Quick Commerce In 2026, Layoffs At Yellow.ai & More

What Lies Ahead For Quick Commerce?

As 2025 draws to a close, India’s quick commerce giants stand armed and ready. Buoyed by proven demand and abundant capitalthe year saw rivals expand rapidly to cater to India’s hunger for 10-minute deliveries. But as we step into 2026, what will be the key trends that will dominate this chatter next year?

Scale Is The Real Moat: The coming year will see quick commerce giants add another 2,000-2,500 new dark stores, targeting only markets with strong order density and easy warehousing. Analysts see 2026 as the last real window to build defensible scale, adding that players delaying infra capex will never catch up.

Swiggy Vs Zepto: Blinkit is unlikely to relinquish its lead in 2026, but the race for the second spot will intensify between Swiggy Instamart and Zepto. Amazon, with a strong logistics backbone, could become a big challenger if it matches speed and reliability. Customer retention, subscriptions and selective discounting will define this fierce contest.

The New GMV Engine: In 2026, non-grocery categories such as personal care, toys and small appliances are expected to replace groceries as the primary GMV driver. Higher margins and impulse demand will turn quick commerce into a lifestyle habit, with festivals only amplifying the trend.

Private Label Bet: Private labels will remain strategic but limited, contributing a mere 5–10% of the GMV for quick commerce giants. Companies will rather focus on low-loyalty niches like gifting and ready-to-eat meals to capture incremental spend and expand margins.

Vertical Consolidation: The upcoming year will also likely see vertical quick commerce players in fashion, premium grocery and babycare either grow into category leaders or get acquired. The next two years will see consolidation, with smaller startups juggling innovation, scale and tough unit economics.

But the real question is: who will scale without breaking the quick commerce maths? Let’s find out…

From The Editor’s Desk

✂️ Yellow.ai Axes 100 Jobs

- The conversational AI startup has laid off over 100 employees, impacting about 30% of its total workforce. The job cuts, which were carried out in multiple phases, largely affected the company’s engineering and product teams.

- The startup attributed the layoffs to AI-led automation. It claimed that it has realigned its team to focus on skills needed for agentic AI, thereby reducing roles tied to legacy models.

- Founded in 2015, the startup pivoted to a GenAI-led customer service automation platform in 2021. The company claims to automate more than 16 Bn conversations annually for its 1,100 clients.

⛔ Startup Shutdowns In 2025

- The year saw a record 25 startup shutdowns, doubling from 12 in 2024. This spike reflects the brutal reality of a capital-starved ecosystem, with most closures tied to failed fundraising attempts.

- While startups like subtl.ai, BharatAgri, Blip and Otipy closed after multiple failed attempts to raise capital, late stage players like BluSmart and The Good Glamm Group shut down due to operational failures.

- The pain was sector-agnostic, but enterprise tech and AI were hit the hardest, followed by consumer services, mobility, and fintech.

🔔 Tonbo Files DRHP For OFS-Only IPO

- The defence tech startup has filed its draft IPO papers with SEBI for a public issue, which will consist solely of an OFS of up to 1.81 Cr equity shares. The listing is expected to be in the range of INR 800 Cr to INR 1,000 Cr.

- Founded in 2012, Tonbo Imaging builds advanced imaging and battlefield systems for militaries globally. Its clients include the Indian armed forces, NATO, US Navy SEALs, Israeli defence forces and other global OEMs.

- On the financial front, the startup reported a consolidated net profit of INR 5.4 Cr in Q1 FY26 against a top line of INR 68.7 Cr. It clocked a revenue of INR 469.1 Cr in FY25 against a profit of INR 72.8 Cr.

📈 Paytm’s UPI Share Improves

- The fintech major’s UPI market share improved further to 7.7% in November, processing 154.6 Cr transactions worth INR 1.64 Lakh Cr. This marks a marginal but consistent climb since January 2025, when it started with a 6.9% share.

- Despite the gains, it remains in the third place. However, among new entrants, Navi saw its market share climb to 3% with 60.9 Cr transactions, while BHIM UPI reached 0.7% with 14.1 Cr transactions.

- Overall, UPI transaction volume dipped to 2,047 Cr in November from 2,070 Cr in October. PhonePe retained the top spot with 46.15% share, while Google Pay slipped to 34.80%. Both saw small declines amid the sector-wide slowdown.

💰 CoreEL Technologies Bags Big Bucks

- The defence tech company has raised $30 Mn in its Series B round led by ValueQuest to scale its manufacturing capacity, boost R&D and bid for large aerospace programmes globally.

- Founded in 1999, CoreEL supplies system-level products and specialised electronic modules for defence applications. It also designs and manufactures systems for radar, avionics, electronic warfare and secure data links.

