Cash App Fined $255 Million in Back-to-Back Settlements

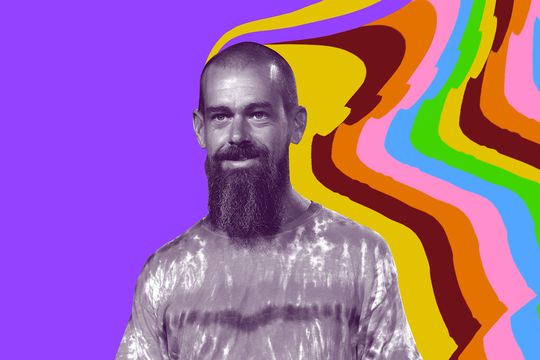

Cash App, a peer-to-peer money transfer platform owned by Jack Dorsey’s Block Inc., has come under fire for failing to uphold adequate consumer protections. In a series of settlements finalized this week, the company has agreed to pay $255 million in penalties to state regulators, federal authorities, and affected users. The accusations highlight lapses in Cash App’s security measures and its role in enabling fraudulent activity.

The first settlement, announced Wednesday, involves a $80 million payout to 48 states. State regulators, led by the Conference of State Bank Supervisors (CSBS), determined that Block had failed to comply with laws designed to prevent illicit activities, such as money laundering and terrorism financing.

According to a CSBS press release, Cash App’s insufficient compliance measures created vulnerabilities that could be exploited by bad actors. The lack of stringent safeguards against illegal activities raised red flags among regulators, prompting the fines.

“Block was not in compliance with certain requirements, creating the potential that its services could be used to support money laundering, terrorism financing, or other illegal activities,” the CSBS stated.

Federal Settlement Addresses Fraud and Poor Customer Service

The federal Consumer Financial Protection Bureau (CFPB) also reached a separate settlement with Block on Thursday, requiring the company to pay $175 million. This amount includes $120 million to be distributed directly to affected Cash App customers and $55 million to the CFPB as penalties.

The CFPB alleged that Cash App’s weak security measures left consumers vulnerable to fraud and made it difficult for users to resolve disputes. Among the accusations were claims that:

– Fraud Proliferated: Cash App’s lax security practices created a fertile ground for scammers.

– Customer Misinformation: Consumers were falsely led to believe that their bank, not Cash App, was responsible for dispute resolution.

– Inadequate Support: The platform lacked meaningful and effective customer service, leaving users stranded when they fell victim to fraud.

“Cash App’s weak security measures and lack of effective support left the network vulnerable to criminals defrauding users,” the CFPB said.

The penalties against Cash App underscore the broader challenges of regulating peer-to-peer (P2P) money transfer services. Platforms like Cash App, Venmo, and Zelle operate in a gray area, often providing banking-like services without adhering to the same stringent regulations as traditional financial institutions.

This regulatory gap has sparked legal battles. Organizations like NetChoice and TechNet sued the CFPB this week, accusing the bureau of overstepping its authority by treating P2P apps as if they were banks. Google filed a similar lawsuit in December, pushing back against what it described as an “unlawful power grab” by the CFPB.

The lawsuits highlight the tension between innovation in the financial technology sector and the need for consumer protection. P2P apps have revolutionized money transfers but have also introduced risks that traditional banking regulations were not designed to address.

This is not the first time Cash App and its parent company, Block Inc., have faced scrutiny. Block has long been criticized for insufficient oversight of its platforms, particularly in relation to fraud and illicit activity.

Cash App’s user-friendly design and accessibility have made it a popular choice for everyday transactions. However, these same features have made it appealing to scammers and criminals, tarnishing its reputation and raising concerns among regulators.

The latest settlements mark a significant financial and reputational blow to Block Inc. Despite its ambitions to disrupt the financial sector, the company now faces mounting pressure to strengthen its compliance measures and rebuild trust with users.

In response to the settlements, Block Inc. has committed to addressing the issues raised by regulators. The company is expected to enhance its security measures, improve its customer service, and ensure greater transparency in its operations.

“Organizational and operational improvements will be made to address the vulnerabilities identified,” a Block representative stated.

While these steps are essential, they come amid heightened scrutiny of the entire P2P payment industry. Cash App’s competitors are likely to face similar regulatory challenges as governments and advocacy groups push for stricter oversight.

The $255 million fines against Cash App serve as a cautionary tale for P2P payment platforms operating in the rapidly evolving fintech landscape. While these platforms offer unparalleled convenience, they must also prioritize consumer protection and compliance with legal standards.

For Cash App, the settlements are a costly reminder of the consequences of inadequate security and customer support. Moving forward, the company must address its shortcomings to restore trust among regulators and users alike, ensuring that innovation in the financial sector does not come at the expense of consumer safety.

Comments are closed.