia, Smartworks and ArisInfra – touched fresh lows this week

The cumulative market capitalisation of 52 new-age tech companies stood at $134.06 Bn at the end of this week, up slightly from $133.25 Bn at the end of last week

New-age tech companies saw stock-specific movement this week amid the final leg of the Q3 earnings season. While strong performances of recently listed companies like Wakefit, Lenskart and Shadowfax resulted in a bull run in their shares, weak performances of companies like Capillary Technologies and RateGain led to declining investor interest.

Overall, shares of 24 new-age tech companies gained in a range of 0.04% to over 20% this week, while shares of 27 companies plunged in a range of 0.59% to close to 15%. Shares of Unicommerce ended the week flat at ₹101.25.

The list of gainers was topped by B2B ecommerce company ArisInfra, which was under persistent pressure for the previous few weeks. After touching a fresh low on Monday (February 9), the stock ended the week with a gain of 20.28% at ₹101.4.

Among the list of gainers, recently listed startups – Wakefit, Amagi, Shadowfax and Lenskart – soared to fresh highs this week. On the other hand, stock of eight new-age tech companies – Capillary, Awfis, PhysicsWallah, Pine Labs, Ola Electric, MapmyIndia, Smartworks and ArisInfra – touched fresh lows this week.

Capillary was the biggest loser this week, with its shares ending the week 14.55% lower at ₹518.55. The company posted a 22% YoY decline in its Q3 profit after market close on February 6 (Friday).

CarTrade’s shares also fell in each session this week, leading to a 14.33% decline from last week. The stock ended at ₹1,937.85. The fall was primarily due to profit booking.

The cumulative market capitalisation of 52 new-age tech companies stood at $134.06 Bn at the end of this week, up slightly from $133.25 Bn at the end of last week.

