India & AI In 2025, Flipkart’s Desh Wapsi & More

Tracing India AI’s 2025 Journey

The year 2025 saw AI move from boardroom chatter to a business imperative. Startups and enterprises began embedding GenAI tools and copilots into core functions, unlocking tangible gains in efficiency and innovation. So, what shaped the Indian AI ecosystem’s journey this year?

Localising AI For India: After years of leaning on globally trained models, companies are now prioritising systems that understand India’s realities – local languages, patchy infrastructure and business realities. Multilingual AI shifted from nice-to-have to non-negotiable, and demand zoomed for AI platforms that work with limited internet.

In response, big tech giants expanded AI infrastructure and sovereign cloud capabilities in India, enabling local training, deployment and data residency.

GenAI Matures: Enterprises also moved away from force-fitting GenAI everywhere. Instead, they began layering classic AI, domain-specific models and GenAI more thoughtfully based on use case, risk and cost. Organisations became sharper about where GenAI truly adds value, especially given its propensity to hallucinate and higher compute costs.

The Next Frontier: Agentic AI emerged as the next big theme. Interest is high, but adoption remains a concern. Real scale is rare as organisations hesitate to hand over end-to-end processes to autonomous agents. However, smaller startups, with fewer legacy constraints, are pulling ahead by redesigning workflows and capturing early efficiency gains.

Surface-Level Adoption? Despite growing experimentation, genuine enterprise-wide integration is yet to materialise. Fragmented data, legacy systems, internal resistance, limited AI literacy and weak governance continue to slow progress.

The Risk Factors: Meanwhile, AI risk is rising faster than governance. Control and audit structures remain uneven, and companies are already encountering inaccurate outputs and incomplete analysis in high-stakes areas like underwriting, fraud detection and compliance.

As AI moves deeper into mission-critical decisions, can Indian enterprises marry bold experimentation with the discipline needed to turn AI into a true operating layer? Let’s find out…

From The Editor’s Desk

🚚 Flipkart Flips Back To India

- The ecommerce unicorn has received in-principle nod from the National Company Law Tribunal to shift its domicile back to India. Under this, the company will merge its Singapore-based subsidiaries into local entities.

- The approval clears a major regulatory hurdle for the ecommerce giant’s anticipated IPO next year, though the scheme remains conditional on final approval from Singapore authorities.

- Flipkart’s decision to reverse flip mirrors the path taken by other new-age tech giants like Groww and Meesho, both of which redomiciled to India before going public earlier this year.

💰 Atomberg Eyes INR 40 Cr

- The home appliances startup is in talks to raise $4.8 Mn in secondary capital. The round, which is expected to close within weeks, will value the startup at around INR 5,000 Cr.

- Early backer A91 Partners will dilute its stake in the round, while cofounders will sell shares worth about INR 12 Cr.

- Founded in 2012, Atomberg sells home appliances like fans, mixer grinders, water purifiers and others. The startup is eyeing a public listing by Q4 FY27, with plans to file its DRHP with SEBI by July 2026 for an up to INR 2,000 Cr IPO.

🔔 Wakefit’s Muted D-Street Debut

- The D2C mattress brand’s shares made an underwhelming debut on the bourses, listing at INR 194.10 on the BSE against the issue price of INR 195. On the NSE, Wakefit shares listed flat at INR 195 apiece.

- Wakefit’s public issue was oversubscribed 2.5X, suggesting that retail enthusiasm during subscription didn’t translate to post-listing buying momentum. With Meesho and Aequs already listed this month, the damp listing also suggests market fatigue.

- The startup’s IPO comprised a fresh issue of shares worth INR 377.2 Cr and an offer for sale component of 4.68 Cr shares.

📊 Scapia’s Mixed FY25

- The travel-focussed fintech startup saw its operating revenue surge 71% YoY to INR 28.7 Cr in FY25, signalling strong traction. Yet, net losses declined a mere 6% YoY to INR 83 Cr during the fiscal year under review.

- Total expenditure rose 10% YoY to INR 123.4 Cr, roughly 4X its annual revenue, indicating that customer acquisition costs and operational expenses remained high despite cost discipline efforts.

- Founded in 2022, Scapia offers co-branded travel credit cards with Federal Bank. It also operates a booking platform for flights and hotels. The startup uses the card as a top-of-funnel acquisition tool to feed a broader travel ecosystem monetisation play.

🚀 Sisir Radar Takes Off With $7 Mn Funding

- The spacetech startup has raised INR 63.5 Cr in its Series A round led by 360 ONE Asset and Shastra VC to expand its workforce and launch an L-band synthetic aperture radar (SAR) satellite by 2026.

- Founded in 2022, Sisir Radar offers cutting-edge SAR systems for both air-borne and space-borne platforms. Its orbital system is capable of delivering 0.75-metre resolution imaging that works through clouds, rain, darkness and forest cover.

