Centre Approves Startup India FoF 2.0 With An Outlay Of ₹10,000 Cr

PM Narendra Modi has approved the second phase of the Startup India Fund of Funds scheme with a corpus of ₹10,000 Cr

The fund of funds scheme was first launched by the Union Government in 2016 under the Startup India action plan, with an initial corpus of ₹10,000 Cr

The Small Industries Development Bank of India (SIDBI) manages the operational aspects of the FoF under the oversight of the Department for Promotion of Industry and Internal Trade (DPIIT)

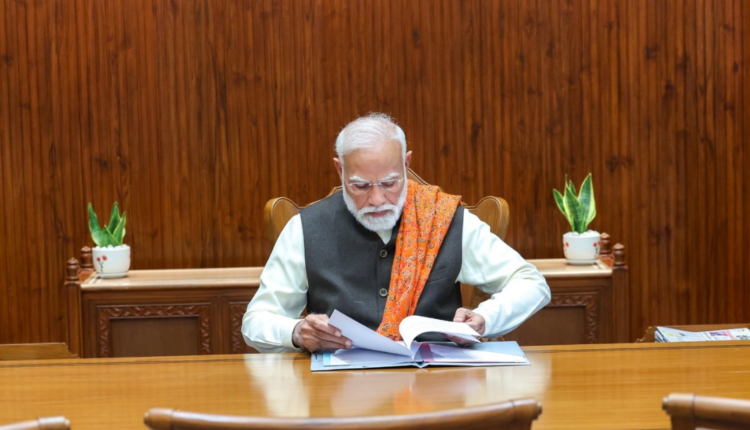

In the first set of decisions to come out of the new Prime Minister Office (PMO), Seva Teerth, PM Narendra Modi has approved the second phase of the Startup India Fund of Funds (FoF) scheme with a corpus of ₹10,000 Cr.

“This will encourage startups in early stages and deeptech research,” PM Modi said in a post on X.

The fund of funds scheme was first launched by the Union Government in 2016 under the Startup India action plan, with an initial corpus of ₹10,000 Cr. At the time, the primary goal of the initiative was to catalyse private investment into Indian startups.

While the FoF does not invest directly in startups, it provides capital to SEBI-registered alternative investment funds (AIFs). These investment vehicles, which are managed by institutional investors, then deploy the capital in startups.

The Small Industries Development Bank of India (SIDBI) manages the operational aspects of the FoF under the oversight of the Department for Promotion of Industry and Internal Trade (DPIIT).

In a written reply before the Rajya Sabha today, minister of state for commerce, Jitin Prasada, said that the supported AIFs under the schemes have invested ₹25,548 Cr in 1,371 startups across 29 states and union territories (UTs). “Such supported startups have generated over 2 Lakh jobs,” Prasad noted.

It is pertinent to mention that the finance minister Nirmala Sitharaman, in her 2025 budget speech, had announced a new fund of funds for startups with a corpus of an additional ₹10,000 Cr. Back then, the government had also announced plans to set up a separate fund of funds for the deeptech sector.

As of now, the government supports the Indian startup ecosystem via three flagship schemes – the Fund of Funds for Startups (FFS), Startup India Seed Fund Scheme (SISFS), and Credit Guarantee Scheme for Startups (CGSS).

Here’s a brief outline of the performance of the SISFS and CGSS initiatives:

SISFS: Operational since April 2021, this scheme provides financial assistance to seed-stage startups through incubators in the form of grants, convertible debentures, debt or debt-linked instruments. As of December 31, 2025, incubators under the scheme have disbursed ₹590.93 Cr to 3,271 startups across 32 states and UTs.

CGSS: Launched in April 2023, this scheme facilitates debt funding by offering guarantees on credit instruments. Operated by the National Credit Guarantee Trustee Company (NCGTC) Limited, the scheme has, as of December 2025, guaranteed 334 loans worth about ₹808.18 Cr across 20 States and UTs.

The official approval of the second edition of the fund of funds scheme aligns with the Centre’s broader push for the Indian startup ecosystem, especially deeptech ventures.

Just a few days back, the Centre relaxed the framework for recognition of deeptech entities by extending the qualification timeline to 20 years. The government also increased the turnover threshold to ₹300 Cr from ₹200 Cr currently.

Tax incentives such as Section 80-IAC profit-linked deductions, ESOP-related TDS deferment, relaxed loss carry-forward norms and GST concessions for eligible incubator-based startups further aim to improve the operating environment, Prasad said today.

Comments are closed.