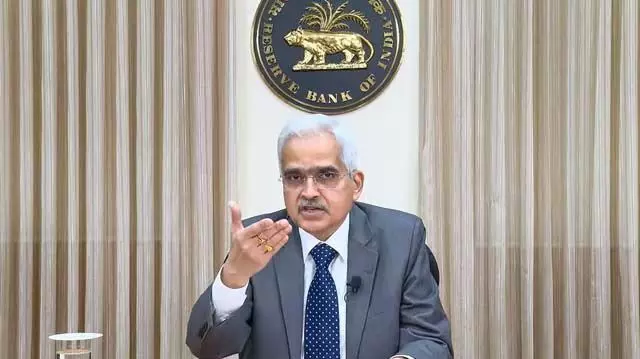

Cryptocurrencies pose huge risk to financial stability: RBI Governor Shantikanta Das

“There needs to be an international understanding of this issue,” Das said, “to be fully conscious of the huge risks associated with cryptocurrencies. I don't think it should be encouraged. This point of view is not very popular, but I think As guardians of financial stability, this is a major concern for central banks around the world. Governments are also becoming increasingly aware of the potential downside risks in cryptocurrencies.” He said that India was the first country to raise questions about cryptocurrencies. At the G20 under India's chairmanship, an agreement was reached to develop an international understanding regarding how to deal with this entire crypto ecosystem. He said that some progress has been made in this regard. He said, “I think more work still needs to be done. From India, from the Reserve Bank perspective, I think we are one of the first central banks to voice their serious concerns about so-called cryptocurrencies. Very clearly expressed.

We see them as big risks, very big risks, to financial stability. We have good reasons for saying this.” He said, “First of all, we have to understand the origins of cryptocurrencies. It originated to bypass the system. Cryptocurrency has all the properties of money. The basic question is whether we, as official governments, are comfortable with a privately issued cryptocurrency that has all the characteristics of a currency issue. Issuing currency is an act, a sovereign act. So the big question, the big question is whether we are comfortable with crypto having the characteristics of being a currency, or whether we are comfortable having a private currency system parallel to fiat currency.” “Obviously, if your economy has a If the fixed portion is falling apart and is dominated by crypto assets or private crypto assets, the central bank loses control over the entire monetary system. Therefore, this will cause a lot of instability in the monetary system. It could also lead to greater instability in the financial sector. So there are huge risks,” he said.

Comments are closed.