Honasa’s Latest Tryst, The Eggoz Controversy & More

From Mamaearth To Men’s Personal Care

Honasa seems determined to leave no corner of the personal care market untouched. The Mamaearth parent has now announced the acquisition of men’s grooming brand Reginald Men for INR 195 Cr. So, why is Honasa foraying into this new aisle?

Tapping Into The South: On paper, the logic is straightforward. Men’s personal care is projected to swell to become an INR 40,000 Cr market by 2032, and Honasa wants a stake in that upside. Reginald already derives nearly 80% of its sales from southern India, giving Honasa a ready-made fortress in a region where building scale from scratch would take years. With Honasa’s muscle, this stronghold can be transformed into a pan-India play.

The Reginald Thesis: The numbers only sweeten the story. In the first seven months of FY26, Reginald clocked close to INR 74 Cr in turnover, with a healthy 24% EBITDA margin. Honasa is effectively buying profitable growth and a clear line of sight to an incremental INR 500 Cr revenue opportunity by plugging Reginald into its distribution, marketing and formulation rails rather than rebuilding them.

The M&A Flywheel: Strategically, Reginald fits cleanly into Honasa’s “focus category” thesis. The men’s personal care brand makes sunscreens, moisturisers and serums, mirroring Honasa’s core growth engines. It also extends Honasa’s house of brands to new areas following the investment in Fang Oral Care and the launch of the premium Luminéve brand last quarter.

As Honasa races to bolt on more brands, can it keep integrating at this pace without stretching its systems, focus and brand equity too thin? Let’s find out…

From The Editor’s Desk

Eggoz In The Eye Of A Storm

- After a viral video claimed that a sample of Eggoz eggs contained cancer-linked minerals, the D2C brand has publicly rejected the allegations as misinformation.

- The startup shared its own report asserting there are “no banned materials, no pesticides, no heavy metals, and nothing harmful” in its eggs. It also promised an independent report by the weekend to counter consumer anxiety.

- Founded in 2017, Eggoz sources from poultry partners but controls feed and other inputs. It then sells its products via quick commerce platforms and offline stores. The startup clocked a revenue of INR 73.1 Cr in FY24 against a loss of INR 25 Cr.

The Age Of Agentic AI

- Through 2025, Indian enterprises moved from GenAI pilots to full-blown, multi-purpose AI agents running customer support, sales funnels, and operational back offices.

- Crucially, the conversation shifted from experimentation to RoI: CXOs are now asking how agents can cut costs more efficiently, lift conversions, or improve NPS. The fastest adoption is happening in processes where work is repetitive and regulation-heavy.

- Experts broadly agree that Indian BFSI is riding the strongest agentic AI tailwinds because the sector sits on complex workflows and rich data across lending, insurance, collections, and fraud prevention.

Fireside’s Evolving Consumer Thesis

- Last week, the consumer-focussed VC firm closed its fourth fund at $253 Mn. The new fund’s mandate is to double down on India’s 2030 consumer – a cohort that is experimental, aspirational, proudly regional and digitally native.

- Alongside, Fireside is sharpening its focus on ESG, AI-led personalisation and emerging categories like sports, fitness, wellness and travel, reflecting the fund’s belief that consumption is evolving faster than supply.

- In the past eight years, Fireside has become one of India’s biggest consumer-focussed VC firms, backing 60+ startups like boAt, The Ayurveda Experience and The Sleep Company. Together, its portfolio boasts a combined AUM of INR 5,300 Cr.

Inito Nets $29 Mn

- The health tech startup has raised INR 260 Cr in its Series B round led by Bertelsmann India Investments to build a broader at-home health diagnostics platform, powered by AI-engineered antibodies.

- Founded in 2015, the Bengaluru-based startup’s flagship fertility monitor lets women track key reproductive hormones in about 10 minutes, and offers personalised analytics and insights.

- With over 20 patents and a dataset of more than 30 Mn fertility hormone tests, Inito is now betting that its accumulated IP and data can be repurposed into new test categories and geographies to support global ambitions.

Infibeam To Embrace A New Identity

- The listed SaaS startup plans to rebrand itself as ‘AvenuesAI’, dropping the old name once regulatory approvals come through. This signals the company’s shift from a generic payments venture to an AI-led digital payments technology company.

- The company has framed the rebranding as a full-stack transformation, where AI will power “nearly every layer” of the value chain – from transaction authorisation and routing to fraud detection and platform architecture.

- This follows Infibeam earlier this year announcing a strategic portfolio alignment, positioning itself as a pure-play fintech and AI payments company while pushing subsidiary Rediff as the AI-first platform for commerce and content.

