The Gig Insurance Problem, Jio’s $4 Bn IPO & More

The Reality Of Gig Worker Insurance

Zomato and Swiggy are locked in a battle with their own delivery partners. The foodtech giants claim that they are investing in insurance, upskilling and incentives to expand the social safety net for gig workers. Yet, worker unions claim otherwise.

What Are Foodtechs Offering? Eternal shelled out INR 100 Cr in premiums last year to cover its gig army, while Swiggy previously claimed to be paying over INR 30 Cr in insurance claims annually. Then, there is Zepto, which introduced basic accident and health insurance covering OPD costs and telehealth consultations only in FY25.

The Other Side: Gig worker unions claim that insurance benefits don’t come in handy during medical emergencies, cashless treatment remains a myth, and hospitals refuse to accept gig workers due to insufficient documented incomes. Most injured delivery partners are forced to pay out-of-pocket.

Govt Steps In: With the two sides at odds, the Centre last year overhauled labour laws, mandating insurance coverage through a marketplace-funded welfare corpus. Separately, there is the Pradhan Mantri Suraksha Bima Yojana and the e-Shram portal, which connects workers to social welfare schemes. However, digital literacy gaps and irregular work patterns still exclude millions.

The Structural Gaps: Despite the efforts, critics point out that gig workers lack formal contracts and government-mandated benefits like provident fund and ESIC coverage. They also flag that state-backed schemes provide only up to INR 2 Lakh accidental coverage, which is insufficient to meet escalating treatment costs. Low awareness about insurance and policy complexities also contribute to the problem.

With India’s gig workforce projected to grow to 2.35 Cr over the next five years, how long will the race for 10-minute deliveries take its toll on the gig workforce. While that is a question to ponder, here is why gig workers are at odds with foodtech behemoths.

From The Editor’s Desk

📶 Jio Dials Bankers For $4 Bn IPO

- Reliance’s digital arm is gearing up for a massive $4 Bn IPO, which is expected to be India’s largest-ever public markets debut. RIL is aiming to list a slim 2.5% stake to keep demand high and pricing competitive for global investors.

- The plan, however, hinges on the finance ministry easing rules to allow large firms to dilute less than 5%. If the law shifts, this IPO will set a new benchmark for how India’s tech giants go public.

- This follows RIL MD Mukesh Ambani confirming last year that Jio would hit the bourses by mid-2026. While a listing was teased back in 2019, Reliance strategically delayed the launch to scale its digital ecosystem.

🛵 SoftBank Sheds Ola Electric Stake

- The Japanese tech investor offloaded 9.46 Cr shares, or 2.15% stake, in the EV maker between September 2025 and January 2026. This effectively brought down SoftBank’s shareholding in Ola Electric to 13.53%.

- This follows SoftBank selling another 2.15% stake in the company between July and September last year. Other backers like Tiger Global and Z47 have also aggressively shed their shareholding in the OEM in the past year.

- Ola Electric’s stock price has been on a downward spiral on the back of stagnating revenues, heavy losses, shoddy customer service reviews and regulatory heat. Market share, too, has crashed as legacy giants like TVS and Bajaj raced ahead in 2025.

📉 Weekly Funding Numbers Take A Hit

- The first full week of 2026 saw a cautious start, with Indian startups raising $68.4 Mn across 19 deals. This marked a 34% dip from $104.2 Mn in the preceding week.

- Healthtech topped the sectoral charts, but tranches were noticeably slimmer across the board. Capital distribution shifted heavily toward B2C startups, which lapped up 70% of the capital last week.

- Meanwhile, seed stage ventures pulled in a modest $16.8 Mn. As 2026 unfolds, the focus is clearly on essential consumer plays rather than the high-burn experiments of the past.

🛍️ What’s In Store For Ecommerce In 2026?

- The era of scale at any cost is officially over. Ecommerce’s focus in 2026 will shift to profitability and scale as investors will swap raw growth targets for a strict checklist of gross margins and predictable cash flows.

- The narrative for 2026 will be all about operational hygiene, and treating logistics and unit economics as the primary drivers of valuation.

- Looking ahead, quick commerce will continue to dominate the top 30 cities, forcing brands to master multi-channel strategies to survive. This year, real winners won’t just be those who sell well, but those who own their supply chains.

🏦 Razorpay Sharpens Edge For 2026 IPO

- The fintech powerhouse has sought bids from merchant bankers, including Kotak Mahindra and Axis Capital, for an IPO, which will comprise an INR 4,500 Cr fresh issue.

- Razorpay is also mulling a secondary pre-IPO round to hit a specific valuation benchmark. The startup was last pegged at a hefty $7.5 Bn during its last $375 Mn fundraise in 2021.