- This comes as the Indian spacetech ecosystem is projected to become a $77 Bn market opportunity by 2030, driven by policy push, growing deeptech corpus, defence applications and commercial space missions.

Inc42 Markets

Inc42 Startup Spotlight

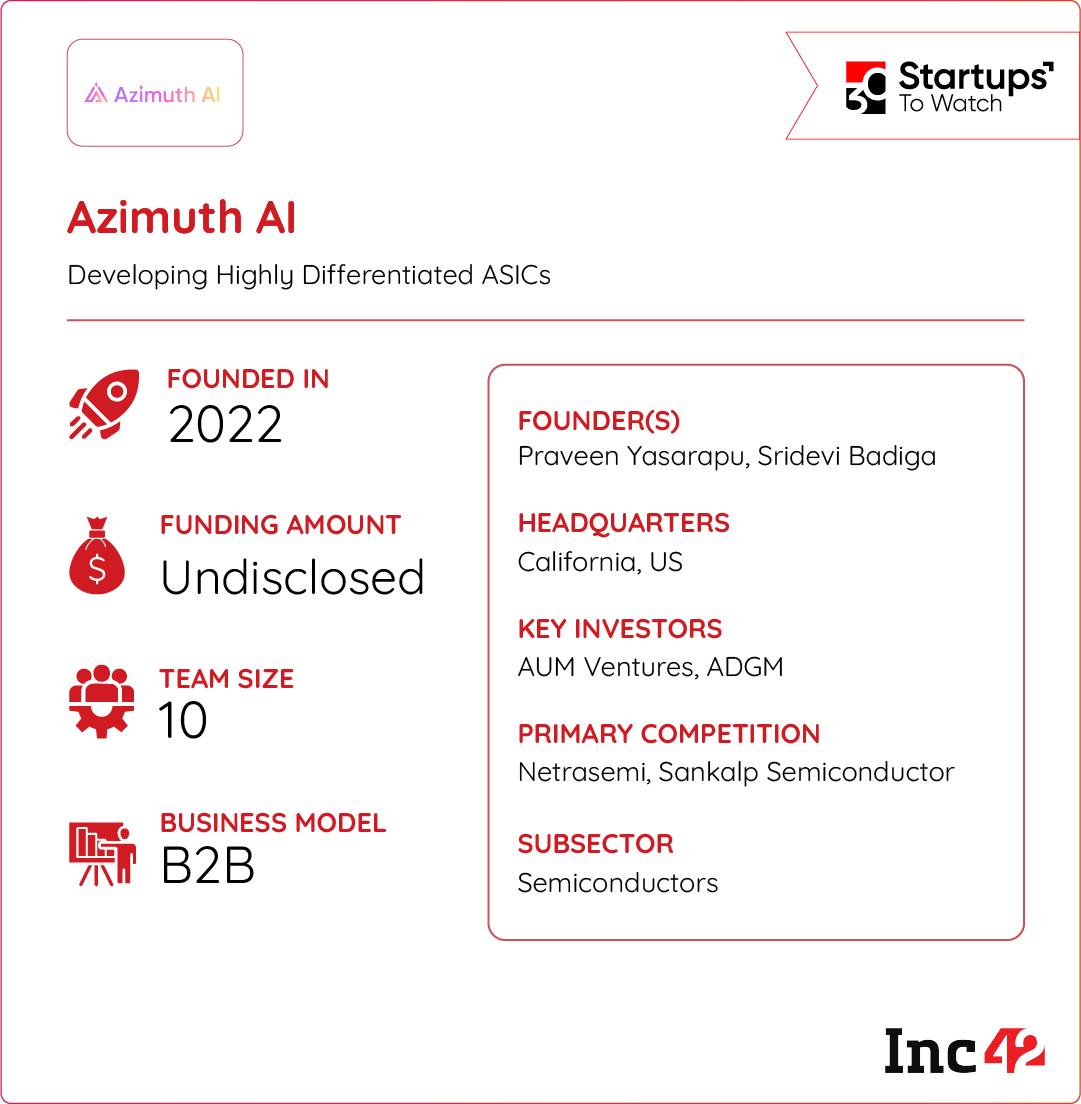

How Azimuth Is Making Power-Efficient Chips

Running complex AI workloads demands high-performance chips. However, existing solutions either consume too much power or lack the specialised compute needed for real-time industrial and energy applications. Trying to solve this problem is Azimuth AI.

Custom-Made Chips: Founded in 2022, Azimuth AI builds application-specific integrated circuits (ASICs) optimised for edge AI and low-power operation. Its tailor-made chips utilise software-defined architectures to deliver high inference performance while keeping energy consumption minimal.

