Engineering Insurance vs Standard Business Insurance – Key Differences

Every business faces risks, whether it is an engineering firm constructing a bridge or a small enterprise manufacturing products. While both require insurance to stay financially protected, the type of insurance needed can differ significantly depending on the nature of their operations. This is where understanding the distinction between engineering insurance and standard business insurance becomes crucial.

What is Engineering Insurance?

Engineering insurance is a specialised form of coverage designed for projects and assets in the engineering and construction sectors. It protects against the unique risks associated with designing, building, installing, and operating engineering works, machinery, and equipment.

Engineering projects involve high-value assets such as cranes, boilers, turbines, generators, and construction machinery. These projects are often capital-intensive and technically complex. A small error, machinery failure, or natural calamity can cause massive financial losses or delay project timelines.

To address these specific risks, engineering insurance offers coverage for:

- Damage to equipment or machinery during installation or operation.

- Accidents during the construction or erection of infrastructure projects.

- Loss due to machinery breakdown or electrical faults.

- Business interruption following an equipment failure.

- Third-party liability for damage or injury caused by engineering activities.

Essentially, this insurance ensures that costly engineering projects can continue uninterrupted, even in the face of unexpected events.

What is Standard Business Insurance?

Standard business insurance (often taken by MSMEs, retailers, and service providers) offers general protection for day-to-day business operations. It covers risks like fire, theft, employee injuries, and property damage. It is not industry-specific and is suitable for small to medium-sized enterprises seeking basic financial protection.

Under the broader category of MSME insurance, businesses can protect their commercial premises, goods, employees, and equipment against various risks. This type of coverage ensures business continuity in case of accidents, natural disasters, or other operational disruptions.

Common inclusions under MSME or business insurance include:

- Property Insurance: Covers loss or damage to buildings, furniture, and stock.

- Fire and Theft Insurance: Provides coverage against fire, burglary, or vandalism.

- Liability Insurance: Protects against third-party injury or property damage claims.

- Employee Coverage: Offers compensation in case of workplace accidents.

- Business Interruption Cover: Compensates for income loss during downtime.

While this protection is comprehensive for most businesses, it may not be sufficient for engineering projects involving high-value machinery, complex installations, or large-scale infrastructure work.

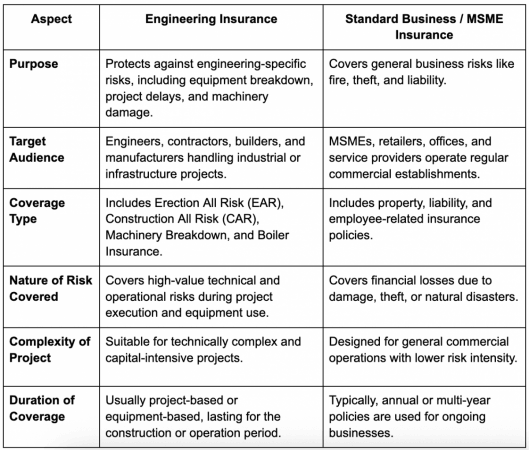

Key Differences Between Engineering Insurance and Standard Business Insurance

Though both types of insurance aim to safeguard financial interests, the core difference lies in what they cover and who they are designed for. Let’s break it down:

Why Engineering Businesses Need Specialised Coverage?

Engineering projects require precision, costly equipment, and skilled manpower, so even minor mishaps can result in significant losses or downtime. Regular MSME insurance may not fully cover these risks.

For example, a machinery breakdown during production or a damaged boiler at a manufacturing unit could halt operations and lead to significant repair costs. Companies like Bajaj General Insurance Limited offer engineering insurance that addresses risks such as machinery breakdowns, project delays, and third-party liabilities, helping businesses maintain continuity and manage unforeseen technical failures effectively.

How to Choose the Right Insurance for Business?

When deciding between engineering insurance and MSME insuranceconsider the nature of your business and the scale of operations:

- If your business involves the design, construction, or installation of engineering works, choose engineering insurance.

- If you run a retail shop, small factory, or service-based business, MSME insurance is a better fit.

- Evaluate your equipment’s value, potential project risks, and business continuity requirements.

- Always review the policy wording to understand inclusions, exclusions, and claim procedures.

- Consulting with a trusted insurance partner can help you customise the right coverage to meet your project or business needs.

Conclusion

The choice between engineering insurance and standard business insurance depends on your business type and risks. Engineering insurance safeguards high-value, complex projects against equipment failure, delays, and construction-related risks, while standard business insurance covers everyday operational risks for MSMEs. Understanding your operations and potential exposures helps ensure you choose the right coverage to protect your business and maintain continuity.

Disclaimer:

*Standard T&C Apply

Insurance is the subject matter of solicitation. For more details on benefits, exclusions, limitations, terms, and conditions, please read the sales brochure/policy wording carefully before concluding a sale.

Comments are closed.