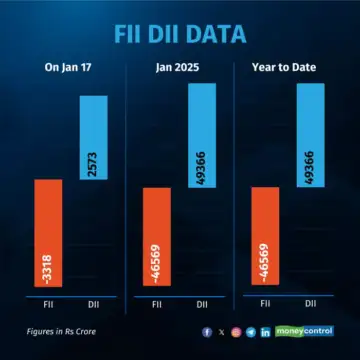

FIIs net selling shares worth Rs 3318 crore, DIIs net buying Rs 2573 crore – Read

On January 17, Domestic institutional investors (DIIs) bought shares worth Rs 2573 crore, while on the other hand, foreign institutional investors (FIIs) net sold shares worth Rs 3318 crore, provisional data from NSE showed.

During the trading session, DIIs bought Rs 12,497 crore and sold shares worth Rs 9,924 crore, and FIIs purchased Rs 10,486 crore in shares while offloading equities worth Rs 13,805 crore.

For the year so far, FIIs have net sold Rs 46,569 crore, while DIIs have net bought Rs 49,366 crore worth of shares.

Market View

At close, the Sensex was down 423.49 points or 0.55 percent at 76,619.33, and the Nifty was down 108.60 points or 0.47 percent at 23,203.20.

Infosys, Axis Bank, Shriram Finance, Kotak Mahindra Bank, Wipro were among major losers on the Nifty, while gainers included BPCL, Reliance Industries, Hindalco Industries, Nestle India and Hindalco Industries.

Among sectors, IT and Bank indices closed in the red while oil & gas, power, FMCG, PSU, capital goods, realty and metal indices gained.

According to Vinod Nair, Head of Research, Geojit Financial Services., “Declines in the banking and IT sectors negatively impacted large caps, causing domestic markets to end lower following a volatile session.” Nair added that a cautious outlook on discretionary spending led to a decline in IT stocks while private banking stocks declined due to expectations of subdued deposit and credit growth, as well as tighter liquidity conditions. “We expect investors to adopt a risk-averse stance on the ongoing Q3 results,” he said,

Comments are closed.