- This comes as India’s defence tech ecosystem is seeing renewed investor interest, with startups in the sector raising over $430 Mn in H1 2025.

Inc42 Markets

Inc42 Startup Spotlight

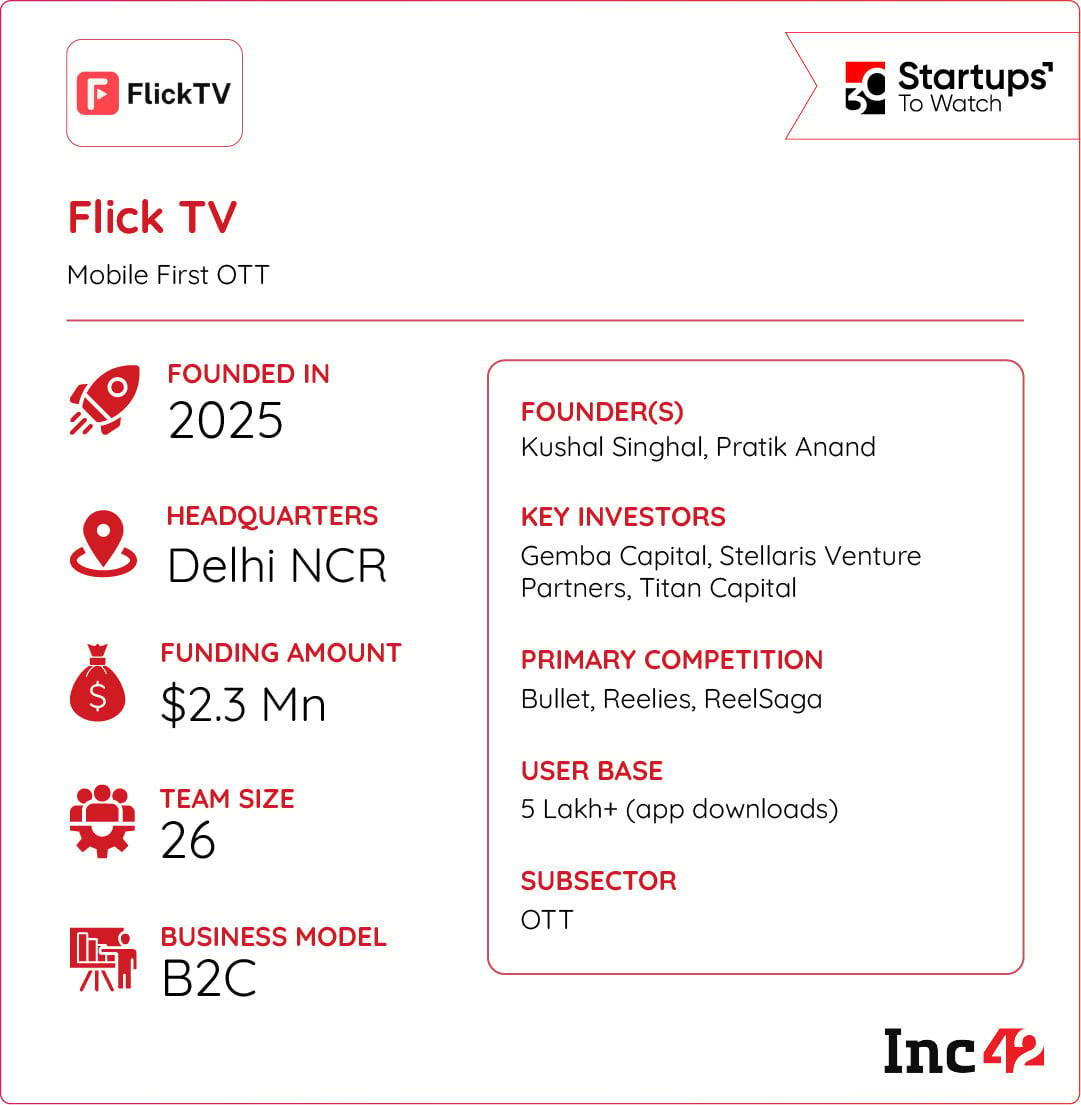

Can Flick TV Fix OTT’s Discovery Problem?

India’s streaming audience juggles multiple OTTs, scrolls endlessly, and still struggles to find engaging content. At the same time, smaller creators continue getting buried in a crowded ecosystem where visibility depends more on virality than quality.

A Creator-First Bet: Founded in 2025, Flick TV is building a creator-first microdrama platform that sits between OTT and social video. The startup focusses on high-quality, mobile-first content that blends professional production with a curated creator marketplace.