Inc42 Markets

Inc42 Startup Spotlight

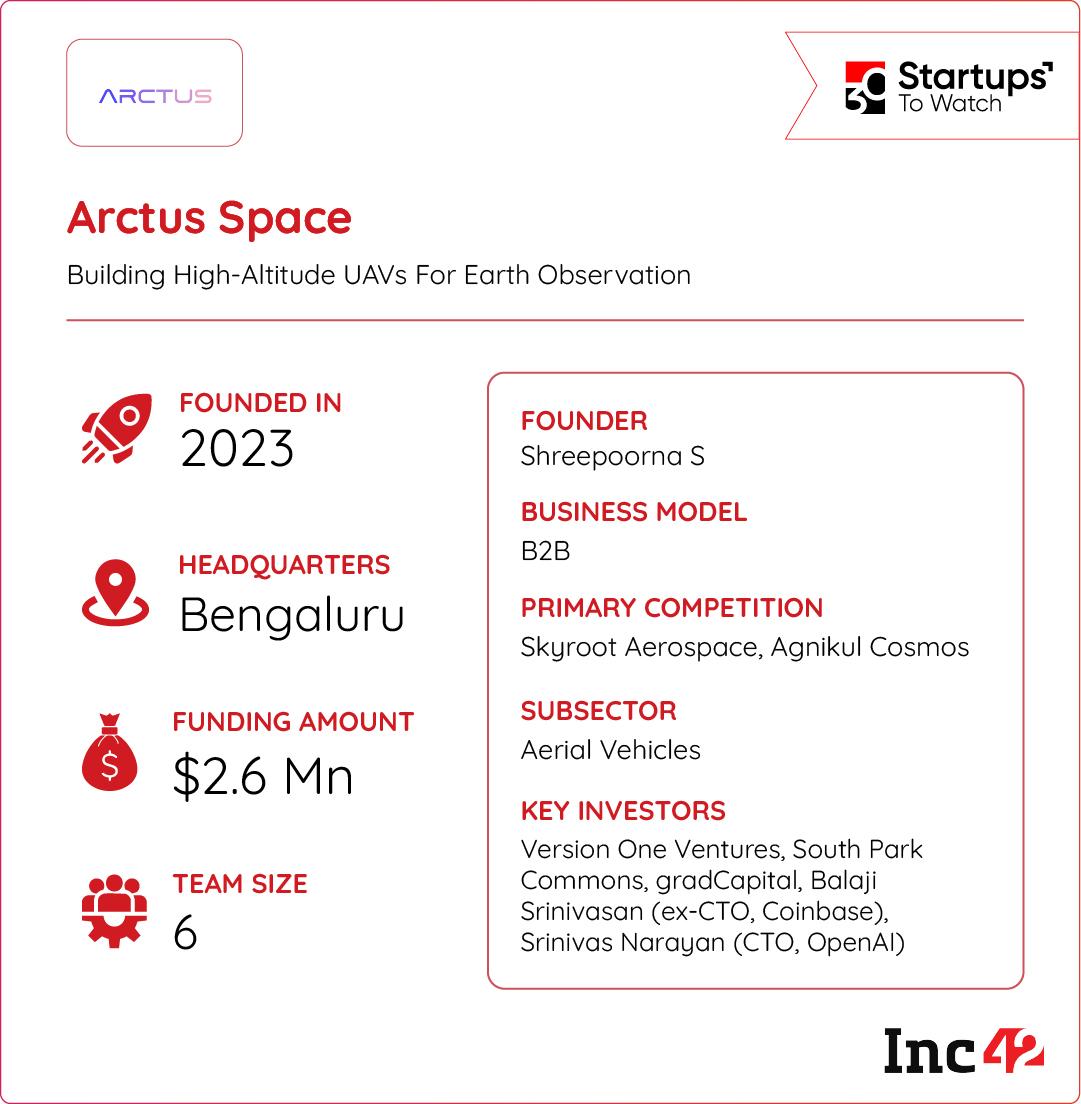

How Arctus Space Is Flying Where Satellites Can’t

Many critical sectors still depend on low-frequency satellite images that are routinely disrupted by clouds and weather patterns. This forces teams to work with incomplete or outdated data, leading to delayed decisions, operational inefficiencies and costly errors.

The High-Altitude Answer: Founded in 2024, Bengaluru-based Arctus Space is building medium-altitude, long-endurance UAVs designed specifically for commercial earth observation. These aircraft can fly at 45,000 feet for up to 24 hours, carrying payloads of up to 200 kgs to deliver high-frequency imaging that fills the gap between satellites and traditional drones.

