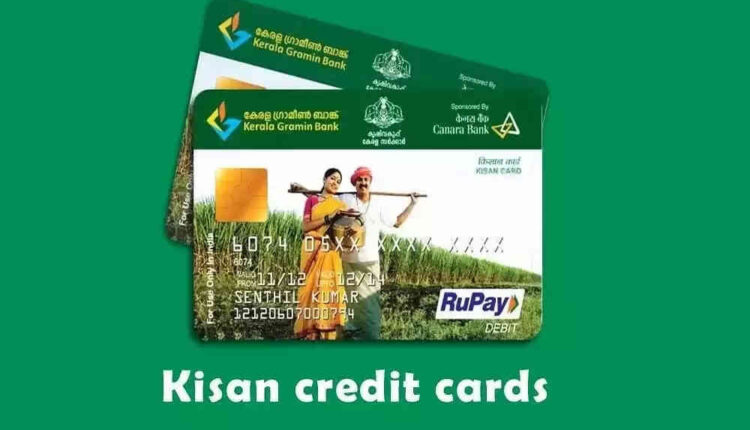

Kisan Credit Card (KCC) Scheme: Easy loan facility for farmers

Kisan Credit Card (KCC) Scheme: Kisan Credit Card (KCC) Scheme is an important scheme of the Government of India, the objective of which is to provide easy, cheap and timely loans to the farmers for their farming needs. This scheme was started to save farmers from moneylenders and expensive loans. Through KCC, farmers can easily meet the expenses of seeds, fertilizers, pesticides, irrigation and other agricultural expenses.

What is KCC scheme?

Kisan Credit Card is a kind of credit facility, under which farmers are given loan from the bank as per their land, crop and need. Farmers can take this loan through card and can withdraw or deposit money as and when required. Due to this, farmers do not need to go to the bank again and again.

Main benefits of KCC scheme

The biggest advantage of this scheme is that farmers get loans at low interest rates. Further rebate in interest is also given if the loan is repaid on time. Apart from this, the farmer also gets insurance protection in case of crop failure or natural disaster, which reduces his risk. Under KCC, farmers can take loans not only for farming but also for expenses related to animal husbandry, dairy and fisheries.

Who can take benefit of KCC?

Those farmers who:

- do farming or are agricultural laborers

- Those who own or rent farming land

- Farmers involved in animal husbandry, dairy or fish farming

- The government has further simplified this scheme keeping in mind the small and marginal farmers.

How to apply for KCC?

For Farmer KCC:

- by visiting your nearest bank branch

- By submitting necessary documents like identity card, land related documents and photo.

- You can fill the application form

- After completion of investigation, the bank issues Kisan Credit Card to the farmer.

Importance of KCC scheme in 2025

Due to increasing cost of farming in 2025, KCC scheme has become even more important for farmers. This scheme is helping farmers to strengthen farming by providing them financial security, timely funds and low interest loans.

conclusion

Kisan Credit Card Scheme is a reliable and beneficial scheme for farmers. It not only simplifies farming expenses but also makes farmers financially self-reliant. If farmers use this scheme properly, they can improve their farming and avoid the burden of debt.

- Gold Price Today: There was no major change in gold prices today, investors heaved a sigh of relief.

- PM Kisan Yojana: Rs 2000 will come to the accounts of farmers before Diwali and Chhath, know the complete update related to the installment.

- Gold Price Today: Gold’s shine has faded a bit, see the latest rates of 18K, 22K and 24K

Comments are closed.