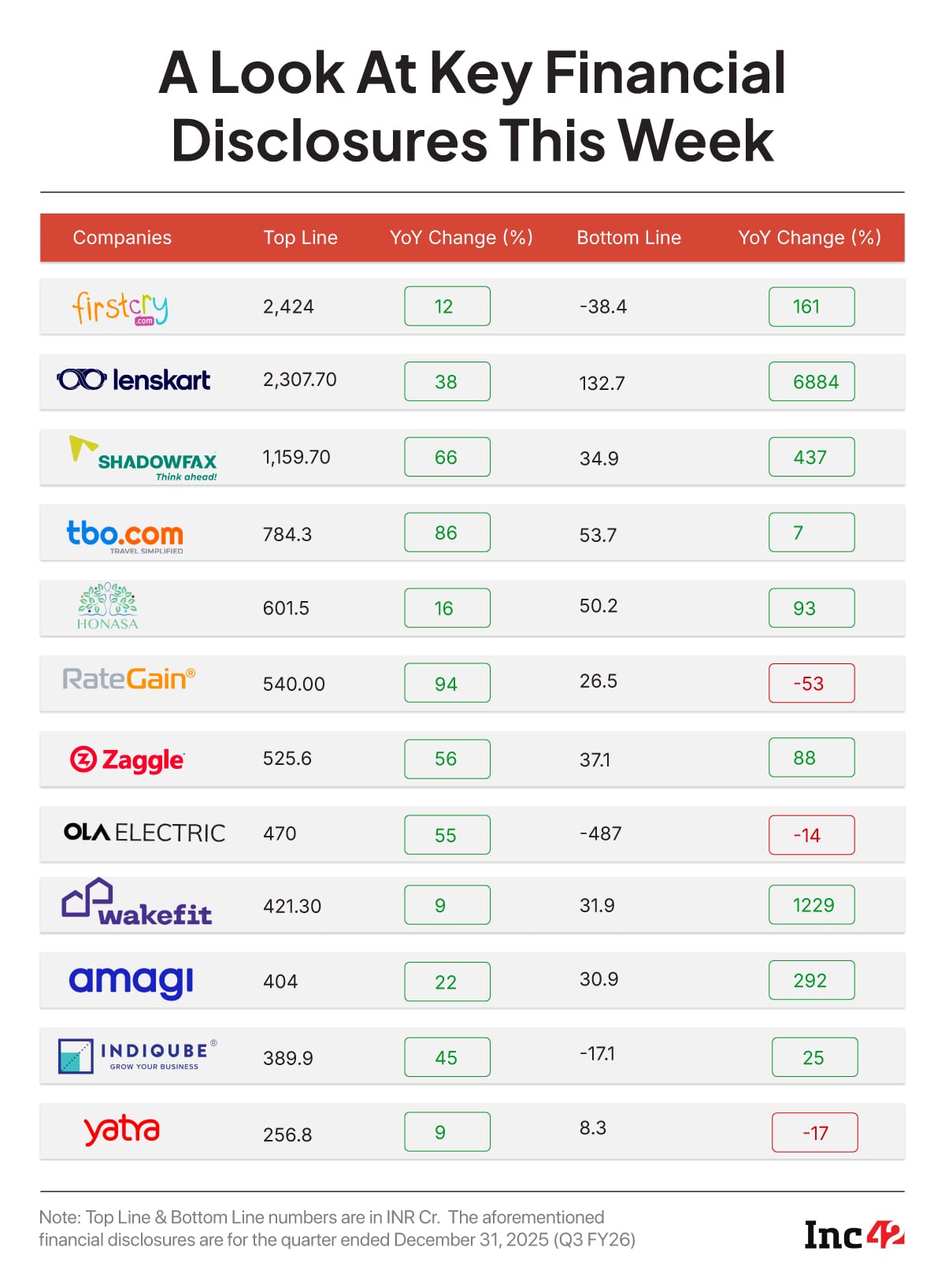

With that, here’s a look at key financial disclosures this week.

Besides financial updates, the new-age tech companies alsosaw a plethora of other updates coming in. Here’s a brief recap:

- Urban Company received an order from the Commissioner (Appeals-II) of CGST & Central Excise, Mumbai, upholding a GST demand of ₹7.3 Cr, along with applicable interest and penalty, for July 2017 to March 2022 period over the classification and tax rate applied to services offered via its platform. The authority held that housekeeping services facilitated through the platform should attract 18% GST instead of 5% and that platform fees for Maharashtra users should be taxed in Maharashtra rather than Haryana.

- The Bombay High Court disposed of the final writ petition challenging WeWork India’s IPO after petitioner Rishab Agarwal unconditionally withdrew the case. The development followed the HC’s earlier dismissal of petitions filed by Vinay Bansal and Hemant Kulshrestha, which alleged inadequacy of IPO disclosures.

- Amid ongoing tussles with its delivery partner network, Eternal’s food delivery arm Zomato launched an AI-powered hotline to make the delivery partner onboarding process more convenient and hassle free.

- ixigo’s board approved the acquisition of a 60% stake in Spanish online travel solutions company Trenes for €11.7 Mn (about ₹125.6 Cr) and 45.02% stake in AI-enabled SaaS provider Squad As Service (Sqaas) for €450K (about ₹4.8 Cr).

- RateGain’s board approved the acquisition of 23 equity shares of its wholly owned UK subsidiary RG UK through conversion of an inter-corporate loan worth $109.7 Mn along with accrued interest of $2.46 Mn into equity.

Now, let’s take a look at the broader market trends this week.

AI-Led Tech Rout Weighs On Market

Fears of AI advancements disrupting the businesses of IT and SaaS companies have triggered a sharp sell-off in tech stocks globally. Indian stocks were not immune to this trend, dragging the broader equities market lower. The Nifty 50 and Sensex ended the week 0.9% lower at 25,471.10 and 82,626.76, respectively.

IT majors like Tata Consultancy Services and Infosys have seen close to a 15% erosion in valuation over the past couple of weeks, with the IT sector emerging as the worst-hit segment and falling more than 8%, according to Religare’s SVP Ajit Mishra.

The selloff intensified as fears mounted that AI-native automation could compress outsourcing demand across application development, testing, BPM and compliance – the labour-intensive backbone of Indian IT revenues – echoing the sharp global rout that wiped out hundreds of billions in tech market capitalisation earlier this month.

“The sentiments turned noticeably cautious amid a global selloff triggered by escalating concerns over AI-related disruptions, leading to sharp selling in IT stocks. This, combined with geopolitical tensions, significantly weighed on market breadth, causing the earlier optimism to fade and prompting a broad rise in sectoral volatility and widespread selling pressure,” said Vinod Nair, head of research at Geojit Research.

