Singapore billionaire Kwek Leng Beng’s family feud among VnExpress International’s five most-read business stories in 2025

1. Kwek Leng Beng family feud

As one of the 10 richest individuals in Singapore, Kwek Leng Beng has captured the public’s attention this year with a drama involving his son, Sherman, surrounding the question of who would lead the property developer City Developments Limited (CDL) and its business empire.

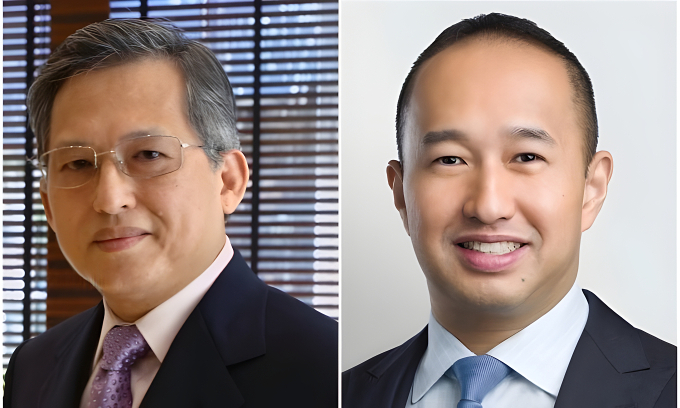

Kwek Leng Beng (L), executive chairman of City Developments Limited, and Sherman Kwek, group CEO of the company. Photo courtesy of Reuters, City Developments Limited |

The saga began with Leng Beng, CDL’s executive chairman, filing a lawsuit in late February against Sherman, the group’s CEO.

The billionaire alleged that his son and several other directors had circumvented the company’s nomination committee to reshape the board and push through wide-ranging governance changes in what was described as an “attempted coup” aimed at consolidating control of the company.

The dispute stemmed from Sherman’s earlier move to appoint two new independent directors to the board, despite objections from his father. Leng Beng sought to overturn his son’s decisions and remove him from the CEO chair.

The conflict soon spilled into the public arena, with Sherman attributing responsibility to Catherine Wu, a long-time adviser to his father and to CDL’s hotel business.

He accused her of interfering in matters “well beyond her scope” and said her influence should be curtailed.

The legal battle, however, ended abruptly in mid-March when Leng Beng withdrew the lawsuit, saying all directors had agreed to move past the episode. Wu had stepped down from her advisory role a few days earlier.

Sherman said in August that succession plans for the chairman’s role remain “fluid,” noting that any decision would also hinge on discussions with shareholders and the board.

At the same briefing, Leng Beng said: “As far as the succession plan is concerned, the past is over.

“We look forward to the future with strength, tenacity … I am always looking forward, and this should be the case,” he said, as quoted by Channel News Asia.

Despite the boardroom feud, Leng Beng’s net worth is estimated at $4.7 billion Wednesday, a new historic peak. He is now the 8th richest person in Singapore.

2. Gold price surge

Global gold prices repeatedly climbed to new levels this year, driven by uncertainties in trade policies and geopolitical conflicts.

Spot gold soared past the 2024 records early in the year, reaching $2,946 per ounce in February amid tariff concerns, and surpassing $3,288 in April.

It touched the landmark level of $4,000 in October and this month reached a new peak of $4,549. By the last day of the year gold has risen 64%.

Gold’s rally this year has been driven by rate cuts and bets of further monetary easing by the U.S. Federal Reserve, robust demand from central banks and rising holdings in exchange-traded funds, Reuters reported.

“Maybe towards the end of the first quarter of 2026, we could see gold test $5,000. Certainly, it seems like the sort of catalysts animating gold, especially over the course of the past year, have become self-sustaining,” Ilya Spivak, head of global macro at Tastylive, said.

|

People queue to buy gold outside a store in Hanoi on Oct. 17, 2025. Photo by VnExpress/Hoang Giang |

Silver has gained over 140% year-to-date, far outpacing gold, and is set for its best year ever.

The global surge of precious metals have pushed up gold prices in Vietnam. Saigon Jewelry Company gold bar closed the year at VND152.8 million per tael, up 81%.

3. Legacy of Honey

City leaders, business figures, and local residents in April gathered to honor Lee Shau Kee, the former second-richest man in Hong Kong, who died in March at 97.

The founder of Henderson Land Development, with a net worth of $30 billion, began to invest heavily in real estate in 1958 when he noticed wave of migration and rising housing demand in Hong Kong.

|

Lee Shau Kee, Chairman of Henderson Land Development, attends an event in Hong Kong, China, 26 June 2009. Photo by Imaginechina via AFP |

Lee broke the market norms of selling whole homes by introducing the option to buy individual floors and pay in installments. This strategy allowed his company to sell properties quickly and expand its operations.

