Indian market needs domestic investors now more than ever – Read

The Indian equity market’s reliance on has never been greater as unabated and rising global volatility dent the appeal of local shares.

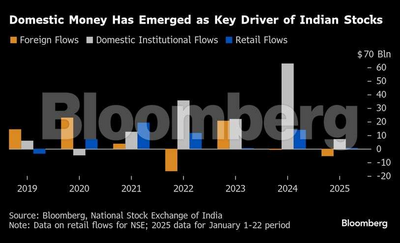

Global investors have pulled out $6 billion from Indian stocks this month, pushing the toward its worst start in nine years. Domestic institutions and remained buyers, with net purchases touching $8 billion during the period, further strengthening their position as the key driver of the market.

Local investors’ faith in the nation’s equities is crucial as the market risks losing its luster after nine straight years of gains. They are providing a cushion to Indian equities at a time when lofty valuations, slowing and heightened uncertainties under Donald Trump’s presidency make global flows volatile.

“Domestic flows are supporting India’s equity valuations and have become the bedrock of the market,” said Kunal Vora, India strategist at BNP Paribas SA. Local money has ensured large supply coming to market during the years of fairly strong foreign selling and will be “extremely important” this year, he said.

A greater participation of , insurance firms and retail investors in the Indian stock market has made India one of the top five markets globally despite waning ownership of foreigners.

Inflows into recurring plans offered by mutual funds emerged as key support for the market. The sustained weakness in Indian equities will test their resilience over the next few months, according to analysts at Citigroup Inc.

Comments are closed.