Creators can publish, monetise, and build audiences without being at the mercy of traditional social media algorithms, giving them more control over their work and revenue.

Making Curation Sharper: Flick TV uses its own recommendation engine that factors in behavioural signals and mood-based cues to reduce discovery fatigue and deliver more personalised content. By combining curated storytelling with a creator-friendly model, the platform aims to solve the twin problems of viewer fatigue and creator invisibility.

Microdrama Mania: The Delhi NCR-based startup is eyeing a piece of the growing microdrama segment, which is projected to become a $5 Bn opportunity in the next five years. With so much headroom, can Flick TV become India’s go-to destination for bingeable micro-stories?

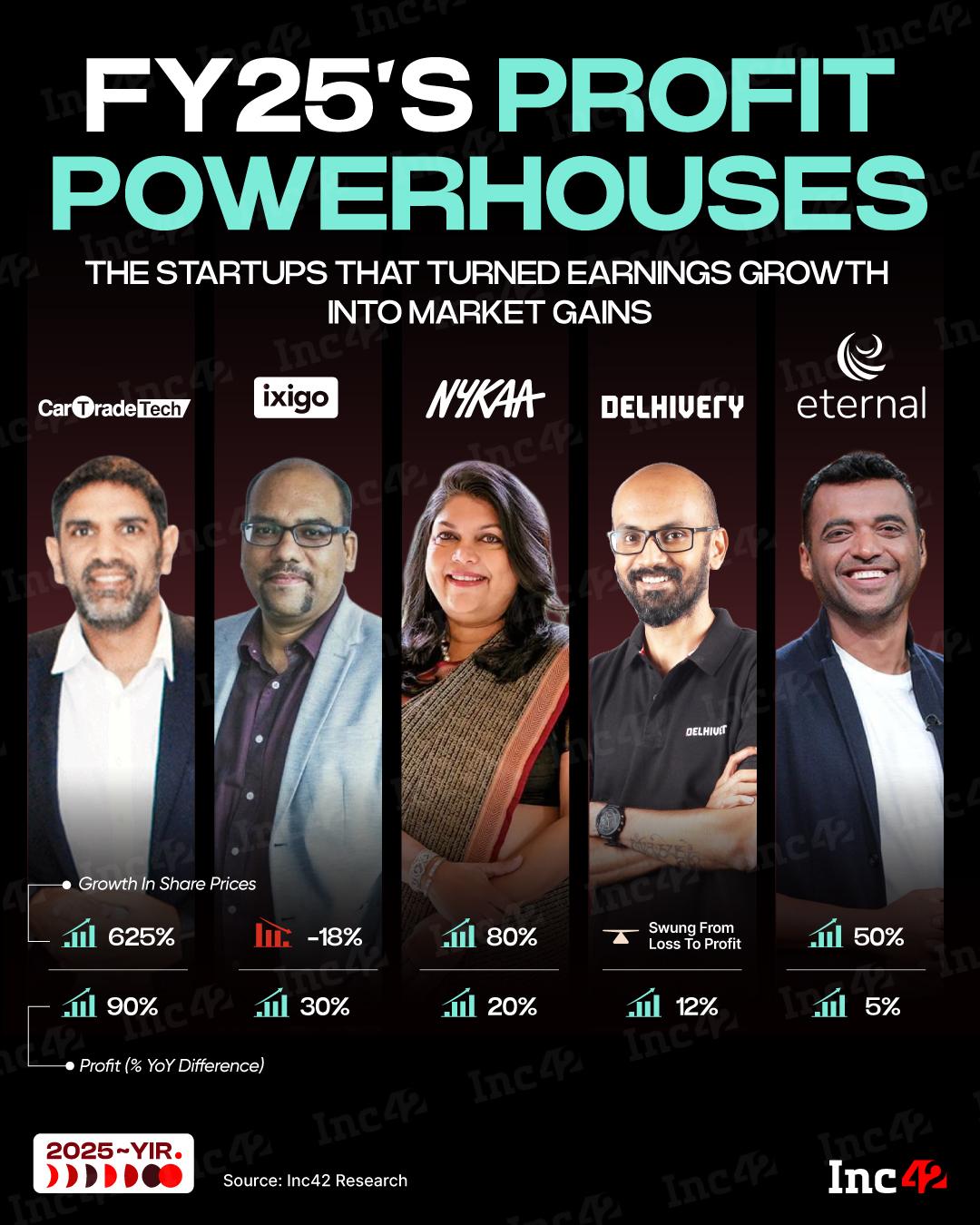

Infographic Of The Day

Profit wasn’t just a metric in FY25 — it became the strategy for listed new-age tech companies. Here’s a look at the startup stocks that made profitability count in FY25.

Comments are closed.