Eternal-Backed Shiprocket Files Updated DRHP For INR 2,342 Cr IPO

The company’s proposed public listing will comprise a fresh issue of equity shares worth up to INR 1,100 Cr and an OFS component of up to INR 1,242.3 Cr

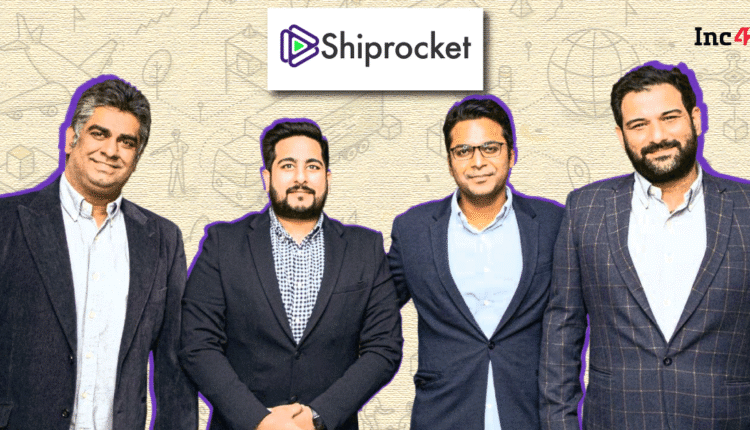

Cofounders Gautam Kapoor, Saahil Goel and Vishesh Khurana, along with institutional investors LR India Fund I, Arvind Ltd, Tribe Capital III among others will offload shares via the OFS

Shiprocket plans to use INR 505 Cr from the IPO proceeds for investments in its platforms, primarily for the emerging business and its core business

Ecommerce enablement company shiprocket has filed its updated draft red herring prospectus (UDRHP) with SEBI for INR 2,342.3 Cr IPO.

The company’s proposed public listing will comprise a fresh issue of equity shares worth up to INR 1,100 Cr and an offer-for-sale (OFS) component of up to INR 1,242.3 Cr.

Cofounders Gautam Kapoor, Saahil Goel and Vishesh Khurana, along with institutional investors LR India Fund I, Arvind Ltd, Tribe Capital III, MCP3 SPV LLC, and Bertelsmann Nederland B.V., will offload shares via the OFS.

Shiprocket plans to use INR 505 Cr from the IPO proceeds for investments in its platforms, primarily for the emerging business and its core business. Of this, INR 294 Cr will be deployed for marketing initiatives and INR 211 Cr will be set aside for strengthening technology infrastructure.

The company plans to use INR 210 Cr for debt repayment, while the remaining proceeds will go towards funding inorganic growth through unidentified acquisitions and general corporate purposes.

Cofounders Kapoor, Goel and Khurana together own a 10.69% stake in the company. Bertelsmann is the biggest shareholder with 21.32% stake, while Tribe Capital III owns 6.39% stake in the company. LR India Fund I and MCP3 SPV LLC own 4.40% and 4.50% stake, respectively. Zomato parent Eternal owns 6.85% stake in the company.

Shiprocket filed its confidential DRHP with SEBI in May and received the market regulator’s nod to float the IPO in November.

Founded in 2017 by Kapoor, Goel, Khurana and Akshay Ghulati, Shiprocket is a third-party logistics service provider that works with 17 courier partners such as Delhivery, FedEx, Aramex, Xpressbees, DTDC, Shadowfax, among others.

Over the years, Shiprocket has expanded beyond logistics into areas like cross-border shipping, payments, marketing tools, omnichannel commerce and credit for sellers.

The Delhi NCR-based company has raised about $400 Mn to date. It joined the unicorn club in 2022, after raising $33.5 Mn in a round led by Lightrock India.

The company managed to narrow its net loss by 88% to INR 74.5 Cr in FY25 from INR 595.2 Cr in the previous year. Its operating revenue grew 24% YoY to INR 1,632 Cr from INR 1,316 Cr in FY24.

In the first six months of FY26, Shiprocket’s net loss reduced 9.5% to INR 38.3 Cr from INR 42.3 Cr in the year-ago period. Operating revenue rose 15.4% to INR 942.7 Cr from INR 817 Cr in H1 FY25.

Comments are closed.