The owner of Rs 30 thousand crore in the country is not known, survey revealed

The Income Tax Department conducted 465 surveys in the financial year 2024-25, which revealed undisclosed income of Rs 30,444 crore. This information was given in Parliament on Tuesday. Union Minister of State for Finance Pankaj Chaudhary said in a written reply in the Rajya Sabha that whenever the department receives credible information about direct tax evasion, it takes steps like survey, search and seizure to bring the undisclosed income into the tax net.

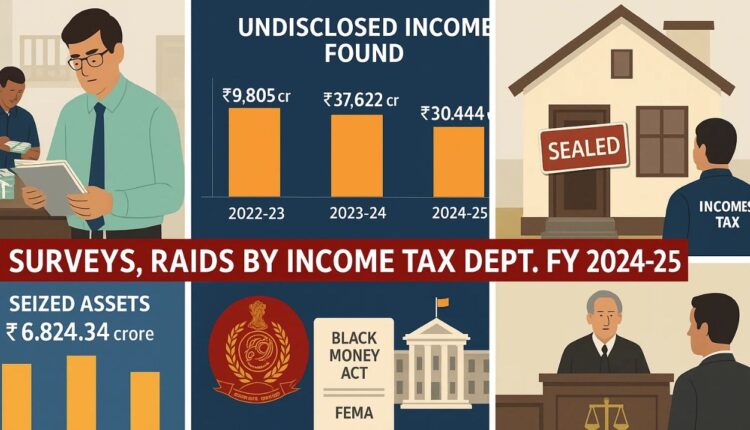

In the financial year 2024-25, the Income Tax Department conducted 465 surveys, which revealed undisclosed income of Rs 30,444 crore. Apart from this, 1437 groups were searched in which assets worth Rs 2,504 crore were seized.

What were the figures of last years?

Undisclosed income of Rs 37,622 crore was detected through 737 surveys in FY 2023-24, and assets worth Rs 2555 crore were seized in searches of 1166 groups. At the same time, in the financial year 2022-23, undisclosed income worth Rs 9805 crore was detected in 1245 surveys, and assets worth Rs 1766 crore were seized in the searches of 1437 groups.

If seen accordingly, a total undisclosed income of Rs 77,871.44 crore was detected in the last three financial years (2022-23, 2023-24 and 2024-25). In these three years, 3,344 groups were searched, in which assets worth Rs 6,824.34 crore were seized.

action under black money law

Action has also been taken under the Black Money (Undisclosed Foreign Income and Assets) and Tax Act, 2015, which came into force from July 1, 2015. Under this law, undisclosed foreign assets worth Rs 4,164 crore were declared in 684 cases in a special period of three months from 1 July 2015 to 30 September 2015. Rs 2,476 crore was recovered as tax and penalty in these cases.

Till March 31, 2025, 1,021 investigations were completed under this law, in which tax and penalty of more than Rs 35,105 crore was sought. Additionally, 163 prosecution complaints were filed.

Enforcement Directorate action

The Enforcement Directorate (ED) also seized assets worth Rs 89.78 crore in 17 cases under the black money law and filed 10 prosecution complaints, including 4 supplementary complaints. Additionally, assets worth Rs 285.39 crore were seized in 12 cases under Section 37A of the Foreign Exchange Management Act (FEMA).

Income tax target

Minister Pankaj Chaudhary said that the Income Tax Department is fully committed to stopping tax evasion. Upon receiving credible information, the department takes immediate action, which includes surveys, searches and seizure of property. This ensures that no undisclosed income remains outside the tax net.

Comments are closed.