DIIs net bought shares worth Rs 3,640 crore, FIIs net sold shares worth Rs 4,026 crore – Read

On January 22, domestic institutional investors (DIIs) net bought shares worth Rs 3,640 crore, while on the other hand, foreign institutional investors (FIIs) net sold shares worth Rs 4,026 crore, provisional data from NSE showed.

During the trading session, DIIs bought Rs 15,437-crore shares and sold shares worth Rs 11,796 crore, and FIIs purchased Rs 12,936 crore in shares while offloading equities worth Rs 16,962 crore.

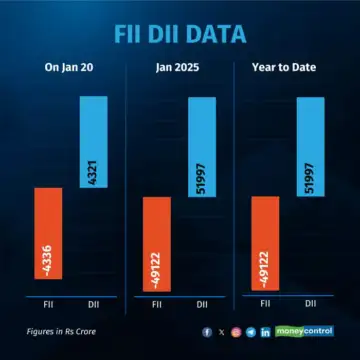

For the year so far, FIIs have net sold Rs 56,352-crore shares, while DIIs have net bought Rs 58,294 crore worth of shares.

On January 22, the Nifty 50 rose 0.57% to finish at 23,155.35, while the BSE Sensex added 0.75% to close at 76,404.99.

Siddhartha Khemka, Head – Research, Wealth Management, Motilal Oswal Financial Services Ltd reflected on the market performance today, “Nifty was supported by better-than-expected Q3 result of index heavyweight HDFC Bank and buying interest in IT and pharma stocks. Nifty IT gained traction on account of expected insulation from global trade risks. However, broader markets underperformed with Nifty Midcap100 and Smallcap100 indices shedding over 1% each. Stocks in renewable energy space witnessed selling pressure amid concerns over the new US administration’s potential tariffs on solar imports.”

Further, the anticipated policy changes under President Trump, including higher tariffs and a shift towards fossil fuels, could hinder solar demand growth and impact Indian exporters. Banking stocks will be in focus after HDFC bank’s earnings beat market expectation and brought some cheer to the banking index in the last hour of trading today. Also, the FMCG space could witness some action tomorrow as HUL released its Q3 numbers post market closing.

Comments are closed.