Azimuth Charges Up: In partnership with Cyient Semiconductors, the startup recently launched ARKA GKT-1, a platform-on-a-chip designed for edge intelligence in the energy and utilities sector. The offering combines high-performance inference with power efficiency, addressing a critical gap in industrial edge deployments.

Scaling Custom Silicon: With its approach, Azimuth is targeting markets that require robust on-device compute, like smart utilities, energy management, and battery systems, where cloud dependency or frequent recharging isn’t viable. Overall, the startup is eyeing a piece of the ASIC-based edge accelerators market, which is projected to hit $9.28 Bn by 2030.

As India pushes deeper into local AI infrastructure, can Azimuth rule the global ASICs market?

Infographic Of The Day

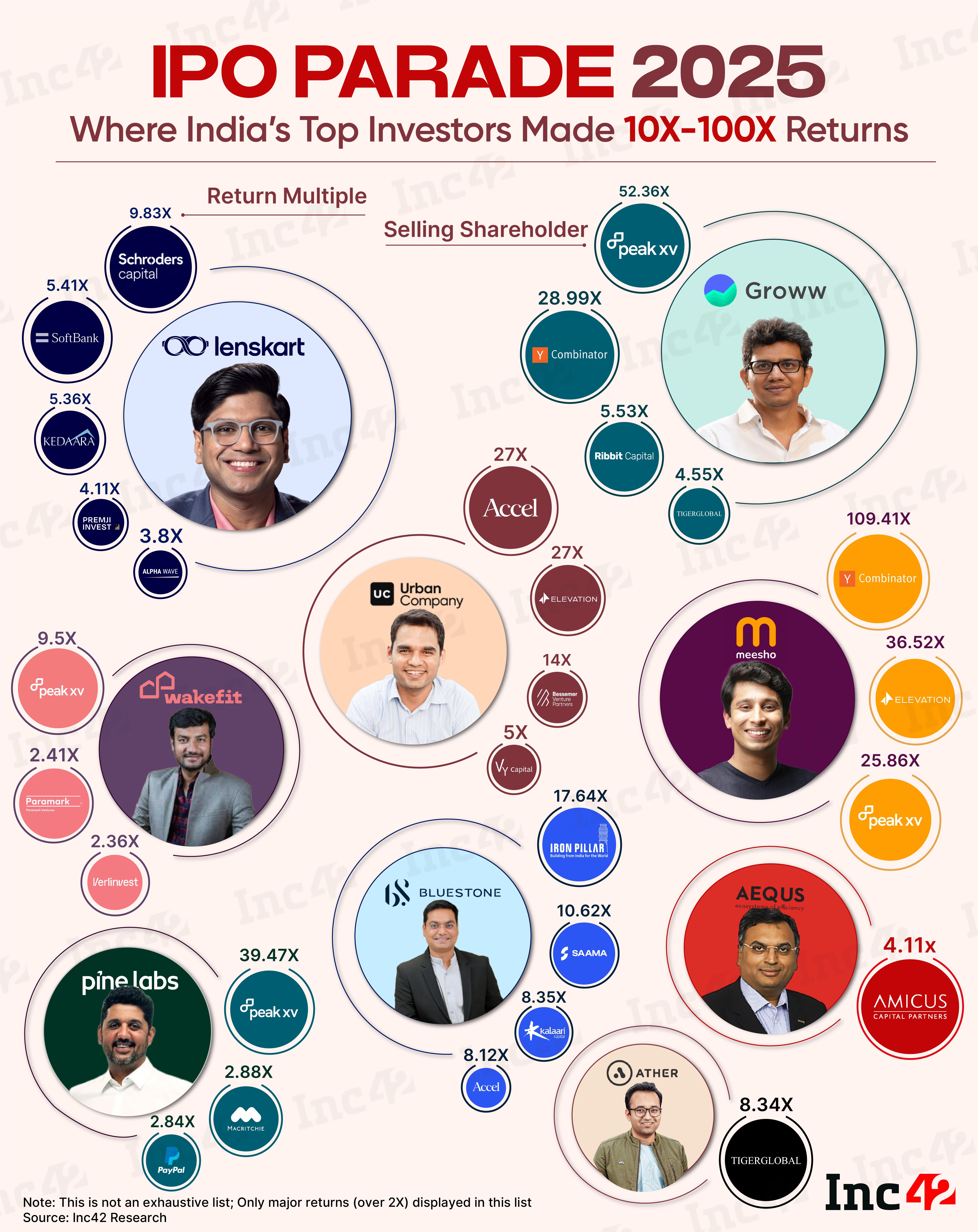

In 2025, as many as 18 homegrown startups went public, collectively raising nearly INR 33,000 Cr and delivering landmark returns for early backers. So, which VCs cashed in on the startup IPO mania?

Comments are closed.