During the turbulent 1960s and 70s, Hong Kong’s property prices plunged to just 10% of their previous value, the stock market nearly collapsed, and the global oil crisis further strained the real estate sector.

Amid the turmoil, Lee spent big to buy low-cost land and founded Henderson Land Development.

Under his leadership, Henderson grew from owning just over 20 properties to more than 100 within a few years. Among them was the city’s landmark International Finance Centre. He later expanded into several other sectors, including hospitality, retail, finance and energy.

He became the world’s fourth wealthiest individual by 1996.

Recalling this period, Lee said: “Only by remaining composed during a crisis can you seize the right opportunities.”

“As long as you choose the right direction and stay on the right path, you can easily become rich. If you choose to farm, then just keep working hard at farming.”

The tycoon generously shared his wealth to support those in need and fund schools and hospitals. His philanthropic efforts also focused on education, especially in providing opportunities to underprivileged students.

4. Malaysia durian tree crackdown

The Malaysian government cut down at least 4,000 durian trees this year, claiming that they were illegally grown on state-controlled land, despite farmers’ protests.

Authorities in a district of Pahang – a major durian-growing state – began destroying durian orchards on April 8, with 1,000 trees cut down within days. The destruction continued in July an d August when 3,000 trees were felled.

|

A durian is seen at a shop in Kuala Lumpur, Malaysia, on July 8, 2020. Photo by AFP |

The trees, ranging from three to 40 years old, were cut down during an operation aimed at tackling land encroachment in Raub district. The operation spans about 250 hectares, with other fruit trees such as rambutan and mangosteen also included in the destruction.

The crackdown followed a call from Pahang’s Sultan Abdullah Ahmad Shah for swift action to stop illegal land occupation across the state.

Local authorities said that the area has become known for unlawful fruit tree planting, with local residents believed to be responsible.

Raub, known as Malaysia’s durian capital and dubbed “Musang King Durian Town,” boasts around 150,000 durian trees sprawling across 2,000 hectares of state land.

Farmers have voiced protests. The Save Musang King Alliance claimed that court violations and ancestral rights allowed farmers to grow the trees. Some farmers even blocked roads to protect their farms and gathered 400 signatures to cease the destruction campaign.

But eventually they did not get to keep the land.

Pahang Forestry Department director Zainuddin Jamaluddin said in August: “The farmers have complied with the department’s firm action to destroy the trees illegally grown on encroached land,” according to The New Straits Times.

5. U.S.- China trade war

The U.S.-China trade war was reignited this year under President Donald Trump’s second term, escalating from initial fentanyl-related tariffs to tit-for-tat hikes peaking at 145%, before de-escalating via truces over rare earths and soybeans.

|

U.S. President Donald Trump and Chinese President Xi Jinping talk as they leave after a bilateral meeting at Gimhae International Airport, on the sidelines of the Asia-Pacific Economic Cooperation (APEC) summit, in Busan, South Korea, October 30, 2025. Photo by Reuters |

The conflict stemmed from U.S. aims to curb trade deficits, fentanyl inflows, and tech dependencies, countered by China’s export controls on critical minerals amid economic resilience.

Trump imposed 10% duty on goods from China in February, prompting China to respond with 15% levies on U.S. coal and liquefied natural gas.

In April, Trump unveiled sweeping “Liberation Day” tariffs, triggering a rapid tit-for-tat that pushed duties above 100% on both sides and expanded export controls, particularly on rare earths and technology.

In May, both sides accused each other of violating earlier understandings, but talks resumed in Geneva, where they agreed to a 90-day tariff pause and partial rollbacks.

Subsequent negotiations in London, Stockholm and Madrid during June to August focused on rare earths, technology exports and TikTok, extending the truce and easing some controls, including licences for Nvidia chips.

Tensions flared again in October as Washington announced new levies and export controls, while China widened rare earth restrictions, imposed port fees and sanctioned U.S.-linked firms. A new trade truce was formed on Oct 30, with commitments on fentanyl, soybeans, tariffs and export controls.

In November, China suspended several retaliatory measures, resumed farm purchases, eased export controls and restored licences. Chinese President Xi Jinping and Trump held a surprise call on Nov. 24, pledging to sustain momentum and expand cooperation.

Trump hailed deals as “great wins,” praising Xi’s positivity while decrying violations. China said it opposed the abuse of tariffs and “suppression,” vowing to retaliate should tension rises.

Comments are closed.