Exclusive: Unacademy’s Gaurav Munjal Issues Clarification On Changing ESOP Exercise Window

Gaurav Munjal said Unacademy is under M&A discussions at a similar valuation for an all-stock deal where there will be no cash involved

Munjal apologised for the early ESOP exercise window and said even his shareholding is half in ESOPs

Earlier reports said that Ronnie Screwvala’s upGrad was in advanced talks to acquire Unacademy for about $300 Mn

Unacademy Group CEO and cofounder Gaurav Munjal has issued a clarification on the controversy surrounding the edtech startup’s decision to reduce the ESOP exercise window to just 30 days from 10 days earlier.

In an internal note shared by Munjal and accessed by Inc42, the cofounder said that the decision was taken in the interest of the employees.

Here’s Munjal’s full statement:

“Yesterday evening, an official communication from the company went to exited employees asking them to exercise their options at a valuation of INR 2,650 Cr.

Since then, there has been some backlash on why this is being done.

I want to clarify this. Unacademy is under M&A discussions at a similar valuation for an all-stock deal where there will be no cash involved. This means that founders and investors are not getting any cash as a part of this deal.

Since the valuation is significantly lower than the money raised by Unacademy, which is over $800 Mn, shareholders have a right to apply liquidation preference, especially who came at a higher valuation and who will be losing money in an M&A at this valuation.

When liquidation preference is properly enforced, ESOPs effectively become zero. But we didn’t want that to happen. So we requested the board to figure out a way to ensure that employees can get shares in the company if there is a stock deal, even if it is at a lower valuation.

And this is why we asked exited employees to exercise their shares so that they can at least get common shares in Unacademy, and in case of an M&A, in the merged entity. This will ensure parity for exited employees with common shareholders. It is an attempt to ensure that all of our stakeholders (investors, shareholders, ESOP holders alike) are in a position where they all get a fair opportunity in their respective positions.

This is our best way to provide some value to their contributions to Unacademy. Else it would all go down to zero. Even my ESOPs which are almost half of my shareholding at Unacademy are in the same boat as yours.

This is not the outcome that we wanted, neither for investors nor for employees. As the CEO, I take full ownership, and I am sorry that this is happening. But I want to assure you that we tried our best to make sure that ESOPs don’t go to zero.”

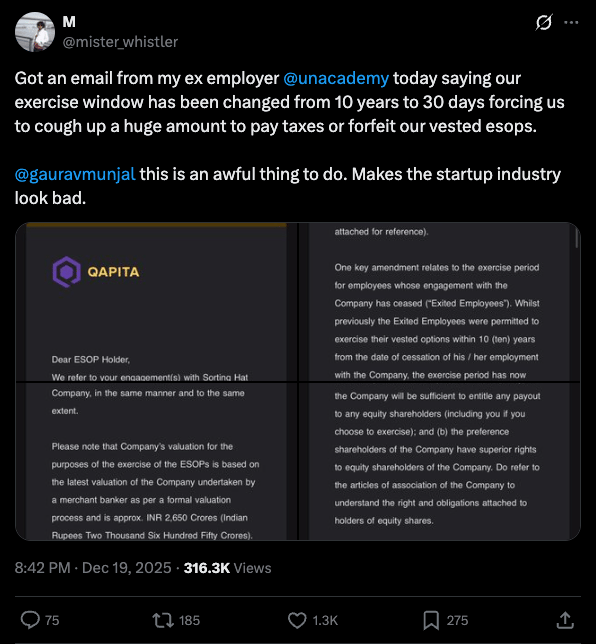

This comes a day after a former Unacademy employee took to X to announce the change in the ESOP exercise window. The former employee said that the move to reduce the window to 30 days would force employees “to cough up a huge amount to pay taxes or forfeit our vested ESOPs”.

Earlier this month, Munjal confirmed for the first time that Unacademy, once valued at $3.5 Bn, was in talks for merger and acquisition (M&A).

Over the past year or so, the startup has been said to be in acquisition talks with companies like Allen and upGrad. Most recently, the Ronnie Screwvala-led startup was reported to be in talks to acquire Unacademy for around $300 Mn.

Earlier this month, Munjal confirmed for the first time that Unacademy, once valued at $3.5 Bn, was in talks for merger and acquisition (M&A).

Over the past year or so, the startup has been said to be in acquisition talks with companies like Allen and upGrad. Most recently, the Ronnie Screwvala-led startup was reported to be in talks to acquire Unacademy for around $300 Mn.

Earlier this year, it was reported that Unacademy cofounders Roman Saini and Munjal exited the startup, which counts the likes of Tiger Global, Peak XV Partners, SoftBank, WaterBridge Ventures, and Meta among its backers.

Comments are closed.