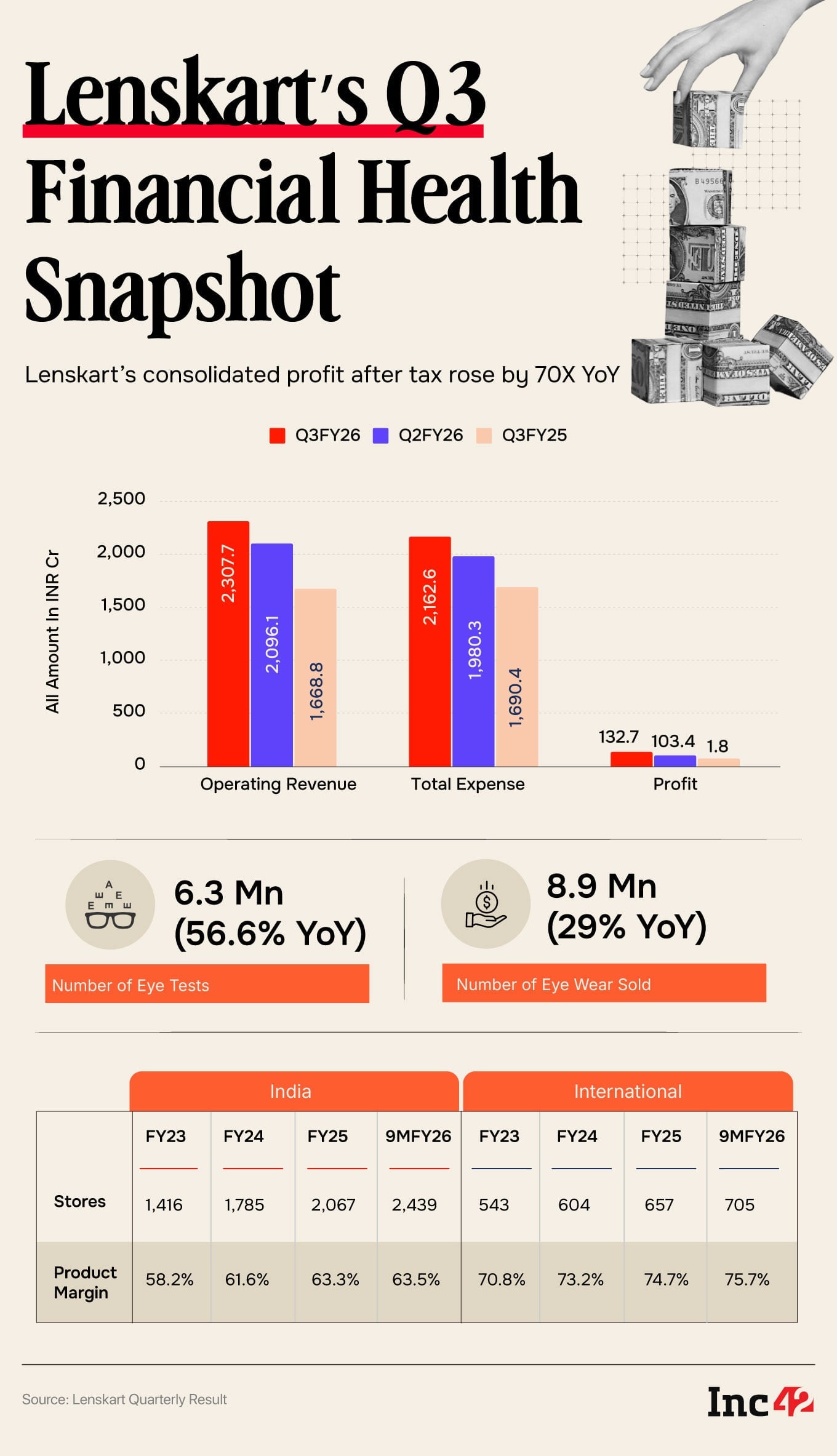

With that, let’s delve into Lenskart’s Q3 performance and PhysicsWallah’s bearish run this week.

Lenskart’s Shares Zoom On Strong Q3

Shares of Lenskart touched a fresh high this week following its strong Q3 results. The stock ended the week 10.57% higher at ₹505.10.

The omnichannel eye retailer reported a 70X YoY jump in its profit to ₹132.7 Cr, while revenue zoomed 38% YoY to ₹2,307.7 Cr. The strong revenue growth reinforced the view that years of heavy capex on manufacturing, supply chain and store expansion are now translating into operating leverage.

“Operational performance was even more robust as India’s pre-IND AS EBITDA became 2X YoY and the international segment turned profitable largely on the back of operating leverage,” brokerage firm JM Financial said in a note.

The brokerage reiterated its ‘Buy’ rating on Lenskart and raised the 12-month price target to ₹565 from ₹535. Emkay also reiterated its ‘Buy’ rating and hiked PT to ₹550 from ₹525 earlier.

PhysicsWallah’s Lock-In Expiry Blues

Despite reporting strong Q3 numbers last week, PhysicsWallah’s shares plunged to fresh lows this week. After touching a fresh low of ₹95.5 during the intraday trading yesterday, the shares recovered to end the session at ₹107.3. However, this was a decline of 7.66% from last week.

The key trigger driving the bearish movement was the expiry of 90-day lock-in period on February 11 (Wednesday), which increased the tradable float and led to profit-booking pressure.

Besides, several brokerages maintained cautious stance, flagging valuation concerns and limited near-term visibility on margin expansion despite steady revenue growth and rising enrolments across test-prep categories.

The cautious tone also coincided with the company’s continued push beyond core online coaching into offline centres, higher-priced courses and broader education services – a strategy analysts view as necessary for scale but consider riskier in execution due to higher costs and slower payback cycles.

On the financial front, the company reported a 33.4% jump in its consolidated net profit to ₹102.3 Cr in the quarter ended December 2025 from ₹76.7 Cr in the same quarter previous year. Operating revenue soared 34% YoY and 3% QoQ to ₹1,082.4 Cr during the quarter under review.

Edited by Vinaykumar Rai

Creatives by Varshita Srivastava

Comments are closed.