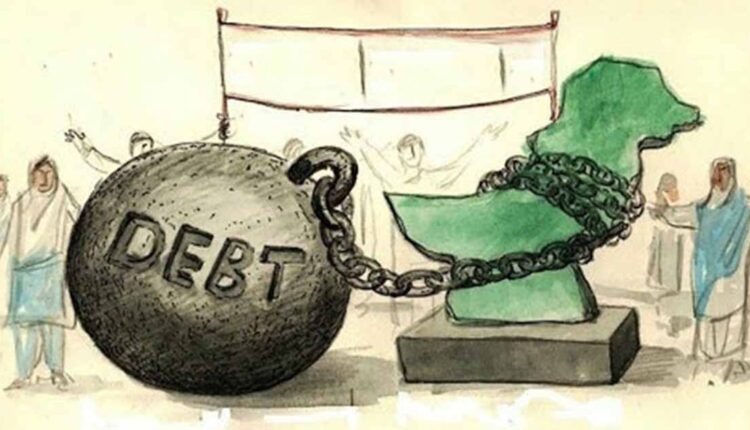

Pakistan Financial Crisis: Pakistan overwhelmed by debt; In 20 months, loans of “so much” billion rupees were taken

- Pakistan’s growing debt crisis

- 20 billion new loans are taken every day

- Pakistan’s total debt is Rs 76,979 billion

Pakistan Financial Crisis: Pakistan has a mountain of debt. In 20 months of Shahbaz government, as many as 76,979 billion rupees have been borrowed. These shocking statistics clearly revealed the fragile economic situation of the country. According to government data, Pakistan’s total debt increased by Rs 12,169 billion between March 2024 and October 2025. That is, Pakistan is borrowing an average of Rs 20 billion per day. According to data provided by the State Bank of Pakistan, the government’s domestic debt increased by Rs 11,300 billion during this period, while external debt increased by Rs 869 billion. As of October 2025, Pakistan’s total debt has risen to Rs 76,979 billion, up from Rs 64,810 billion in February 2024.

Also read: NCDEX Update: There will be a big expansion of NCDEX! SEBI Approval for Mutual Fund Platform

Debt was Rs 42,675 billion in February 2024, which has increased to Rs 53,975 billion by October 2025. External debt, which was Rs 22,134 billion in February 2024, has crossed Rs 23,000 billion by October 2025. A rapid increase in domestic debt is likely to further increase pressure on inflation, interest rates and budgetary leverage. Meanwhile, the International Monetary Fund (IMF) once again approved a new loan of $1.2 billion to debt-ridden Pakistan. However, strict conditions are also attached with these loans.

The IMF accepted conditions for Pakistan to increase tax collection, reduce government spending and speed up the privatization of loss-making state-owned companies. However, according to the current statistics, it is seen that the economy of Pakistan cannot stabilize on its own strength. The World Bank has included Pakistan in the list of countries where external debt service pressure is increasing rapidly. In the current scenario, the biggest challenge facing Pakistan is to implement economic reforms while managing the debt burden, otherwise the crisis may worsen in the future.

Also read: India’s Exports News: New market, new opportunity! 19.37% increase in Indian exports; Indian goods are also in demand

The World Bank’s International Debt Report 2025 also reveals that the financial situation for Pakistan is worrisome. According to the report, Pakistan has taken external debt of approximately $130 billion. However, approximately 40 percent of the country’s export earnings are being spent on debt repayment alone. According to the report, 49 percent of Pakistan’s debt is from multilateral institutions, of which 18 percent is from the World Bank and 16 percent from the Asian Development Bank (ADB). Meanwhile, 43 percent of loans were taken from bilateral countries, with China alone accounting for 23 percent. In addition, 5 percent was borrowed from Saudi Arabia and approximately 8 percent from private lenders.

Comments are closed.