Tonbo Imaging Files DRHP For OFS-Only IPO

The defence tech startup’s public issue will have an OFS of up to 1.81 Cr equity shares

Investor CEAQ Technologies plans to offload the maximum 1.5 Cr shares, while promoters and promoter group entity will be selling about 23 Lakh shares via the IPO

The startup’s objective behind the public listing is to enhance its visibility and brand image, as well as provide liquidity to shareholders

Defence tech startup Tonbo Imaging has filed its DRHP with the Securities and Exchange Board of India (SEBI) for its IPO, which will comprise only an offer for sale (OFS).

The public issue will have an OFS of up to 1.81 Cr equity shares, according to the DRHP.

Investor CEAQ Technologies plans to offload the maximum 1.5 Cr shares via CEAQ Technologies Pvt Ltd (formerly Tonbo Imaging Pvt Ltd) and CEAQ Technologies Pte Ltd (formerly Tonbo Imaging Singapore Pte Ltd).

Other investors that will offload shares include Timothy Guy Mitchell (2.09 Lakh shares), Artiman Partners (1.97 Lakh shares), Amit Dilip Shah (84,600 shares), and Ramesh Radhakrishnan (80,000 shares).

Meanwhile, promoters and cofounders Arvind Lakshmikumar (CEO), Ankit Kumar (CBO), and Cecilia D’Souza (CCO), along with promoter group entity Vinimaya Advisory, will cumulatively sell about 23 Lakh shares.

The startup’s objective behind the public listing is to enhance its visibility and brand image, as well as provide liquidity to shareholders.

Earlier this year, Inc42 reported that the startup’s IPO would be in the range of INR 800 Cr to INR 1,000 Cr.

On the financial front, Tonbo Imaging reported a consolidated net profit of INR 5.4 Cr in the first quarter of FY26 on an operating revenue of INR 68.7 Cr. For the full fiscal year FY25, its operating revenue stood at INR 469.1 Cr, while net profit was at INR 72.8 Cr.

Prior to FY25, Tonbo Imaging reported standalone financials. It set up two subsidiaries in Armenia and Australia in FY25.

Founded in 2012, Tonbo Imaging is a Bengaluru‑based startup that does end-to-end development of advanced imaging, sensor, targeting and battlefield systems for military and security applications. Important to mention that the startup had raised over $46 Bn in private funding from investors like Yali Capital, Tenacity Fund, among others.

Tonbo Imaging’s Funding History

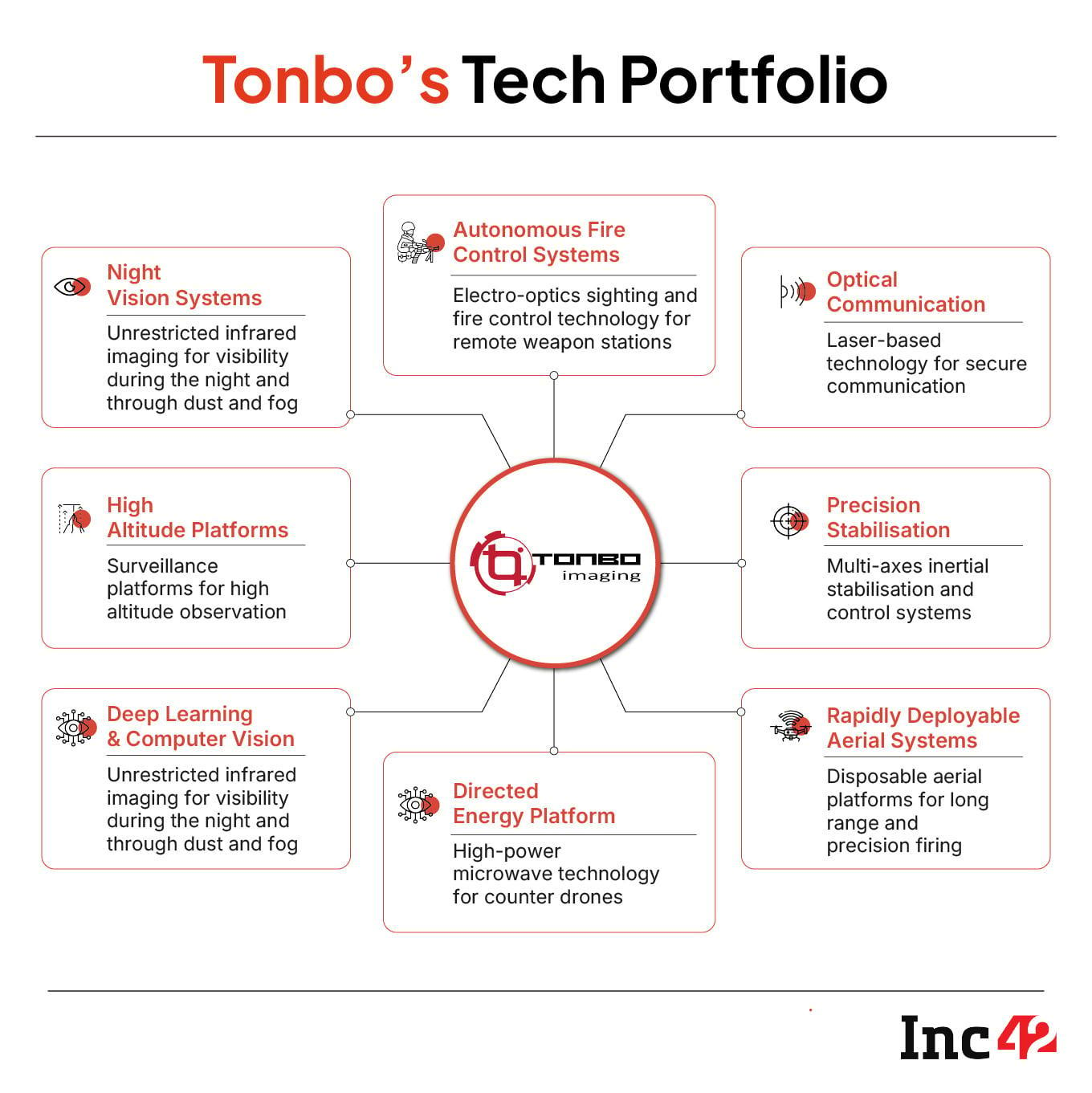

Tonbo Imaging builds electro‑optical and infrared (EO/IR) hardware and software that enhances defence forces’ abilities. Its product portfolio includes thermal imaging cores, weapon sights, hand‑held thermal binoculars, targeting systems, missile seekers, fire control and guidance systems.

The startup’s offerings span multiple product families used in day/ night operations, from helmet‑mounted sights and handheld targeting units to airborne gimbals and panoramic surveillance systems suitable for helicopters, UAVs and ground units.

Tonbo Imaging also develops integrated software such as HawkAI – a command, control, communication and intelligence (C4I) platform that fuses sensor data for unified battlefield awareness.

It serves both domestic and international defence customers, including the Indian armed forces, NATO, US Navy SEALs, Israeli defence forces, among others. Its business is structured around three revenue buckets: systems directly sold to defence forces, integrated subsystems for partner platforms, and OEM/ white‑label components supplied to global defence manufacturers.

Comments are closed.