- Founded in 2014, Razorpay is an omnichannel payments and banking platform. It has raised over $739 Mn in funding to date. Despite slipping into the red in FY25, the company’s operating revenue skyrocketed 65% YoY to INR 3,783 Cr.

Inc42 Markets

Inc42 Startup Spotlight

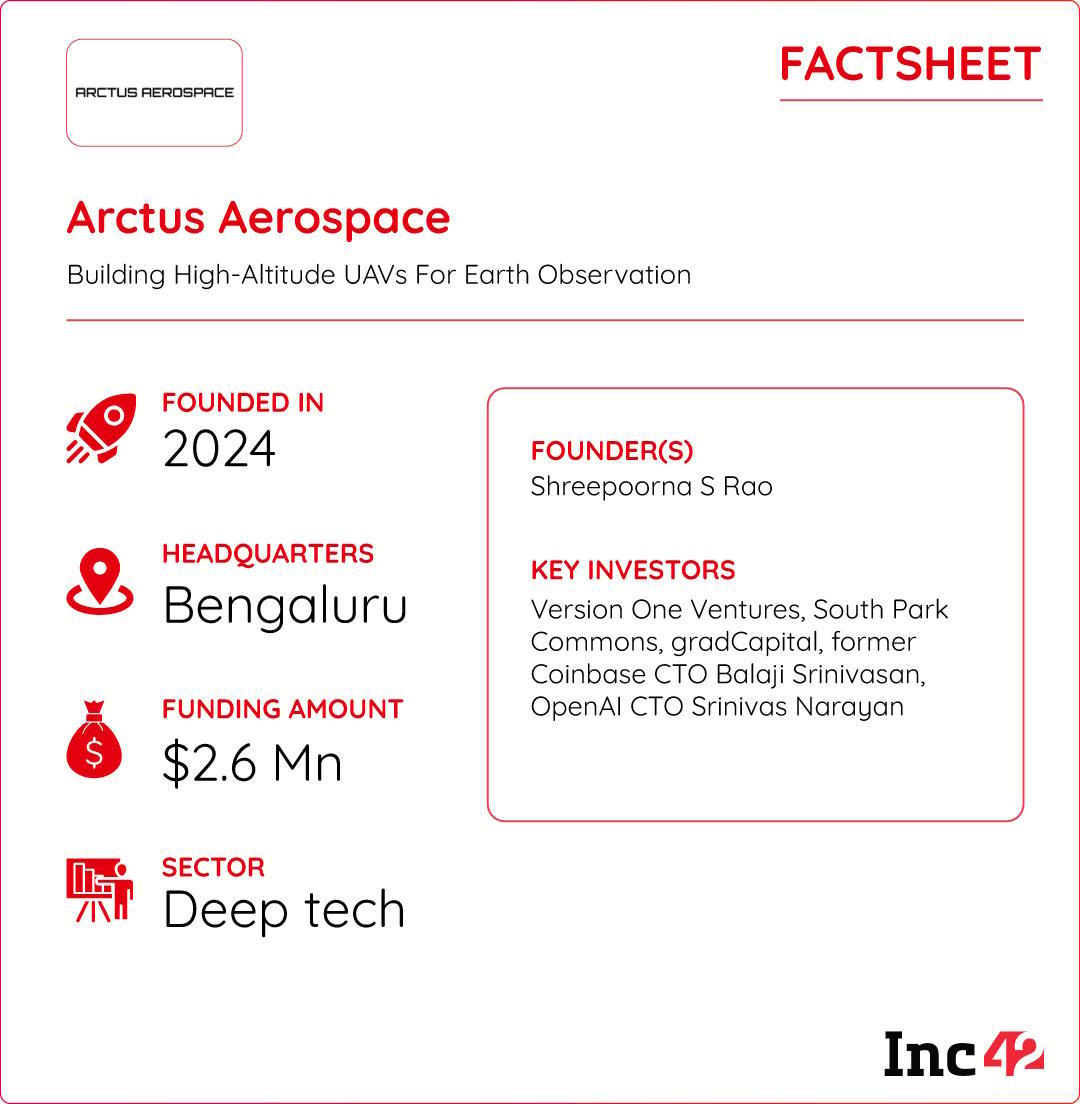

Can Arctus Disrupt Earth Imaging Without Satellites?

Precision agriculture demands hyper-detailed maps of soil health and micro-climate variations. But satellites deliver blurry snapshots from 500 km up, while consumer drones can’t cover large farms efficiently. Solving this problem is Arctus, which aims to deliver satellite-grade data at drone prices.

Filling The Orbital Gap: Founded in 2024, Arctus Aerospace is building high-altitude, long-endurance (HALE) aircrafts that can fly at 45,000 ft for up to 24 hours, and can carry 250 kg sensor payload. These autonomous aircraft aim to capture 1 sq cm per pixel resolution from 10-15 km altitude.

