Stormy Year For Startups, Kuku FM’s IPO & More

The Controversies Of The Year

The Indian startup ecosystem had its share of ups and downs this past year. And while we have recounted tales of IPOs and how startups have turned the corner, it’s time to take a look at everything that sparked debates and conversations in 2025.

Regulatory Reckoning: Months after the ban on online real money gaming, enforcement agencies moved in. WinZO founders Saumya Singh Rathore and Paavan Nanda were arrested over alleged money laundering and the use of algorithms that pitted players against bots.

In edtech, Dataisgood founder Ankit Maheshwari was detained at Delhi airport amid accusations of cheating, misusing investor funds and stealing data.

Cooking The Books? SEBI turned the screws on listed startups. DroneAcharya was hauled up for allegedly inflating salesdiverting IPO proceeds and using hyped announcements to spruce up its stock.

BluSmart also collapsed after a probe by the markets regulator found that its promoters allegedly syphoned off over INR 260 Cr (linked to tightly intertwined Gensol) for luxury apartments and personal bets.

Governance Wars: A whistleblower triggered a probe that snowballed into a boardroom war at Medikabazaar, leading to the CEO’s ouster and claims surfacing that the startup inflated GMV and circular sales.

At Bira 91, investors launched an aggressive offensive against founder-CEO Ankur Jain, seizing the company’s assets amid allegations of unpaid dues and governance breaches.

Questionable Ethics? Meanwhile, quick commerce giants were accused of using dark patterns to nudge users into paying more. On the other hand, Urban Company drew fire for its ‘Insta Maids’ micro-tasking model, while Eggoz faced viral claims linking its eggs to cancer-causing antibiotics.

That’s just scratching the surface. There was a ton of drama this year. Here’s what created storms in the Indian startup ecosystem in 2025.

From The Editor’s Desk

🎙️ Kuku FM Gets The IPO Ball Rolling

- The audio OTT soonicorn has roped in Kotak Mahindra Capital, Axis Bank and Morgan Stanley as bankers to helm its potential $200 Mn (about INR 1,820 Cr) IPO.

- While there is no clarity on its IPO timeline, Kuku FM plans to utilise the fresh proceeds to expand its library of audiobooks and podcasts across multiple languages.

- Founded in 2018, Kuku FM offers a catalogue of audiobooks around finance, well-being, drama series, among others. It claims to host more than 1 Cr listeners and creators. It reported a loss of INR 96 Cr on an operating revenue of INR 88 Cr in FY24.

🛵 Bhavish Aggarwal Sells Ola Electric Shares

- The EV maker’s cofounder Bhavish Aggarwal has offloaded 2.6 Cr shares (0.6% stake) of the company at INR 34.99 each in a bulk deal valued at INR 92 Cr.

- The transaction is part of a calculated promoter-level restructuring designed to eliminate all share pledges worth INR 260 Cr. The share sale released 3.93% of the company’s previously encumbered shares.

- This deal unfolds against Ola Electric’s most challenging year, which saw its market share tumble to 7% in the E2W segment, an ongoing CCPA probe into customer complaints, and a declining stock price.

💰 Digantara Nets $50 Mn

- The spacetech startup has raised the funding as part of its Series B round from SBI Investments Co Japan, 360 One Asset, Ronnie Screwvala, and others to expand its footprint and ramp up manufacturing capabilities.

- Going forward, the startup plans to launch a total of 15 space surveillance satellites by FY27. It is also developing two dedicated missile-warning satellites, marking a deeper move into defence and national security use cases.

- Founded in 2020, Digantara builds hardware, software and AI-based tools to track objects and debris in space.

🎯 Turtlemint Gets SEBI Nod For IPO

- The markets regulator has approved the insurtech startup’s plans to float an IPO. This comes three months after Turtlemint filed its DRHP with SEBI via the confidential route for up to $200 Mn listing.

- Founded in 2015, Turtlemint operates an online platform for comparing and purchasing various insurance products. Its SaaS vertical also provides plug-and-play APIs and backend workflows to financial institutions such as banks and NBFCs.

- Backed by Nexus Venture Partners and Peak XV Partners, the startup clocked an operating revenue of INR 674 Cr in FY25, up 33.6% YoY, against a loss of INR 47.1 Cr.

💸 Moxie Beauty Nets $15 Mn

- The D2C haircare brand closed its Series A funding round, led by Bessemer Venture Partners, to fuel research, ramp up hiring, and expand distribution channels.

- Founded in 2023, Moxie Beauty offers a range of hair care products dedicated to the specific needs of Indian hair textures. It offers 19 products, including shampoos, conditioners and styling products.

- The company claims that its revenue has grown 4X in the past year and is clocking an annual run rate of over INR 100 Cr. It operates in the broader D2C segment, which is projected to cross $300 Bn by 2030.

Inc42 Markets

Inc42 Startup Spotlight

Can Medyseva Solve The Rural Health Crisis?