AI-Powered Eyes In The Sky: Arctus combines its hardware advantage with an AI-powered data pipeline that turns raw imagery into actionable intelligence for crop-health tracking, infrastructure mapping and safety audits. The platform is built for industries that need continuous monitoring and real-time responsiveness, capabilities that traditional satellite constellations cannot economically provide at the high resolution and frequency.

Global Ambitions: With R&D and manufacturing already established in Bengaluru and expansion plans targeting North America, Europe, Australia and the Middle East, Arctus is eyeing a piece of the global earth observation market, which is projected to exceed $14 Bn by 2030. Can a year-old startup from India redefine how the world sees Earth from above?

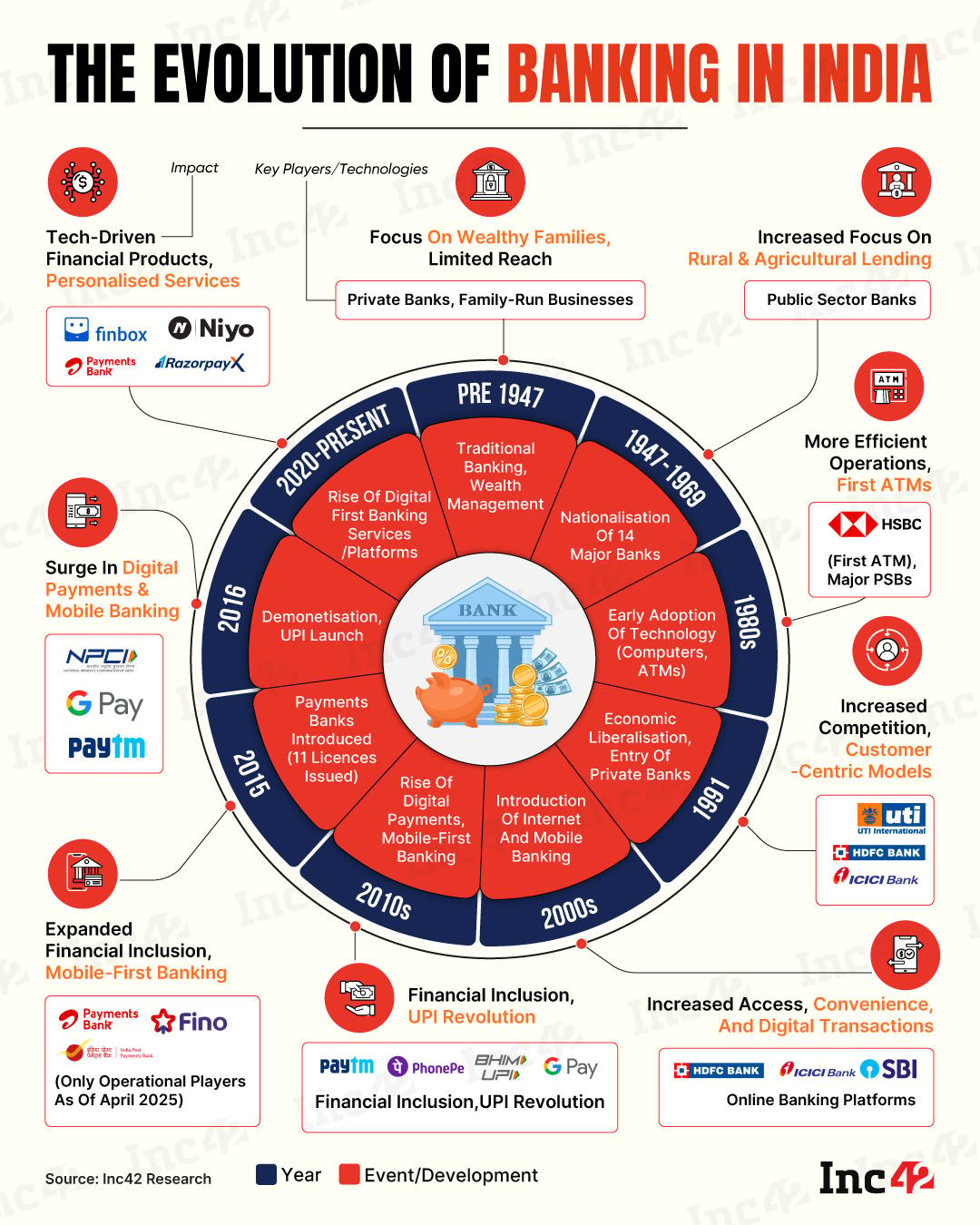

Infographic Of The Day

From traditional wealth-focussed institutions to today’s digital-first ecosystem, India’s banking system has transformed massively over the decades. Here’s how…

Comments are closed.