At $100 an hour compared to $10,000 per hour for comparable systems, Arctus is targeting sectors like agriculture, oil & gas, mining and climate monitoring .

Vertical Integration Moat: Arctus designs nearly everything in-house – fuel systems, actuators, flight software, telemetry. It also utilises carbon-fibre and metal 3D printing for optimal weight-strength ratios. Only engines and select PCBs come from vendors, built to exact specifications.

Steep Climb Ahead: However, execution risks loom large. Regulatory approvals for high-altitude autonomous flights remain untested, while privacy concerns and unproven unit economics could also play spoilsport.

Can Arctus navigate engineering, regulation, and capital constraints to make its bold vision a reality?

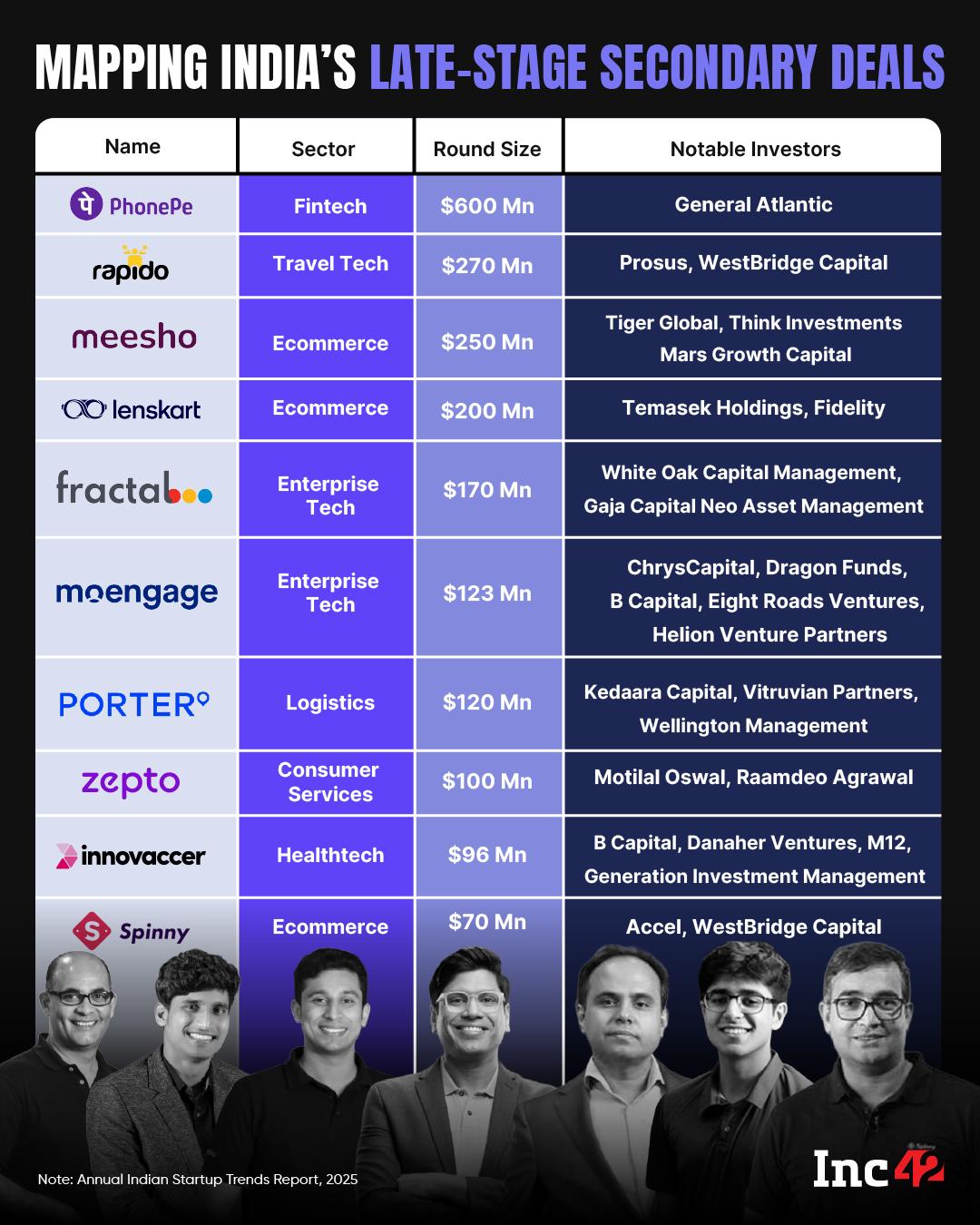

Infographic Of The Day

Secondary startup transactions became a key liquidity lever in 2025 as investors sought partial exits, portfolio rebalancing and strategic allocations. Here are the major secondary rounds that grabbed the spotlight last year…

Comments are closed.