In rural India, a basic doctor visit can cost a day’s wages and a 60 km journey. With few qualified doctors in villages, families delay care until minor illnesses turn critical — a gap Medyseva has set out to close.

A Phygital Health Network: Founded in 2022, Medyseva operates a phygital healthcare network that blends staffed satellite clinics with teleconsultation. Its flagship MedyAarogya centres act as rural extensions for partner hospitals, medical colleges and specialist groups, connecting village patients to urban specialists without forcing them to travel.

Verticalised Care: To go beyond basic OPD, Medyseva has built focussed offerings: MedyMate for general care, MedyMind for mental health, MedyShe for women’s health, and MedyVision for ophthalmology and nutrition. Together, these verticals aim to make specialised care as accessible as primary consultations for the rural milieu.

The Next Step: Medyseva has expanded its clinic footprint across Madhya Pradesh, while partnering with providers in Maharashtra and Chhattisgarh. With rural India still home to some of the world’s deepest primary-care gaps, can Medyseva’s phygital model scale fast enough to change health outcomes for millions?

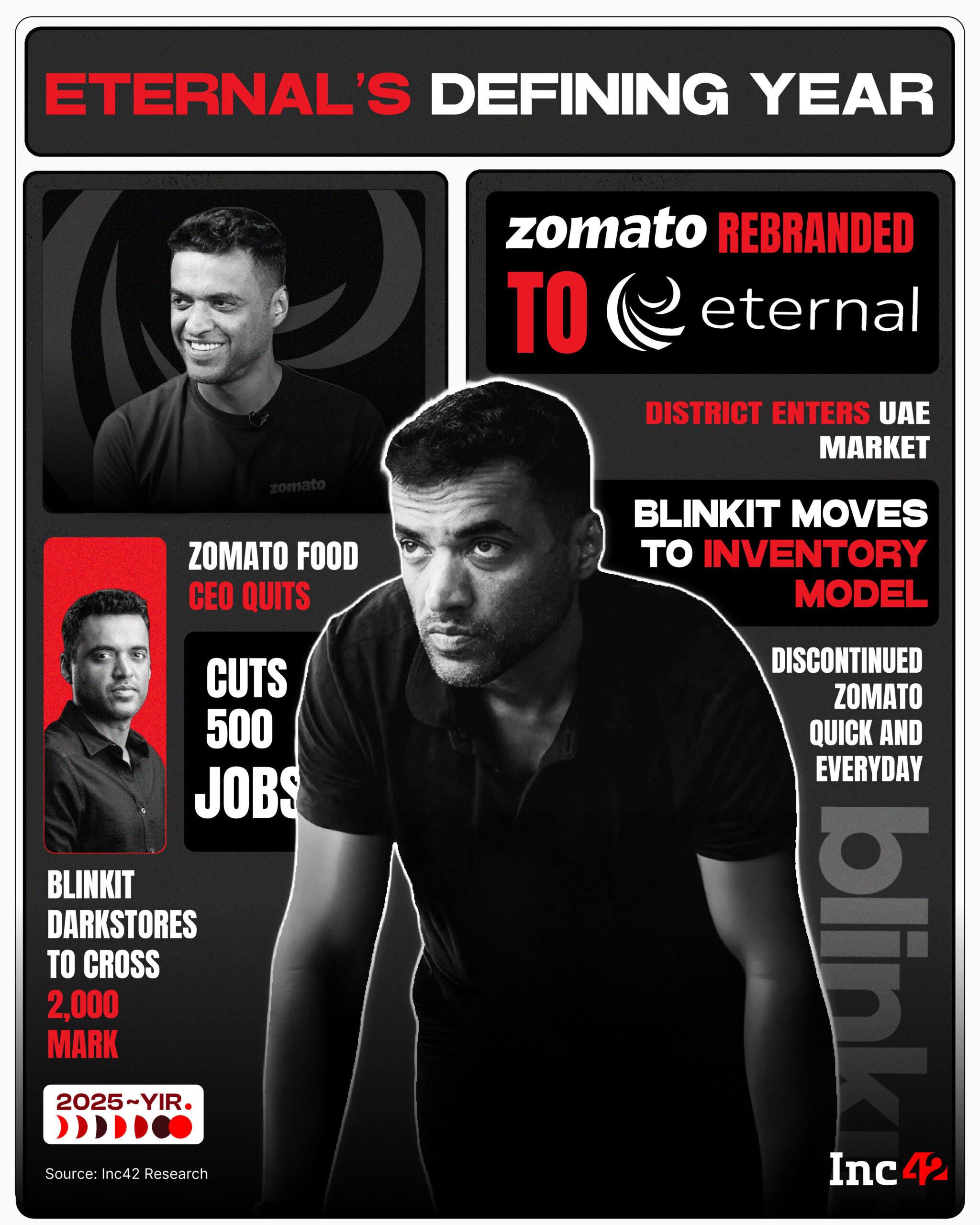

Infographic Of The Day

From Zomato to Eternal, here’s how 2025 unfolded for the listed foodtech juggernaut.

Comments are closed.